Vodafone 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

48 |Performance

on a weighted average price method, is attributed to distributable profits which would

not occur for the sale of non-treasury shares. Any excess above the original purchase

price must be transferred to the share premium account.

Vodafone Italy share purchase

On 19 April 2005, the Board of directors of Vodafone Italy approved a proposal to buy

back issued and outstanding shares for approximately €7.9 billion (£5.4 billion). If the

proposal is approved by the shareholders of Vodafone Italy, participation will be invited

on a pro rata basis. In accordance with Dutch and Italian corporate law the buy back

will take place in two tranches, the first in June 2005 and the second expected to be in

October 2005. After the transaction is completed the Company and Verizon

Communications Inc. will continue to hold approximately 77% and 23%, respectively, of

Vodafone Italy indirectly through their wholly owned subsidiaries. It is anticipated that

the buy back will be funded from currently available and forecast available cash of

Vodafone Italy. At 31 March 2005, Vodafone Italy had net cash on deposit with Group

companies of €7.2 billion (£4.9 billion).

Funding

The Group’s consolidated net debt position at 31 March 2005 reduced marginally to

£8,339 million, from £8,488 million at 31 March 2004, principally as a result of the

cash flow items above, share purchases, equity dividend payments and £143 million of

foreign exchange movements. This represented approximately 9% of the Group’s

market capitalisation at 31 March 2005 compared with 10% at 31 March 2004.

Average net debt at month end accounting dates over the twelve month period ended

31 March 2005 was £8,350 million, and ranged between £7,472 million and £8,994

million during the year.

A further analysis of net debt, including a full maturity analysis, can be found in notes

18 and 19 to the Consolidated Financial Statements.

The Group remains committed to maintaining a solid credit profile, as currently

demonstrated by its stable credit ratings of P-1/F1/A-1 short term and A2/A/A long

term from Moody’s, Fitch Ratings and Standard & Poor’s, respectively. Credit ratings

are not a recommendation to purchase, hold or sell securities, in as much as ratings do

not comment on market price or suitability for a particular investor, and are subject to

revision or withdrawal at any time by the assigning rating organisation. Each rating

should be evaluated independently.

The Group’s credit ratings enable it to have access to a wide range of debt finance,

including commercial paper, bonds and committed bank facilities.

Commercial paper programmes

The Group currently has US and euro commercial paper programmes of $15 billion and

£5 billion, respectively, which are available to be used to meet short term liquidity

requirements and which were undrawn at 31 March 2005 and 31 March 2004. The

commercial paper facilities are supported by $10.4 billion (£5.5 billion) of committed

bank facilities, comprised of a $5.5 billion Revolving Credit Facility that matures on

24 June 2009 and a $4.9 billion Revolving Credit Facility that matures on 26 June

2006. As at 31 March 2005, no amounts had been drawn under either facility.

Bonds

The Group has a €15 billion Medium Term Note programme and a $12 billion US shelf

programme, both of which are used to meet medium to long term funding

requirements. At 31 March 2005, amounts of €9.2 billion and $nil, respectively, were

in issue from these programmes. No bonds were issued under either programme in

the 2005 financial year.

On 29 September 2004, the Group filed a Shelf Registration Statement in Japan for a

¥600 billion shelf programme which became effective from 7 October 2004. No bonds

have been issued under this programme.

At 31 March 2005, the Group had capital market debt in issue with a nominal value of

£10,582 million.

Committed facilities

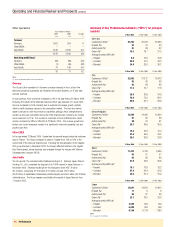

The following table summarises the committed bank facilities currently available to the

Group.

Committed Bank Facilities Amounts drawn

29 November 2001

¥225 billion term credit facility, maturing The facility was drawn down in full on

15 January 2007, entered into by 15 October 2002. The facility is

Vodafone Finance K.K. and guaranteed available for general corporate

by the Company. purposes, although amounts drawn

must be on-lent to the Company.

24 June 2004

$5.5 billion Revolving Credit Facility, No drawings have been made

maturing 24 June 2009. against this facility. The facility

supports the Group’s commercial

paper programmes and may be used

for general corporate purposes

including acquisitions.

24 June 2004

$4.9 billion Revolving Credit Facility, No drawings have been

maturing 26 June 2006. made against this facility. The

facility supports the Group’s

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

Under the terms and conditions of the $10.4 billion committed bank facilities, lenders

have the right, but not the obligation, to cancel their commitments and have

outstanding advances repaid no sooner than 30 days after notification of a change of

control of the Company. The facility agreements provide for certain structural changes

that do not affect the obligations of the Company to be specifically excluded from the

definition of a change of control. This is in addition to the rights of lenders to cancel

their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of Vodafone Finance

K.K.’s ¥225 billion term credit facility, although the change of control provision is

applicable to any guarantor of borrowings under the term credit facility. As of

31 March 2005, the Company was the sole guarantor.

In addition, Vodafone Japan has a fully drawn bilateral facility totalling ¥8 billion

(£40 million) which expires in January 2007.

Furthermore, two of the Group’s subsidiary undertakings are funded by external

facilities which are non-recourse to any member of the Group other than the borrower,

due to the level of country risk involved. These facilities may only be used to fund their

operations. Vodafone Egypt has a partly drawn (EGP550 million (£50 million))

syndicated bank facility of EGP1.2 billion (£110 million) that fully expires in September

2007, and Vodafone Albania has partly drawn (€60 million (£41 million)) syndicated

bank facilities of €85 million (£58 million) that expire at various dates up to and

including October 2012.

During the 2005 financial year, Vodafone Hungary fully repaid and cancelled its

syndicated bank facility of €350 million.

In aggregate, the Group has committed facilities of approximately £6,814million, of

which £5,572 million was undrawn at 31 March 2005.