Vodafone 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance |35

2004 financial year compared to 2003 financial year

Turnover

Turnover increased 10% to £33,559 in the 2004 financial year, resulting from organic

growth (10%) and changes in exchange rates (4%), partially offset by the impact of

acquisitions and disposals. The foreign exchange impact primarily arose due to a

stronger euro. The impact of acquisitions and disposals resulted mainly from the

disposal of Japan Telecom.

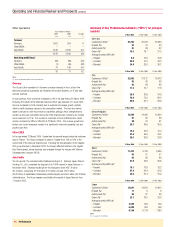

Mobile telecommunications

Years ended 31 March

2004 2003 Change

£m £m %

Service revenue:

– Voice 23,708 21,201 12

– Non-voice 4,541 3,622 25

Subtotal 28,249 24,823 13

Equipment & other 3,666 3,024 21

Total mobile revenue 31,915 27,847 15

The principal component of the increase in turnover from mobile telecommunications

arose from service revenue growth of 13%, driven primarily by growth in the Group’s

controlled customer base, which increased by 9% over the 2003 financial year.

ARPU for the year ended 31 March 2004 was up 4% in Italy and 8% in the UK, and

down 7% and 1% in Japan and Germany, respectively, compared with the year ended

31 March 2003. Total outgoing voice usage in controlled mobile businesses increased

by 11% to 154.8 billion minutes for the year ended 31 March 2004, although the

effect on ARPU was partially offset by tariff reductions and regulatory intervention.

Lower termination rates, resulting from regulatory changes, reduced service revenue by

an estimated £0.3 billion in the year.

Another key driver of the growth in service revenue was the continued success of the

Group’s data product and service offerings. Revenue from data services increased 25%

to £4,541 million for the year ended 31 March 2004 and represented 16.1% of service

revenue in the Group’s controlled mobile subsidiaries for the twelve months ended

31 March 2004, compared with 14.5% for the 2003 financial year. SMS revenue

continued to represent the largest component of both the level of and growth in data

revenue. Non-messaging data revenue increased to 4.2% of service revenue from

3.6% in the prior financial year as a result of the increased focus on providing value-

added services, particularly through Vodafone live!, the Group’s business offerings and

the increased penetration of data services into the Group’s customer base.

Mobile equipment and other turnover increased 21% to £3,666 million, due to revenue

from non-Vodafone customers acquired as a result of the acquisition of service

providers in the UK and increased acquisition and retention activity. Excluding this

revenue, mobile equipment and other turnover increased slightly as a result of higher

gross connections and upgrades.

Non-mobile businesses

Turnover from other operations decreased by 40% to £2,128 million in the year ended

31 March 2004, principally as a result of the deconsolidation of Japan Telecom from

1 October 2003, and the disposal of the Telematik business by Arcor in the previous year.

Operating loss

After goodwill amortisation and exceptional items, the Group reported a total operating

loss of £4,230 million for the year ended 31 March 2004, compared with a loss of

£5,451 million for the previous year. The £1,221 million reduction in the total

operating loss arose as a result of a £228 million credit in respect of exceptional

operating items in the year ended 31 March 2004, compared with an expense of £576

million in the prior year, and a £1,568 million increase in operating profit before

goodwill amortisation and exceptional items, partially offset by a £1,151 million

increase in the goodwill amortisation charge. The charges for goodwill amortisation,

which do not affect the cash flows of the Group or the ability of the Company to pay

dividends, increased by 8% to £15,207 million, principally as a result of the impact of

foreign exchange movements.

Expenses

Years ended 31 March

2004 2003

% of turnover % of turnover

Direct costs(1) 39.9 38.9

Operating expenses(1) 22.5 24.1

Depreciation and amortisation(2) 13.6 13.6

Notes:

(1) Before exceptional items

(2) Before goodwill amortisation

Direct costs include interconnect costs and gross acquisition and retention costs as

well as other direct costs. Operating expenses include payroll costs and other

operating expenses.

The increase in direct costs as a percentage of turnover was principally due to an

increase in the proportion of acquisition and retention costs, primarily following the

acquisition of a number of service providers in the UK. Acquisition and retention costs

net of equipment revenue as a percentage of service revenue, for the Group’s

controlled mobile businesses, increased to 12.6%, compared with 12.3% for the

comparable period. This was partially offset by the disposal of Japan Telecom.

The principal reason for the improvement in operating expenses as a percentage of

turnover was the maintenance of network operating costs at a similar level to the

previous financial year, despite the growth in customer numbers and usage. Operating

expenses as a proportion of turnover also benefited from the disposal of Japan

Telecom.

Depreciation and amortisation charges, excluding goodwill amortisation, increased by

10% to £4,549 million from £4,141 million in the comparable period. The launch of

3G services in a number of countries resulted in approximately £0.3 billion of additional

depreciation and amortisation in the current year as 3G infrastructure and licences

have been brought into use.

Goodwill amortisation

Retranslating the goodwill amortisation charge for the year ended 31 March 2004 at

the average exchange rates applicable for the year ended 31 March 2003 would have

reduced the charge by £965 million to £14,242 million, with a corresponding reduction

in total Group operating loss.

Exceptional operating items

Net exceptional operating income for the year ended 31 March 2004 of £228 million

comprises £351 million of recoveries and provision releases in relation to a contribution

tax levy on Vodafone Italy, net of £123 million of restructuring costs principally in

Vodafone UK. Net exceptional operating charges of £576 million were charged in the

year ended 31 March 2003, comprising £485 million of impairment charges in relation

to the Group’s interests in Japan Telecom and Grupo Iusacell, and £91 million of

reorganisation costs relating to the integration of Vizzavi into the Group and related

restructuring.

In accordance with accounting standards the Group regularly monitors the carrying

value of its fixed assets. A review was undertaken at 31 March 2004 to assess

whether the carrying value of assets was supported by the net present value of future

cash flows derived from assets using cash flow projections for each asset in respect of

the period to 31 March 2014. The results of the review undertaken at 31 March 2004

indicated that no impairment charge was necessary.