Vodafone 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

36 |Performance

Exceptional non-operating items

Net exceptional non-operating charges for the year ended 31 March 2004 of £103

million principally relate to a loss on disposal of the Japan Telecom fixed line

operations. In the prior year, net exceptional non-operating charges of £5 million

mainly represented a profit on disposal of fixed asset investments of £255 million,

principally relating to the disposal of the Group’s interest in Bergemann GmbH, through

which the Group’s 8.2% stake in Ruhrgas AG was held, offset by an impairment charge

in respect of the Group’s investment in China Mobile of £300 million.

Loss on ordinary activities before interest

The Group’s loss on ordinary activities before interest fell by 21% to £4,333 million for

the year ended 31 March 2004 due to a reduction in the total operating loss of

£1,221 million offset by an increase in charge for exceptional non-operating items of

£98 million.

Net interest payable

Net interest payable, including the Group’s share of the net interest expense of joint

ventures and associated undertakings, decreased from £752 million for the year ended

31 March 2003 to £714 million for the year ended 31 March 2004.

The Group net interest cost for the year ended 31 March 2004 increased to

£499 million, including £215 million (2003: £55 million) relating to potential interest

charges arising on settlement of a number of outstanding tax issues, from £457 million

for the prior year and was covered 28 times by operating cash flow plus dividends

received from associated undertakings. The Group’s share of the net interest expense

of associated undertakings and joint ventures decreased from £295 million to

£215 million, principally as a result of the sale of the Group’s stake in Grupo Iusacell.

Taxation

The effective rate of taxation for the year ended 31 March 2004 was (62.5)%

compared with (47.6)% for the year ended 31 March 2003. The effective rate includes

the impact of goodwill amortisation and exceptional items, which may not be deductible

for tax purposes. Aside from the negative impact of non-tax deductible goodwill

amortisation on the effective tax rate, the Group’s tax charge has benefited further from

the restructuring of the Group’s Italian operations in the prior year, from the current

year restructuring of the French operations, from a fall in the Group’s weighted average

tax rate and from other tax incentives. These benefits outweighed the absence of the

one-off benefit arising from the restructuring of the German group in the previous year.

Basic loss per share

Basic loss per share, after goodwill amortisation and exceptional items, improved from

a loss per share of 14.41 pence to a loss per share of 13.24 pence for the year ended

31 March 2004. The loss per share includes a charge of 22.33 pence per share

(2003: 20.62 pence per share) in relation to the amortisation of goodwill and a charge

of 0.01 pence per share (2003: 0.60 pence per share) in relation to exceptional items.

Review of operations

Please refer to the summary of Key Performance Indicators on page 44 and note 3 of

the Consolidated Financial Statements.

In October 2004, the Group announced a new organisational structure effective from

1 January 2005. The following results are presented in accordance with the new

reporting structure.

2005 financial year compared to 2004 financial year

Mobile businesses

Germany

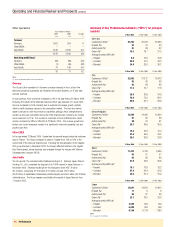

Years ended 31 March Local currency

2005 2004 Change change

£m £m % %

Turnover 5,684 5,536 3 5

Trading results

Voice services 4,358 4,254 2 4

Non-voice services 962 89579

Total service revenue 5,320 5,149 3 5

Net other revenue(1) 122 155 (21) (20)

Interconnect costs (734) (725) 1 3

Other direct costs (314) (334) (6) (4)

Net acquisition costs(1) (348) (367) (5) (3)

Net retention costs(1) (330) (321) 3 5

Payroll (409) (390) 5 7

Other operating

expenses (668) (675) (1) 1

Depreciation and

amortisation(2) (976) (751) 30 32

Operating profit(2) 1,663 1,741 (4) (3)

Notes:

(1) Turnover includes revenue of £242 million (2004: £232 million) which has been excluded from other revenue and deducted

from acquisition and retention costs in the trading results.

(2) Before goodwill amortisation

Vodafone has built on its strong position in the German mobile market following the

successful launch of 3G services and consolidated its overall position.

A 9% growth in the average customer base compared to the prior year was the main

driver of the 5% increase in service revenue in local currency. Customer growth was

strong as a result of successful and competitively priced, but low subsidy, offerings

which had a dilutive effect on ARPU. The offerings included partner cards, which offer

a second SIM card without a handset to contract customers at a low monthly cost to

the customer, and SIM only prepaid promotions, which attracted a substantial

proportion of prepaid customers in the second half of the financial year. ARPU, and

consequently service revenue growth, in the second half of the financial year was also

impacted by a reduction in the mobile call termination rate from 14.3 eurocents to

13.2 eurocents in December 2004. A further cut to 11.0 eurocents in December 2005

has also been agreed with Deutsche Telekom.

Non-voice service revenue increased due to the success of non-messaging data

offerings, the revenue from which increased by 85% in local currency to £163 million.

In the consumer segment, the number of Vodafone live! active devices increased by

105% over the financial year to 4,845,000 at 31 March 2005 and, in the business

segment, there were strong sales of Vodafone Mobile Connect 3G/GPRS data cards.

Demonstrating Vodafone’s lead in the 3G market in Germany, there were 358,000

registered 3G devices at 31 March 2005.