Vodafone 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance |37

The commencement of depreciation and amortisation on the 3G network and licence,

following launch of services in the second half of the previous financial year, reduced

operating profit before goodwill amortisation, with licence amortisation contributing the

largest share of this reduction. A higher proportion of prepaid additions, particularly in

the second half of the financial year, and lower contract subsidies led to net acquisition

costs decreasing by 3% in local currency in spite of an 8% increase in gross customer

additions. Lower loyalty scheme costs were offset by higher upgrade costs, particularly

in the second half of the financial year following increased activity through indirect

channels, and consequently net retention costs increased by 5%. Other operating

expenses and direct costs remained relatively stable compared to the prior year.

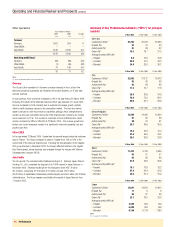

Italy

Years ended 31 March Local currency

2005 2004 Change change

£m £m % %

Turnover(1) 5,565 5,312 5 7

Trading Results

Voice services 4,548 4,380 4 6

Non-voice services 780 669 17 19

Total service revenue 5,328 5,049 6 7

Net other revenue(1) 19 13 46 38

Interconnect costs (913) (874) 4 6

Other direct costs(3) (302) (306) (1) –

Net acquisition costs(1) (93) (76) 22 23

Net retention costs(1) (97) (64) 52 55

Payroll (323) (301) 7 10

Other operating

expenses (659) (646) 2 4

Depreciation and

amortisation(2) (703) (652) 8 10

Operating profit(2)(3) 2,257 2,143 5 7

Notes:

(1) Turnover includes revenue of £218 million (2004: £250 million) which has been excluded from other revenue and deducted

from acquisition and retention costs in the trading results.

(2) Before goodwill amortisation

(3) Before exceptional items

Vodafone continues to perform robustly in Italy despite aggressive competition, through

strong market positioning driven by innovative promotions and a focus on high value

customers, through targeted retention initiatives. Notwithstanding market penetration

levels of over 100%, driven by the effect of customers having more than one SIM and

increased competition, Vodafone had good customer growth, with gross additions

higher than in the previous year and only a slight increase in churn to 17.2%.

Total turnover grew by 7%, when measured in local currency, reflecting the rise in

service revenue that was driven by an 8% increase in the average customer base.

ARPU remained stable despite a slight reduction in activity levels. Strong promotional

campaigns, such as fixed price phone calls for voice users or unlimited text messaging,

after paying for the first text message per day, in return for up front subscription fees,

significantly stimulated usage, with minutes of use increasing by 12% and the number

of text messages sent increasing by 11%.

Non-voice service revenue grew by 19% with revenue from non-messaging data

offerings increasing to £87 million, representing an 85% increase in local currency.

Vodafone live! active devices increased by 169% to 2,751,000 at 31 March 2005. In

the business segment Vodafone continued to increase its market share, with a 10%

growth in the customer base and continuing net inflow of customers through mobile

number portability. Strong revenue growth for this segment was supported by a higher

proportion of non-voice service revenue, partially driven by sales of Vodafone Mobile

Connect data cards.

Following the successful launch of consumer 3G services in November 2004,

customers had registered 665,000 3G devices on Vodafone’s network by the end of

the financial year.

United Kingdom

Years ended 31 March

2005 2004 Change

£m £m %

Turnover(1) 5,065 4,782 6

Trading results

Voice services 3,672 3,522 4

Data services 826 674 23

Total service revenue 4,498 4,196 7

Net other revenue(1) 177 146 21

Interconnect costs (771) (752) 3

Other direct costs (367) (325) 13

Net acquisition costs (388) (333) 17

Net retention costs (391) (321) 22

Payroll(3) (389) (387) 1

Other operating

expenses(3) (657) (616) 7

Depreciation and

amortisation(2) (737) (510) 45

Operating profit(2)(3) 975 1,098 (11)

Notes:

(1) Turnover includes revenue of £390 million (2004: £440 million) which has been excluded from other revenue and deducted

from acquisition and retention costs in the trading results.

(2) Before goodwill amortisation.

(3) Before exceptional items.

In an intensively competitive market, Vodafone achieved growth in the customer base

and revenue whilst maintaining costs through the execution of a structured plan to

drive revenue and tighter control of operating expenses.

Turnover increased by 6%, comprising underlying growth of 1% and growth of 5%

attributable to the acquisition of a number of service providers in the prior year,

including Singlepoint. Service revenue rose by 7%, driven by an 8% increase in the

average customer base over the prior financial year. ARPU was broadly stable for the

financial year, with increases in non-voice service revenue and the impact of service

provider acquisitions being offset by termination rate cuts and reduced activity levels.

From 1 September 2004, Vodafone, along with other UK mobile network operators,

excluding the third generation operator, reduced termination rates by approximately

30% impacting service revenue in the second half of the financial year. The impact of

the termination rate cut was to reduce service revenue for the financial year by

3 percentage points.

Increased acquisition and retention activity and the success of new tariffs and services

especially those targeted at corporate and business segments, drove customer growth

in the financial year. Contract churn improved from 24.9% for the year ended 31

March 2004 to 22.7% for the year ended 31 March 2005, although blended churn of

29.7% was in line with the previous year. In addition, total customer activity levels fell

from 91% at 31 March 2004 to 89% at 31 March 2005, reflecting higher levels of

prepaid customer self upgrades, consistent with market trends. In the first half of the

financial year, an agreement was reached to provide wholesale services to BT and at

31 March 2005, 119,000 BT customers, reported as one registered customer, were

connected to the Vodafone network under this agreement.

Non-voice service revenue grew by 23%, with non-messaging data revenue increasing

by 81% to £142 million, mainly due to the success of service offerings such as

Vodafone live!, Vodafone Mobile Connect data cards and BlackBerry from Vodafone. At

31 March 2005, the number of Vodafone live! active devices rose to 3,443,000. In the