Vodafone 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

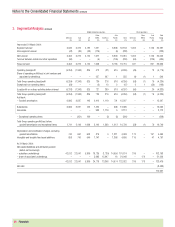

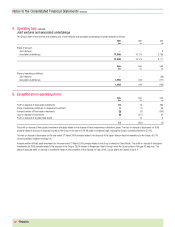

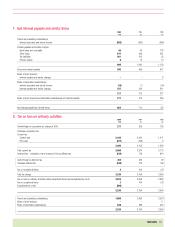

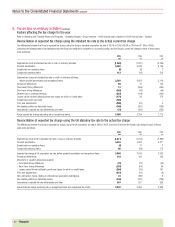

Notes to the Consolidated Financial Statements

82 |Financials

1. Basis of Consolidated Financial Statements

Statutory financial information

The Consolidated Financial Statements are prepared in accordance with applicable accounting standards and in conformity with UK GAAP, which differ in certain material

respects from US GAAP – see note 36.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and

expenses during the reporting period. Actual results could differ from those estimates.

Amounts in the Consolidated Financial Statements are stated in pounds sterling (£), the currency of the country in which the Company is incorporated. The translation into US

dollars of the Consolidated Financial Statements as of, and for the financial year ended, 31 March 2005, is for convenience only and has been made at the Noon Buying Rate

for cable transfers as announced by the Federal Reserve Bank of New York for customs purposes on 31 March 2005. This rate was $1.8888: £1. This translation should not

be construed as a representation that the sterling amounts actually represented have been, or could be, converted into dollars at this or any other rate.

2. Accounting policies

The Group’s material accounting policies are described below. For a discussion on the Group’s critical accounting estimates see “Operating and Financial Review and

Prospects – Critical Accounting Estimates”elsewhere in this Annual Report.

Accounting convention

The Consolidated Financial Statements are prepared under the historical cost convention and in accordance with applicable accounting standards of the United Kingdom

Accounting Standards Board and pronouncements of its Urgent Issues Task Force.

Basis of consolidation

The Consolidated Financial Statements include the accounts of the Company, its subsidiary undertakings and its share of the results of associated undertakings for financial

statements made up to 31 March 2005. A listing of the Company’s principal subsidiary undertakings and associated undertakings is given in note 34.

Foreign currencies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those transactions, adjusted for the effects of any hedging arrangements. Foreign

currency monetary assets and liabilities are translated into sterling at year end rates.

The results of international subsidiary undertakings, joint ventures and associated undertakings are translated into sterling at average rates of exchange. The adjustment to

year end rates is taken to reserves. Exchange differences, which arise on the retranslation of international subsidiary undertakings’, joint ventures’ and associated

undertakings’ balance sheets at the beginning of the year, and equity additions and withdrawals during the financial year, are dealt with as a movement in reserves.

Other translation differences are dealt with in the profit and loss account.

Turnover

Group turnover comprises turnover of the Company and its subsidiary undertakings and excludes sales taxes, discounts and sales between Group companies. Total Group

turnover comprises Group turnover plus the Group’s share of the turnover of its associated undertakings and joint ventures.

Turnover from mobile telecommunications comprises amounts charged to customers in respect of monthly access charges, airtime usage, messaging, the provision of other

mobile telecommunications services, including data services and information provision, fees for connecting customers to a mobile network, revenue from the sale of

equipment, including handsets and revenue arising from agreements entered into with Partner Networks.

Access charges and airtime used by contract customers are invoiced and recorded as part of a periodic billing cycle and recognised as turnover over the related access

period, with unbilled turnover resulting from services already provided from the billing cycle date to the end of each period accrued and unearned turnover from services

provided in periods after each accounting period deferred. Revenue from the sale of prepaid credit is deferred until such time as the customer uses the airtime, or the credit

expires.

Other turnover from mobile telecommunications primarily comprises equipment sales, which are recognised upon delivery to customers, and customer connection revenue.

Customer connection revenue is recognised together with the related equipment revenue to the extent that the aggregate equipment and connection revenue does not exceed

the fair value of the equipment delivered to the customer. Any customer connection revenue not recognised together with related equipment revenue is deferred and

recognised over the period in which services are expected to be provided to the customer.

Revenue from data services and information provision is recognised when the Group has performed the related service and, depending on the nature of the service, is

recognised either at the gross amount billed to the customer or the amount receivable by the Group as commission for facilitating the service.

Turnover from other businesses primarily comprises amounts charged to customers of the Group’s fixed line businesses, mainly in respect of access charges and line usage,

invoiced and recorded as part of a periodic billing cycle.