Vodafone 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

44 |Performance

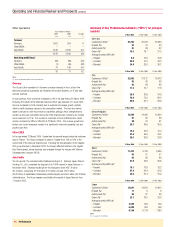

Other operations

Years ended 31 March

2004 2003 Change

£m £m %

Turnover

Germany 1,002 924 8

Other EMEA –––

Asia Pacific 1,126 2,616 (57)

2,128 3,540 (40)

Operating profit/(loss)(1)

Germany (58) (89) (35)

Other EMEA (1) (49) (98)

Asia Pacific 79 149 (47)

20 11 82

Notes:

(1) before goodwill amortisation and exceptional items

Germany

The Group’s other operations in Germany comprise interests in Arcor, a fixed line

telecommunications businesses, and Vodafone Information Systems, an IT and data

services business.

In local currency, Arcor’s turnover increased by 4% in the year ended 31 March 2004.

Excluding the results of the Telematik business which was disposed of in June 2002,

turnover increased by 16%, primarily due to customer and usage growth, partially

offset by tariff decreases caused by the competitive market. The fixed line market

leader continued to drive this intensive competition, although Arcor strengthened its

position as the main competitor during the 2004 financial year, increasing its contract

voice customers by 11%. The number of customers of Arcor’s ISDN service, Direct

Access, increased by 98% to 389,000 at 31 March 2004. This revenue growth and

further cost control measures resulted in a significantly improved operating loss and

positive cash flow.

Other EMEA

In the year ended 31 March 2004, Cegetel had the second largest residential customer

base in France. The Group increased its stake in Cegetel from 15% to 30% in the

second half of the previous financial year. Following the reorganisation of the Cegetel-

SFR group structure in December 2003, the Group’s effective interest in the Cegetel

fixed line business, whose business was enlarged through the merger with Télécom

Développement, became 28.5%.

Asia Pacific

The Group’s 66.7% controlled entity Vodafone Holdings K.K. (formerly Japan Telecom

Holdings Co., Ltd.) completed the disposal of its 100% interest in Japan Telecom in

November 2003. Receipts resulting from this transaction were ¥257.9 billion

(£1.4 billion), comprising ¥178.9 billion (£1.0 billion) of cash, ¥32.5 billion

(£0.2 billion) of transferable redeemable preferred equity and ¥46.5 billion (£0.2 billion)

withholding tax. The Group ceased consolidating the results of Japan Telecom from

