Vodafone 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

92 |Financials

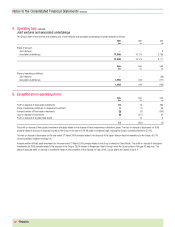

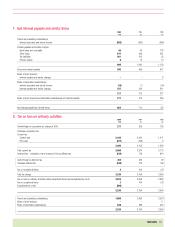

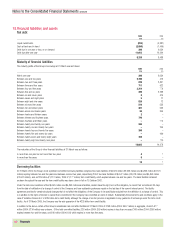

8. Tax on loss on ordinary activities continued

Factors affecting the tax charge for the year

Refer to Operating and Financial Review and Prospects – Operating Results – Group Overview – 2005 financial year compared to 2004 financial year – Taxation.

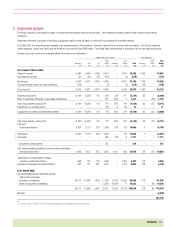

Reconciliation of expected tax charge using the standard tax rate to the actual current tax charge

The differences between the Group’s expected tax charge, using the Group’s standard corporation tax rate of 36.0% in 2005 (36.4% in 2004 and 37.0% in 2003),

comprising the average rates of tax payable across the Group and weighted in proportion to accounting profits, and the Group’s current tax charge for each of those years

were as follows:

2005 2004 2003

£m £m £m

Expected tax credit at standard tax rate on loss on ordinary activities (1,693) (1,837) (2,295)

Goodwill amortisation 5,292 5,535 5,196

Exceptional non-operating items (5) 38 2

Exceptional operating items 113 (83) 213

Expected tax charge at standard tax rate on profit on ordinary activities,

before goodwill amortisation and exceptional items 3,707 3,653 3,116

Permanent differences 93 47 140

Fixed asset timing differences 12 (509) (404)

Short term timing differences (163) (18) (64)

Deferred tax on overseas earnings (322) (418) (424)

Losses carried forward utilised/current year losses for which no credit taken (171) 26 278

Exceptional current tax credit (166) ––

Prior year adjustments (289) (61) 4

Non taxable profits/non deductible losses (148) (281) (239)

International corporate tax rate differentials and other (73) (125) (232)

Actual current tax charge (excluding tax on exceptional items) 2,480 2,314 2,175

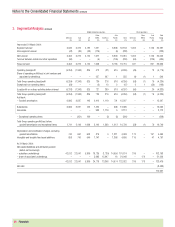

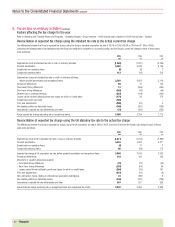

Reconciliation of expected tax charge using the UK statutory tax rate to the actual tax charge

The differences between the Group’s expected tax charge, using the UK corporation tax rate of 30% in 2005, 2004 and 2003 and the Group’s tax charge for each of those

years were as follows:

2005 2004 2003

£m £m £m

Expected tax credit at UK corporation tax rate on loss on ordinary activities (1,411) (1,514) (1,863)

Goodwill amortisation 4,410 4,562 4,217

Exceptional non-operating items (4) 31 2

Exceptional operating items 95 (69) 173

Expected tax charge at UK corporation tax rate, before goodwill amortisation and exceptional items 3,090 3,010 2,529

Permanent differences 118 152 165

Movement in valuation allowances against:

– Fixed asset timing differences (22) (21) (40)

– Short term timing differences (197) (64) 60

– Losses carried forward utilised/current year losses for which no credit taken (264) (26) 161

Prior year adjustments (315) (61) (9)

Net (over)/under charge relating to international associated undertakings 23 (186) 8

Non taxable profits/non deductible losses (148) (281) (239)

International corporate tax rate differentials and other 547 527 358

Actual total tax charge (excluding tax on exceptional items and exceptional tax credit) 2,832 3,050 2,993