Vodafone 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |125

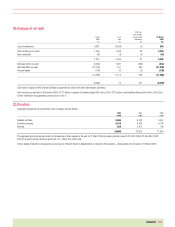

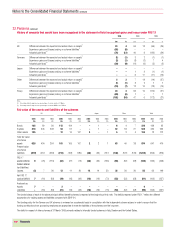

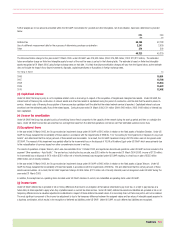

Comprehensive (loss)/income for the years ended 31 March

2005 2005 2004 2003

Ref. $m £m £m £m

Total recognised losses relating to the year (UK GAAP) (11,471) (6,073) (14,307) (780)

Items (increasing)/decreasing total recognised losses:

Net difference between loss for the financial year (UK GAAP) and

net loss (US GAAP) (11,789) (6,242) 888 764

Additional minimum pension liability, net of tax (j) 87 46 144 (191)

Available for sale securities, net of tax (j) 166 88 378 (137)

Derivative financial instruments, net of tax (j) 21(1) 1

Currency translation, net of tax 171 91 (353) 913

Comprehensive (loss)/income (US GAAP) (l) (22,834) (12,089) (13,251) 570

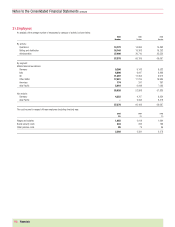

Shareholders’ equity at 31 March

2005 2005 2004

Ref. $m £m £m

Equity shareholders’ funds (UK GAAP) 187,590 99,317 111,924

Items increasing/(decreasing) equity shareholders’ funds:

Investments accounted for under the equity method (a) 9,525 5,043 15,669

Connection revenue and costs (b) (26) (14) (55)

Goodwill and other intangible assets (c) 76,918 40,723 45,320

Capitalised interest (d) 2,888 1,529 1,615

Licence fee amortisation (e) (1,043) (552) (109)

Exceptional items (f) 595 315 –

Income taxes (g) (76,563) (40,535) (50,177)

Proposed dividends (i) 2,635 1,395 728

Other (j) 45 24 114

Shareholders’ equity (US GAAP) 202,564 107,245 125,029

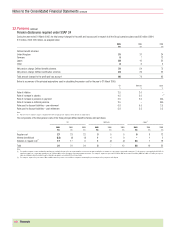

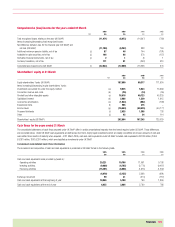

Cash flows for the years ended 31 March

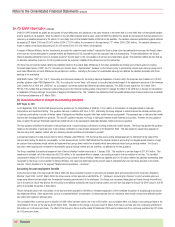

The consolidated statements of cash flows prepared under UK GAAP differ in certain presentational respects from the format required under US GAAP. These differences

are reconciled below. Under US GAAP, cash equivalents are defined as short term, highly liquid investments which are readily convertible into known amounts of cash and

were within three months of maturity when acquired. At 31 March 2005, cash and cash equivalents under US GAAP included cash equivalents of £816 million (2004:

£4,381 million; 2003: £291 million), which are classified as investments under UK GAAP.

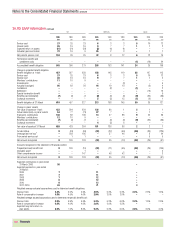

Condensed consolidated cash flow information

The movement and composition of cash and cash equivalents is presented in US GAAP format in the following table.

2005 2005 2004 2003

$m £m £m £m

Cash and cash equivalents were provided by/(used in):

Operating activities 20,221 10,706 11,091 9,708

Investing activities (9,000) (4,765) (3,778) (9,497)

Financing activities (15,291) (8,096) (1,915) (1,202)

(4,070) (2,155) 5,398 (991)

Exchange movement 59 31 (374) (112)

Cash and cash equivalents at the beginning of year 10,936 5,790 766 1,869

Cash and cash equivalents at the end of year 6,925 3,666 5,790 766