Vodafone 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

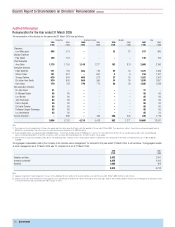

Board’s Report to Shareholders on Directors’ Remuneration continued

66 |Governance

Each element of the reward package focuses on supporting different Company

objectives, which are illustrated below:

The principles of the Policy are cascaded, where appropriate, to executives below

Board level as set out below:

Report on Executive Directors’ Remuneration for the

2005 Financial Year and Subsequent Periods

Total remuneration levels

In accordance with the Policy, the Company benchmarks total remuneration levels

against other large European domiciled companies, using externally provided pay data.

Total remuneration for these purposes means the sum of base salary and short,

medium and long term incentives. The European focus was selected because Europe

continues to be Vodafone’s major market and the Company is one of the top ten

companies in Europe by market capitalisation. The competitive data is used as one

input to determine the remuneration level of the Chief Executive and Board. The

Committee also takes into account other factors including personal and Company

performance in determining the target remuneration level.

Components of executive directors’ remuneration

Executive directors receive base salary, short/medium term incentive (annual deferred

share bonus), long term incentives (performance shares and share options) and pension

benefits. Vesting of all incentives is dependent on the achievement of performance

targets that are set by the Remuneration Committee prior to the awards being granted.

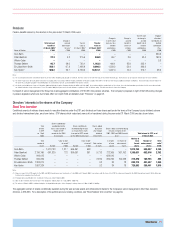

Base salary

Salaries are reviewed annually with effect from 1 July and adjustments may be made

to reflect competitive national pay levels, the prevailing level of salary reviews of

employees within the Group, changes in responsibilities, Group and individual

performance. External remuneration consultants provide data about market salary

levels and advise the Committee accordingly. Pension entitlements are based only on

base salary.

Incentive awards

Short/medium term incentive: Annual deferred share bonus

The purpose of the Vodafone Group Short Term Incentive Plan (“STIP”) is to focus and

motivate executive directors to achieve annual business KPIs that will further the

Company’s medium term objectives. The STIP awards made in July 2002 vested in

July 2004. Details of STIP awards are given in the table on page 71.

The STIP comprises two elements: a base award and an enhancement award. Release

of both elements after three years is dependent upon the continued employment of the

participant.

Base award

The base award is earned by achievement of one year KPI linked performance targets

and is delivered in the form of shares. The target base award level for the 2005

financial year was 100% of salary with a maximum of 200% of salary available for

exceptional performance.

The Remuneration Committee reviews and sets the base award performance targets

on an annual basis, taking into account business strategy. The performance measures

for the 2005 financial year relate to EBITDA, total service revenue, free cash flow and

customer satisfaction. Each element is weighted according to the responsibilities of the

relevant director. For the Chief Executive, in the 2005 financial year, the EBITDA target

was 40% of the total, total service revenue 25%, free cash flow 20% and customer

satisfaction 15%, and the payout achieved was 104%. The targets are not disclosed,

as they are commercially sensitive. For the 2006 financial year, the EBITDA measure

will be replaced with Operating Profit (EBIT) and increased focus will be placed on total

service revenue. Free Cash Flow remains a key measure and the customer satisfaction

measure is retained and enhanced.

The Group may, at its discretion, pay a cash sum of up to the value of the base award

in the event that an executive director declines the share award. In these

circumstances, the executive director will not be eligible to receive the enhancement

award or any cash alternative.

Enhancement award

An enhancement award of 50% of the number of shares comprised in the base award

is earned by achievement of a subsequent two-year EPS performance target following

the initial twelve-month period. For awards made in the 2005 financial year, which will

vest in July 2006, the performance target was that growth in EPS, before goodwill

amortisation and exceptional items, must equal or exceed 16% over the two-year

performance period.

The Company is reviewing the current STIP and may propose changes to the design of

the plan to enhance its effectiveness and enable it to be operated outside the UK for

the Company’s international senior executives. Any changes to the plan will be

discussed with major shareholders and relevant institutions with a view to applying the

changes to bonuses earned in the 2006 financial year.

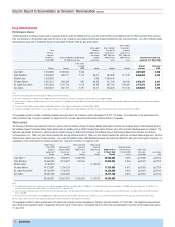

Long term incentives

Awards of performance shares and share options were made to executive directors

following the 2004 AGM on 28 July 2004. The awards for the 2005 financial year will

be also be made following the AGM.

Awards are delivered in the form of ordinary shares of the Company. All awards are

made under plans that incorporate dilution limits as set out in the Guidelines for Share

Incentive Schemes published by the Association of British Insurers. The current

estimated dilution from subsisting awards, including executive and all-employee share

awards, is approximately 2.4% of the Company’s share capital at 31 March 2005

(2.1% as at 31 March 2004).

Performance

Purpose Measure(s)

Base Short/Medium Long Term

salary Term Incentive Incentives

Executive Set against Conditional on Annual awards of

Committee national business performance performance shares

market relevant to individual and share options with

executive performance conditions

Target bonus level

competitive in local

market

•Reflects competitive •Individual contribution

Base salary market level, role and

individual achievement

•Motivates achievement of • EBITDA (to be replaced

annual business KPIs with EBIT from

Annual •Provides incentive to co-invest 1 April 2005)

deferred •Motivates achievement of • Free cash flow

share bonus medium term KPIs •Total service revenue

•Aligns with shareholders •Customer satisfaction

•Adjusted EPS growth

on share deferral

•Incentivise earnings growth • Adjusted EPS growth

Share options and share price growth

•Aligns with shareholders

Performance •Incentivise share price and •Relative Total

shares dividend growth Shareholder Return

•Aligns with shareholders (“TSR”)