Vodafone 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

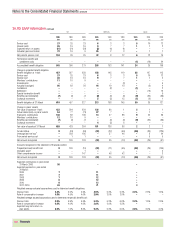

Financials |133

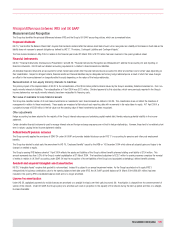

(i) Proposed dividends

Under UK GAAP, final dividends are included in the financial statements when recommended by the Board to the shareholders in respect of the results for a financial year.

Under US GAAP, dividends are included in the financial statements when declared by the Board.

(j) Other

Marketable securities

Under US GAAP, the Group classifies its marketable equity securities with readily determinable fair values as available for sale and are stated at fair value with the unrealised

loss or gain, net of deferred taxes, reported in comprehensive income. Under UK GAAP, such investments are generally carried at cost and reviewed for other than temporary

impairment.

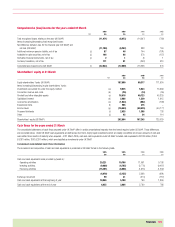

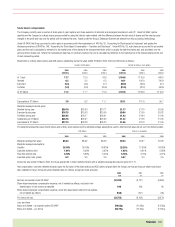

The Group’s fixed asset investments, comprising mainly of equity securities, are classified as available for sale. The table below sets out the information of the cost, fair value

and unrealised gains and losses.

UK GAAP net book

value(1) Unrealised gains Unrealised losses Fair value

£m £m £m £m

31 March 2005 852 330 –1,182

31 March 2004 1,049 241 –1,290

Note:

(1) Determined using the weighted average cost basis.

Minority interests

Where losses in a subsidiary undertaking attributable to the minority interest result in its interest being one in net liabilities, UK GAAP requires a parent company make

provision only to the extent it has a commercial or legal obligation to provide funding that may not be recoverable in respect of the accumulated losses attributable to the

minority interest. US GAAP requires all losses allocable to minority interests in excess of their interest in the equity of the respective subsidiary to be charged to the majority

shareholder.

Derivative instruments

All the Group’s transactions in derivative financial instruments are undertaken for risk management purposes only and are used to hedge its exposure to interest rate and

foreign currency risk. In accordance with UK GAAP, to the extent that such instruments are matched against an underlying asset or liability, they are accounted for as hedging

transactions and recorded at appropriate historical amounts, with fair value information disclosed in the notes to the Consolidated Financial Statements. Under US GAAP, in

accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities”, the Group’s derivative financial instruments, together with any separately

identified embedded derivatives, are reported as assets or liabilities on the Group’s balance sheet at fair value. In a hedge of fair values, changes in the fair value of the

derivative are recorded in earnings with a corresponding change in the fair value of the hedged item also being recorded in earnings. For hedges of future cash flows, the

changes in fair value of the derivative are recorded in other comprehensive income and reclassified to earnings when the hedged item affects earnings. Under US GAAP, all

changes in fair value of derivatives not designated in hedging relationships are accounted for in the consolidated profit and loss account. The Group does not pursue hedge

accounting treatment for:

–interest rate futures, which are typically used to switch floating interest rates to fixed interest rates;

–derivatives entered into for funding and liquidity purposes, including forwards; or

–individual contracts where the underlying value of the transactions amounts to less than £10 million.

The net effect recognised in earnings representing hedge ineffectiveness for fair value hedges and cash flow hedges is not material.

Post employment benefits

Under both UK GAAP and US GAAP, pension costs provide for future pension liabilities. There are differences, however, in the prescribed methods of valuation, which give rise to

GAAP adjustments to the pension cost and the pension prepayment/liability. As at 31 March 2005, the Group operated a number of pension plans for the benefit of its

employees throughout the world, which vary with conditions and practices in the countries concerned. A description of the Group’s major pension plans is provided in note 32.

The investment policy and strategy of the UK main scheme in the UK is set by the Trustees and reflects the liabilities of the plan. The investment policy and strategy of the

German plans are set by the Investment Sub-Committee of the Contractual Trust Agreement and similarly reflects the liabilities of the plans, which are more heavily weighted

towards pensioners than the UK plan.

The basis used to determine the overall long term return on plan assets is to apply the expected rate of return on bonds based on market interest rates at the relevant date to

that proportion of the assets invested in bonds. The bond rate of return is then increased by an allowance for the expected equity risk premium in each market, based on

past experience and future expectations of return and this rate is applied to the relevant proportion invested in equities. The measurement date for the Group’s pension

assets and obligations is 31 March. The measurement date for the Group’s net periodic pension cost is 1 April. From 1 April 2004, actuarial gains and losses are recognised

in the period in which they arise.

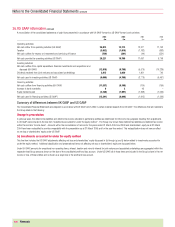

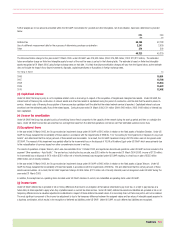

Analyses of the net pension cost, plan assets, obligations and funded status for the major defined benefit plans in the UK, Germany and Japan, prepared under US GAAP, are

provided in the following table.