Vodafone 2005 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

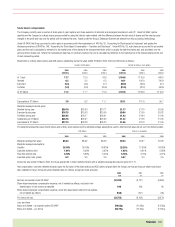

Notes to the Consolidated Financial Statements continued

130 |Financials

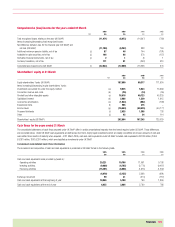

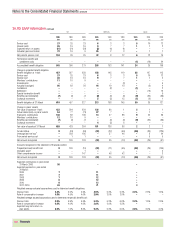

36.US GAAP information continued

(c) Goodwill and other intangible assets

Under UK GAAP, FRS 10, “Goodwill and Intangible Assets”, requires goodwill to be capitalised and amortised over its estimated useful economic life. Prior to the prospective

adoption of FRS 10 on 1 April 1999 the Group offset acquired goodwill against shareholders’ equity in the year of acquisition. Under UK GAAP, licences and customer bases

are not recognised separately from goodwill because they do not meet the recognition criteria.

Under US GAAP goodwill and intangible assets with indefinite lives are capitalised and not amortised, but tested for impairment, at least annually, in accordance with

Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other Intangible Assets”. Intangible assets with finite lives are capitalised and amortised over

their useful economic lives. The Group has assigned amounts to licences and customer bases as they meet the criteria for recognition apart from goodwill. In determining

the value of licences purchased in business combinations prior to adoption of EITF Topic D-108, “Use of the Residual Method to Value Acquired Assets Other Than Goodwill”,

on 29 September 2004, the Group allocated the surplus of the purchase price, over the fair value attributed to the share of net assets acquired, to licences. This was on the

basis the nature of the licences and the related goodwill acquired in business combinations was fundamentally indistinguishable. As a result of the adoption of EITF Topic

D-108 as detailed in (h) below, for business combinations subsequent to 28 September 2004, the Group assigns amounts to licences based on a direct valuation of the

licence. Any residual purchase price is then assigned to goodwill. When testing the recoverability of licences with indefinite lives, the Group adopted a direct valuation

methodology on 1 January 2005. Previously, the Group had used a residual method similar to that used in the initial allocation of amounts to licences in business

combinations prior to 29 September 2004.

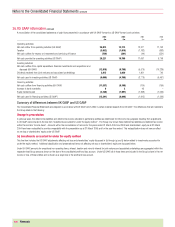

As discussed in (g) below, deferred tax liabilities are recognized on the difference between the US GAAP carrying value of the intangible assets recognised in business

combinations and their respective tax basis. Although this does not affect net assets on the date of acquisition, this results in a significantly larger residual amount being

allocated to intangible assets with an offsetting entry to deferred tax liabilities.

Under UK GAAP and US GAAP, the purchase price of a transaction accounted for as an acquisition is based on the fair value of the consideration. In the case of share

consideration, under UK GAAP the fair value of such consideration is based on the share price at completion of the acquisition or the date when the transaction becomes

unconditional. Under US GAAP, the fair value of the share consideration is based on the average share price over a reasonable period of time before and after the proposed

acquisition is agreed to and announced. This has resulted in a difference in the fair value of the consideration for certain acquisitions and consequently in the amount of

goodwill capitalised under UK GAAP and US GAAP.

Under UK GAAP, costs incurred in reorganising acquired businesses are charged to the profit and loss account as post-acquisition expenses. Under US GAAP, certain of such

costs are considered in the allocation of purchase consideration.

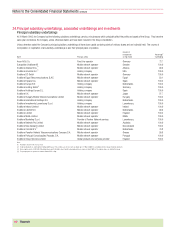

Acquisitions

As described further in note 25, the Group has undertaken a number of transactions in the year ended 31 March 2005, including stake increases in Vodafone Japan and

Vodafone Hungary. Under US GAAP, these transactions have resulted in the Group assigning £2,938 million to intangible assets, including £2,260 million to cellular licences,

£655 million to customer bases and £23 million to goodwill. A corresponding deferred tax liability of £1,182 million was recognised. All intangible assets acquired other than

goodwill are deemed to be of finite life, with a weighted average amortisation period of 17 years, comprising licences of 21 years and customer bases of 5 years.

Goodwill

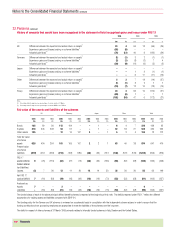

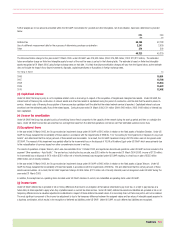

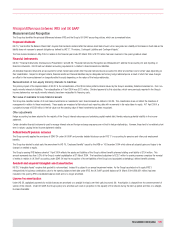

Mobile: OEMEA Mobile: UK Non-mobile: Germany

2005 2004 2005 2004 2005 2004

£m £m £m £m £m £m

1 April ––467 117 41 –

Additions 23 ––352 –43

Exchange movements –––(2) 2(2)

31 March 23 –467 467 43 41

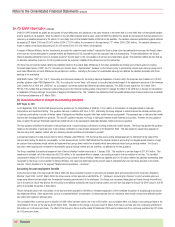

Finite-lived intangible assets

2005 2004

Licences Customer bases Licences Customer bases

£m £m £m £m

Gross carrying value 170,039 7,449 164,226 7,417

Accumulated amortisation (64,468) (6,067) (48,026) (4,939)

105,571 1,382 116,200 2,478