Vodafone 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

118 |Financials

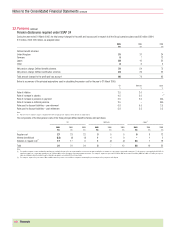

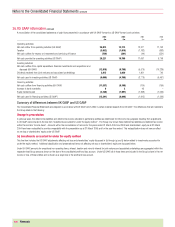

32.Pensions continued

Pension disclosures required under SSAP 24

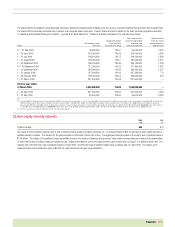

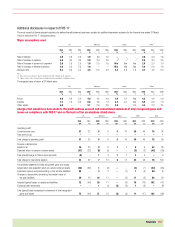

During the year ended 31 March 2005, the total amount charged to the profit and loss account in respect of all the Group’s pensions plans was £95 million (2004:

£79 million, 2003: £95 million), as analysed below:

2005 2004 2003

£m £m £m

Defined benefit schemes:

United Kingdom 31 31 24

Germany 5712

Japan 28 10 32

Other 865

Net pension charge: Defined benefit schemes 72 54 73

Net pension charge: Defined contribution schemes 23 25 22

Total amount charged to the profit and loss account 95 79 95

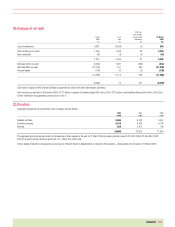

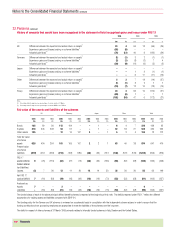

Below is a summary of the principal assumptions used in calculating the pension cost for the year to 31 March 2005:

UK Germany Japan

%%%

Rate of inflation 2.5 2.0 –

Rate of increase in salaries 4.5 3.0 –(1)

Rate of increase in pensions in payment 2.5 2.0 N/A

Rate of increase in deferred pensions 2.5 – N/A

Rate used to discount liabilities – pre-retirement 6.8 5.5 2.5

Rate used to discount liabilities – post-retirement 5.8 5.5 2.5

Notes:

(1) Rate of increase in salaries in Japan is calculated in line with company specific experience where benefits are salary related.

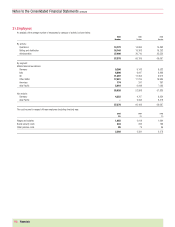

The components of the total pension costs of the three principal defined benefit schemes were as follows:

UK Germany Japan(2)

2005 2004 2003 2005 2004 2003 2005 2004 2003

£m £m £m £m £m £m £m £m £m

Regular cost 27 23 22 3555812

Interest (credit)/cost (13) (9) (4) 149–12

Variation in regular cost(1) 17 17 6 1(2) (2) 23 118

Total 31 31 24 571228 10 32

Notes:

(1) The variation in regular cost was calculated by amortising the shortfall at the date of the last formal valuation or review over the future working lives of members on a percentage of pensionable salary basis. For the purposes of determining the UK SSAP 24

variation in regular cost, a review was undertaken as at 31 March 2003 to reflect the impact of investment market movements. The charge for Japan in the year ended 31 March 2005 also included £23 million (2004: £nil, 2003: £17 million) in respect of

lump sum redundancy benefits payable through a redundancy programme associated with the retirement plan.

(2) The charge for Japan for the year ended 31 March 2004 includes the pension costs in relation to companies sold during the year for that part of the year prior to their disposal.