Vodafone 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

106 |Financials

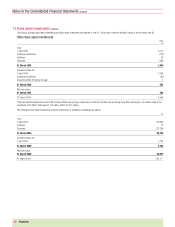

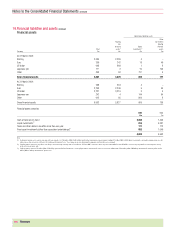

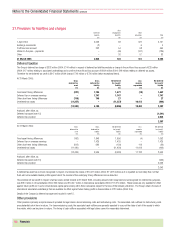

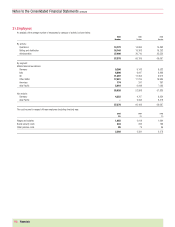

21.Provisions for liabilities and charges Post

Deferred employment Other

taxation benefits provisions Total

£m £m £m £m

1 April 2004 3,608 68 521 4,197

Exchange movements (2) –64

Profit and loss account 332 54 68 454

Utilised in the year – payments –(45) (141) (186)

Other – 26 57 83

31 March 2005 3,938 103 511 4,552

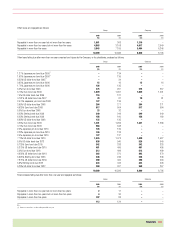

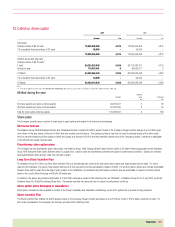

Deferred taxation

The Group’s deferred tax charge of £332 million (2004: £744 million) in respect of deferred tax liabilities excludes a charge to the profit and loss account of £25 million

(2004: £47 million) relating to associated undertakings and a credit to the profit and loss account of £604 million (2004: £49 million) relating to deferred tax assets.

Therefore the net deferred tax credit is £247 million (2004 charge: £742 million or £736 million before exceptional items).

At 31 March 2005:

Gross Gross Net deferred Less: Net deferred

deferred tax deferred tax tax (asset)/ amounts tax (asset)/

asset liability liability unprovided liability

£m £m £m £m £m

Fixed asset timing differences (227) 1,704 1,477 (10) 1,467

Deferred tax on overseas earnings – 1,747 1,747 – 1,747

Other short term timing differences (718) 745 27 – 27

Unrelieved tax losses (11,257) – (11,257) 10,413 (844)

(12,202) 4,196 (8,006) 10,403 2,397

Analysed, after offset, as:

Deferred tax asset (note 15) (1,541)

Deferred tax provision 3,938

2,397

At 31 March 2004: Gross Gross Net deferred Less: Net deferred

deferred tax deferred tax tax (asset)/ amounts tax (asset)/

asset liability liability unprovided liability

£m £m £m £m £m

Fixed asset timing differences (192) 1,848 1,656 (4) 1,652

Deferred tax on overseas earnings – 1,425 1,425 – 1,425

Other short term timing differences (812) 662 (150) 118 (32)

Unrelieved tax losses (11,420) – (11,420) 11,018 (402)

(12,424) 3,935 (8,489) 11,132 2,643

Analysed, after offset, as:

Deferred tax asset (note 15) (965)

Deferred tax provision 3,608

2,643

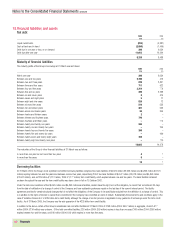

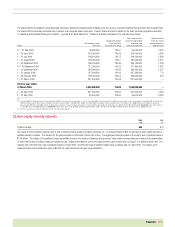

A deferred tax asset has not been recognised in respect of unrelieved tax losses of £10,413 million (2004: £11,018 million) as it is regarded as more likely than not that

there will not be suitable taxable profits against which the reversal of the underlying timing differences can be deducted.

The potential net tax benefit in respect of all tax losses carried forward at 31 March 2005, including amounts both recognised and unrecognised for deferred tax purposes,

was £610 million in UK subsidiaries (2004: £50 million) and £10,647 million in international subsidiaries (2004: £11,370 million). These losses are only available for offset

against future profits (or in some circumstances capital gains) arising within these companies subject to the laws of the relevant jurisdiction. The Group’s share of losses of

international associated undertakings that are available for offset against future trading profits in these entities is £123 million (2004: £nil).

Details of the Company’s deferred tax asset are included in note 15.

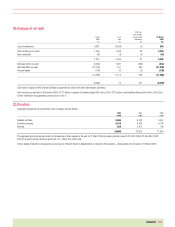

Other provisions

Other provisions primarily comprise amounts provided for legal claims, decommissioning costs and restructuring costs. The associated cash outflows for restructuring costs

are substantially short term in nature. For decommissioning costs, the associated cash outflows are generally expected to occur at the dates of exit of the assets to which

they relate, which are long term in nature. The timing of cash outflows associated with legal claims cannot be reasonably determined.