Vodafone 2005 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |121

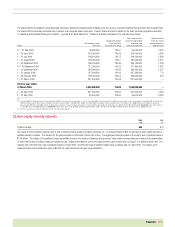

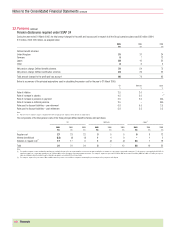

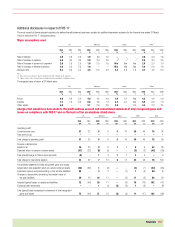

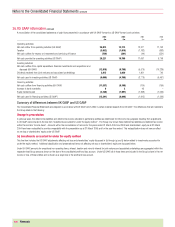

Movement in deficit during the year

UK Germany Japan Other Total

2005 2004 2005 2004 2005 2004 2005 2004 2005 2004

£m £m £m £m £m £m £m £m £m £m

Deficit in schemes before deferred tax at 1 April 23 119 27 73 33 126 82 88 165 406

Current service cost 37 32 68510 30 44 78 94

Cash contributions (136) (88) (23) (68) (9) (22) (41) (33) (209) (211)

Past service cost –––––––1–1

Financial (income)/costs (5) –141134–9

Actuarial (gains)/losses 72 (40) 20 11 –(6) 10 (12) 102 (47)

Exchange rate movements ––1(1) (2) (3) 1(5) –(9)

Other movements –––––(73) –(5) –(78)

(Surplus)/deficit in schemes before deferred tax at 31 March (9) 23 32 27 28 33 85 82 136 165

Other movements in 2004 principally relate to the disposal of the Japan Telecom fixed line business.

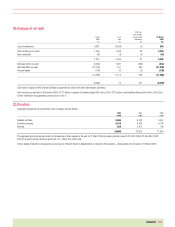

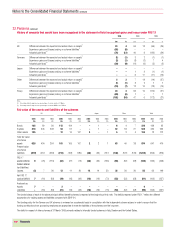

Group net assets and profit and loss account reserves

Under SSAP 24 Under FRS 17

(as adopted) (for information only)

2005 2004 2005 2004

£m £m £m £m

Net assets excluding pension scheme assets/(liabilities) 102,000 114,836 102,000 114,836

Net pension scheme assets/(liabilities) (net of deferred tax) 135 95 (81) (103)

Net assets including pension scheme liabilities 102,135 114,931 101,919 114,733

Profit and loss reserve excluding pension scheme assets/(liabilities) (51,823) (43,109) (51,823) (43,109)

Net pension scheme assets/(liabilities) (net of deferred tax) 135 95 (81) (103)

Profit and loss reserve including pension scheme assets/(liabilities) (51,688) (43,014) (51,904) (43,212)

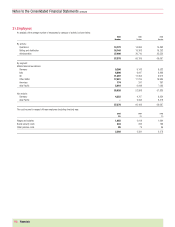

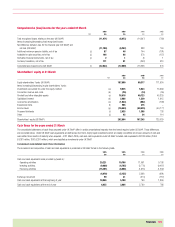

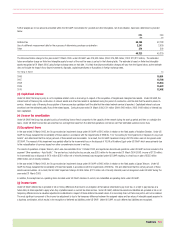

33.Subsequent events

On 13 April 2005, the Group’s associated undertaking, Verizon Wireless, completed its purchase of NextWave Telecom Inc. for $3 billion in cash.

On 19 April 2005, the Board of directors of Vodafone Italy approved a proposal to buy back issued and outstanding shares for approximately €7.9 billion (£5.4 billion). If the

proposal is approved by the shareholders of Vodafone Italy, participation will be invited on a pro rata basis. In accordance with Dutch and Italian corporate law the buy back

will take place in two tranches, the first in June 2005 and the second expected to be October 2005. After the transaction is completed the Company and Verizon

Communications Inc will continue to hold approximately 76.8% and 23.1%, respectively, of Vodafone Italy indirectly through their wholly owned subsidiaries. It is anticipated

that the buy back will be funded from currently available and forecast available cash of Vodafone Italy. At 31 March 2005, Vodafone Italy had net cash on deposit with Group

companies of €7.2 billion (£4.9 billion).

On 11 May 2005, it was announced that an agreement had been reached to merge Cegetel with neuf telecom.

Between 1 April 2005 and 12 May 2005, the Company repurchased 405,500,000 of its own shares, to be held in treasury, under irrevocable purchase orders placed prior to

31 March 2005 for total consideration of £565 million. Further details of these transactions are shown in note 23.

As described in note 26 “Commitments”, the Group has entered into an agreement with Telesystem International Wireless Inc. of Canada to acquire approximately 79% of the

share capital of MobiFon S.A. in Romania, and 100% of the issued share capital of Oskar Mobil a.s. in the Czech Republic.