1 October 2003.

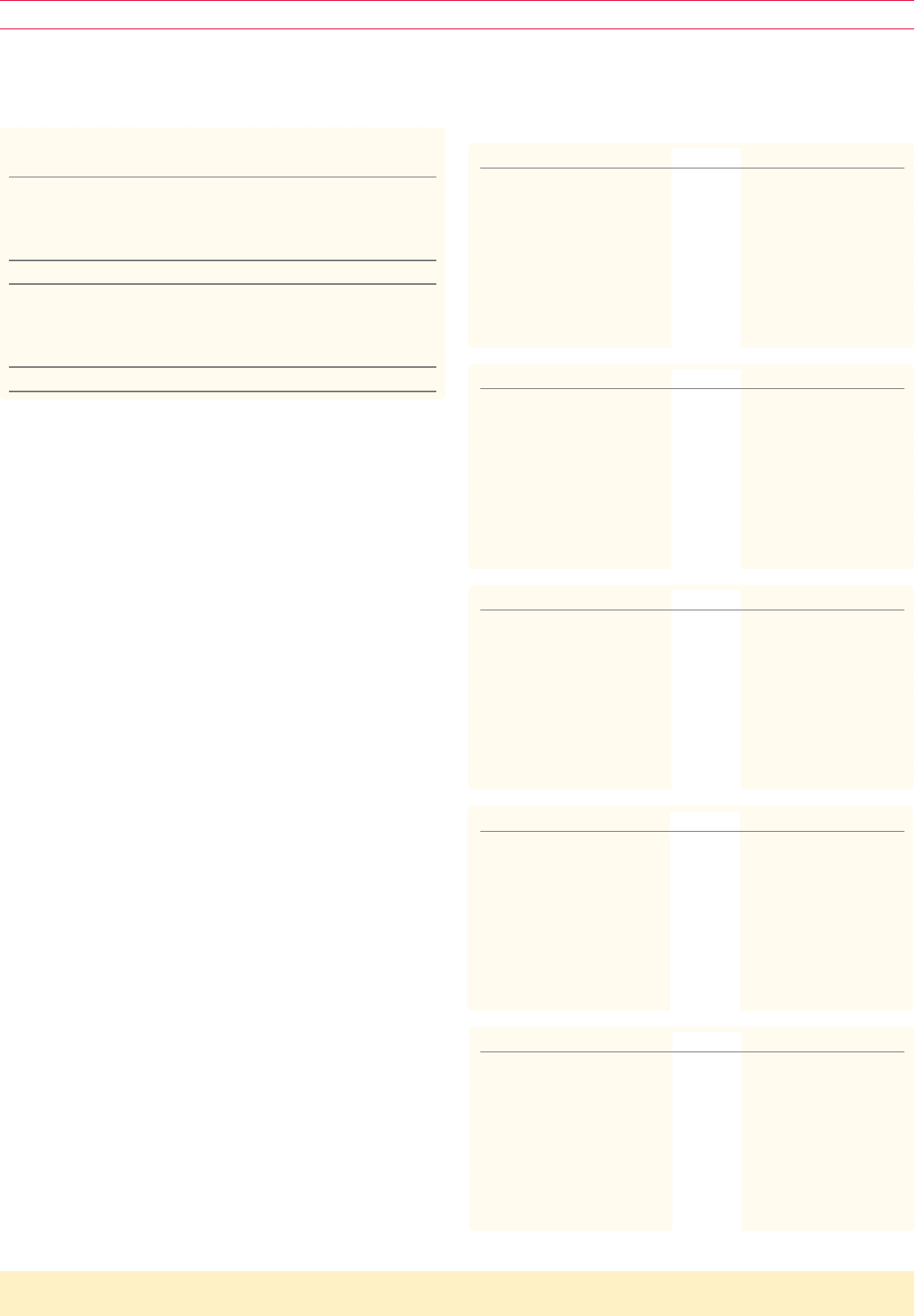

Summary of Key Performance Indicators (“KPIs”) for principal

markets

31 Mar 2005 31 Mar 2004 31 Mar 2003

Germany

Customers (’000s)(1) 27,223 25,012 22,940

Prepaid (%) 52 51 53

Activity level (%)(1) 91 93 92

Churn (%)(1) 18.3 18.7 21.2

Average monthly ARPU (€)(1)

– Prepaid 9.8 10.8 10.8

– Contract 39.9 41.2 43.3

– Blended 24.9 25.9 36.1

31 Mar 2005 31 Mar 2004 31 Mar 2003

Italy

Customers (’000s)(1) 22,502 21,137 19,412

Prepaid (%) 92 92 92

Activity level (%)(1) 92 93 95

Churn (%)(1) 17.2 16.7 17.3

Average monthly ARPU (€)(1)

– Prepaid 25.4 25.8 24.8

– Contract 76.8 75.0 68.2

– Blended 29.9 30.1 28.9

31 Mar 2005 31 Mar 2004 31 Mar 2003

United Kingdom

Customers (’000s)(1) 15,324 14,095 13,300

Prepaid (%) 61 60 59

Activity level (%)(1) 89 91 91

Churn (%)(1) 29.7 29.6 30.0

Average monthly ARPU (£)(1)

– Prepaid 10.3 10.8 10.4

– Contract 47.4 45.9 43.2

– Blended 25.5 25.8 23.8

31 Mar 2005 31 Mar 2004 31 Mar 2003

Spain

Customers (’000s)(1) 11,472 9,705 9,096

Prepaid (%) 53 57 57

Activity level (%)(1) 93 96 96

Churn (%)(1) 21.9 23.6 26.8

Average monthly ARPU (€)(1)

– Prepaid 15.1 13.8 13.2

– Contract 57.4 54.4 52.6

– Blended 34.5 31.4 31.0

31 Mar 2005 31 Mar 2004 31 Mar 2003

Japan

Customers (’000s)(1) 15,041 14,951 13,912

Prepaid (%) 11 96

Activity level (%)(1) 96 97 98

Churn (%)(1) 22.7 23.0 23.3

Average monthly ARPU (¥)

– Prepaid 2,548 N/A N/A

– Contract 6,520 N/A N/A

– Blended 6,148 6,724 7,263

Notes:

(1) See page 28 for definitions.