Vodafone 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

Financials |115

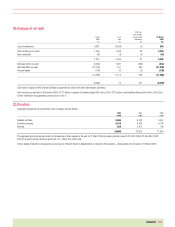

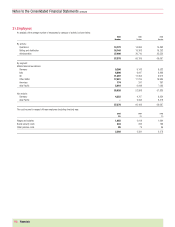

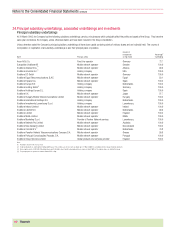

29.Analysis of net debt

Other non-

cash changes

1 April Cash and exchange 31 March

2004 flow movements 2005

£m £m £m £m

Liquid investments 4,381 (3,563) (2) 816

Cash at bank and in hand 1,409 1,408 33 2,850

Bank overdrafts (42) (3) (2) (47)

1,367 1,405 31 2,803

Debt due within one year (2,000) 1,997 (329) (332)

Debt due after one year (12,100) 161 439 (11,500)

Finance leases (136) 12 (2) (126)

(14,236) 2,170 108 (11,958)

(8,488) 12 137 (8,339)

Cash flows in respect of the Commercial Paper programme are shown net within debt-related cash flows.

Debt includes secured debt of £90 million (2004: £132 million) in respect of Vodafone Egypt (£50 million, 2004: £132 million) and Vodafone Albania (£40 million, 2004: £nil).

Further information on guarantees can be found in note 27.

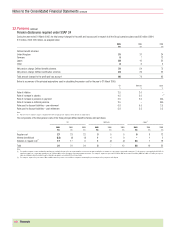

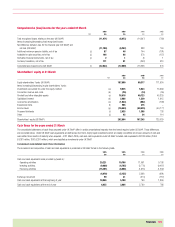

30.Directors

Aggregate emoluments of the directors of the Company were as follows:

2005 2004 2003

£’000 £’000 £’000

Salaries and fees 5,806 6,752 5,457

Incentive schemes 4,218 5,418 5,738

Benefits 582 1,371 709

10,606 13,541 11,904

The aggregate gross pre-tax gain made on the exercise of share options in the year to 31 March 2005 by serving directors was £3,076,200 (2004: £1,904,000; 2003:

£226,873) and by former directors was £2,507,477 (2004: £nil, 2003: £nil).

Further details of directors’ emoluments can be found in “Board’s Report to Shareholders on Directors’ Remuneration – Remuneration for the year to 31 March 2005”.