Vodafone 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

124 |Financials

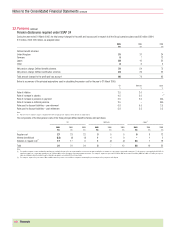

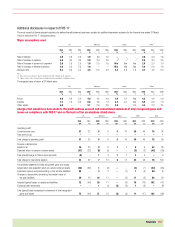

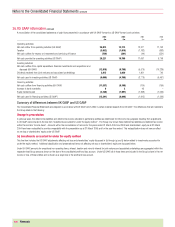

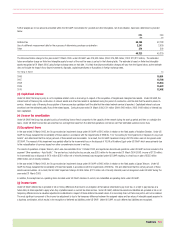

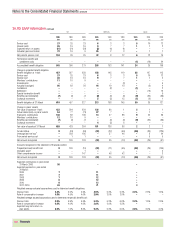

36.US GAAP information

Reconciliations to US GAAP

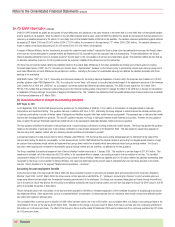

The Consolidated Financial Statements are prepared in accordance with UK GAAP, which differ in certain material respects from US GAAP. The following is a summary of the

effects of the differences between UK GAAP and US GAAP. The translation of pounds sterling amounts into US dollars is provided solely for convenience based on the Noon

Buying Rate on 31 March 2005 of $1.8888: £1.

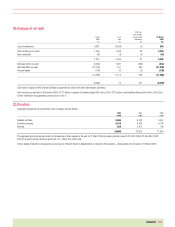

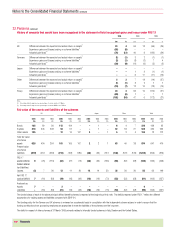

Net loss for the years ended 31 March

2005 2005 2004 2003

Ref. $m £m £m £m

Revenue from continuing operations (UK GAAP) 64,470 34,133 32,741 28,547

Items (decreasing)/increasing revenue:

Investments accounted for under the equity method (a) (10,356) (5,483) (5,276) (4,371)

Connection revenue (b) 2,310 1,223 188 (1,760)

Revenue from continuing operations (US GAAP) 56,424 29,873 27,653 22,416

Loss for the financial year (UK GAAP) (14,242) (7,540) (9,015) (9,819)

Items (increasing)/decreasing net loss:

Investments accounted for under the equity method (a) (34) (18) 1,306 656

Connection revenue and costs (b) 30 16 29 16

Goodwill and other intangible assets (c) (12,243) (6,482) (6,520) (5,487)

Capitalised interest (d) (162) (86) 406 408

Licence fee amortisation (e) (822) (435) (76) (6)

Exceptional items (f) 465 246 (351) 270

Income taxes (g) 13,235 7,007 6,231 4,953

Cumulative effect of change in accounting principle: EITF Topic D-108 (h) (11,667) (6,177) ––

Cumulative effect of change in accounting principle: Post employment benefits (h) (368) (195) ––

Other (j) (223) (118) (137) (46)

Net loss (US GAAP) (26,031) (13,782) (8,127) (9,055)

Loss from continuing operations (13,996) (7,410) (7,734) (9,135)

Loss/(income) from operations and disposal of discontinued operations (f) ––(393) 80

Cumulative effect of changes in accounting principles (h) (12,035) (6,372) ––

Net loss (US GAAP) (26,031) (13,782) (8,127) (9,055)

Basic and diluted loss per share (US GAAP): (k)

– Loss from continuing operations (21.14)¢ (11.19)p (11.36)p (13.40)p

– Loss/(income) from operations and disposal of discontinued operations ––(0.57)p 0.11p

– Cumulative effect of changes in accounting principles (18.18)¢ (9.63)p ––

– Net loss (39.32)¢ (20.82)p (11.93)p (13.29)p

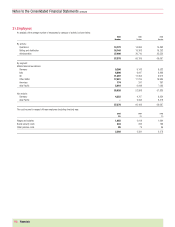

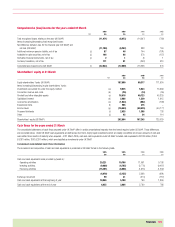

Pro-forma amounts as if the new accounting policy related to post employment benefits was applied retroactively

The following table presents net loss including related per share amounts on a pro forma basis as if the voluntary change in accounting principle related to the accounting for

post employment benefits was applied retroactively. The change in accounting principle resulting from the adoption of EITF Topic D-108 has not been adjusted in the

following table as this was not a voluntary change in accounting principle. Further details on the changes in accounting principles can be found in section (h) of this note.

2005 2005 2005 2004 2003

$m $m £m £m £m

Pro forma net loss (26,400) (13,977) (8,081) (9,163)

Pro forma net loss basic and diluted loss per share (39.88)¢ (21.11)p (11.87)p (13.44)p