Vodafone 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance |49

Exercise of the option could have occurred in either one or both of two phases. The

Phase I option expired in August 2004 without being exercised. The Phase II Option

may be exercised during the periods commencing 30 days before and ending 30 days

after any one or more of 10 July 2005, 10 July 2006 and 10 July 2007. The Phase II

Option also limits the aggregate amount paid to $20 billion and caps the payments

under single exercises to $10 billion. Determination of the market value of the

Company’s interests will be by mutual agreement of the parties to the transaction or, if

no such agreement is reached within 30 days of the valuation date, by appraisal. If an

initial public offering takes place and the common stock trades in a regular and active

market, the market value of the Company’s interest will be determined by reference to

the trading price of common stock.

On 1 July 2002, Vodafone awarded share options to all eligible employees in all

countries in which the Group then operated, other than Japan and Sweden, under its

1999 Long Term Stock Incentive Plan. These share options may be exercised from

1 July 2005 until 30 June 2012 at a price of 90 pence per share (92.99 pence per

share for participants in Italy). If all share options are exercised, Vodafone would issue

approximately 480 million ordinary shares. Vodafone believes that a substantial

number of share options will be exercised on 1 July 2005 and in the period

immediately following.

Potential cash outflows

In respect of the Group’s interest in the Verizon Wireless partnership, an option granted

to Price Communications, Inc. by Verizon Communications is exercisable at any time

up to and including 15 August 2006. The option gives Price Communications, Inc. the

right to exchange its preferred limited partnership interest in Verizon Wireless of the

East LP for either equity of Verizon Wireless (if an initial public offering of such equity

occurs), or common stock of Verizon Communications. The option exercise would

result in an exchange for shares at a fixed value of $1.113 billion plus a preferred

allocation of profits from Verizon Wireless of the East LP on a quarterly basis, but not to

exceed 2.915% per annum. If the exercise occurs, Verizon Communications has the

right, but not the obligation, to contribute the preferred interest to the Verizon Wireless

partnership, diluting the Group’s interest. However, the Group also has the right to

contribute further capital to the Verizon Wireless partnership in order to maintain its

percentage partnership interest at the level just prior to the exercise of the option.

Such amount would not exceed $1.0 billion.

On 27 November 2003, Vodafone Jersey Holdings Ltd was granted a call option over

20% of the issued ordinary share capital of MTC Vodafone (Bahrain) BSCC. The option

is exercisable in two tranches. Tranche one is exercisable at par at any time on or after

28 December 2004 but before 28 December 2007. Tranche two is exercisable at par

plus 20% at any time on or after 28 December 2007 but before 28 December 2009.

On 31 December 2003, as part of the restructuring described within “History and

Development of the Company”, the Group’s associate investment, SFR, granted a put

option to SNCF over its 35% shareholding in Cegetel. SNCF may exercise the put

option, consisting of 4,982,353 shares, at any time during the period from 1 January

2007 to 31 March 2010 and SNCF has been granted a value floor for the option of an

aggregate amount equal to the sum of €183 million less such amount of interest as

has accrued at the euro overnight index average rate on the sum of €32 million

between 31 December 2003 and the date on which the transfer of the SNCF

shareholding to SFR occurs. Furthermore, the option exercise may be accelerated in

certain circumstances and the announcement by SFR of a merger between Cegetel

and neuf telecom expected to occur later in the 2006 financial year, would constitute

such an acceleration event. SNCF also granted SFR a call option over the 35% stake,

which may be exercised at any time between 1 April 2010 and 30 June 2013.

During the 2005 financial year, the Group sold 16.9% of Vodafone Egypt to Telecom

Egypt, reducing the Group’s effective interest to 50.1%. It was also agreed that the

Group and Telecom Egypt would each contribute a 25.5% interest in Vodafone Egypt

The Group believes that it has sufficient funding for its expected working capital

requirements. Further details regarding the maturity, currency and interest rates of the

Group’s gross borrowings at 31 March 2005 are included in note 19 to the

Consolidated Financial Statements.

Financial assets and liabilities

Details of the Group’s treasury management and policies are set out below in

“Quantitative and Qualitative Disclosures about Market Risk”. Analyses of financial

assets and liabilities, including the maturity profile of debt, currency and interest rate

structure, are included in notes 18 and 19 to the Consolidated Financial Statements.

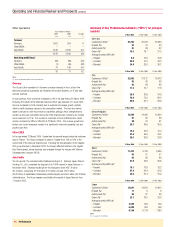

Contractual obligations

A summary of the Group’s principal contractual financial obligations is shown below.

Further details on the items included can be found in the notes to the Consolidated

Financial Statements.

Payments due by period £m

Contractual obligations(1) Total <1 year 1-3 years 3-5 years >5 years

Short term debt(2) 392 392 –––

Long term debt(2) 11,613 –3,620 4,019 3,974

Interest on debt(3) 4,432 444 901 705 2,382

Operating lease

commitments(4) 3,074 630 758 554 1,132

Capital commitments(5) 749 748 1 ––

Purchase commitments(6) 1,242 1,152 87 1 2

Preference shares

(including dividends) 1,560 45 90 90 1,335

Share purchase

programme(7) 565 565 –––

MobiFon and Oskar

acquisition agreements(8) 1,858 1,858 –––

Total contractual cash

obligations(1) 25,485 5,834 5,457 5,369 8,825

Notes:

(1) The above table of contractual obligations excludes commitments in respect of options over interests in Group businesses held

by minority shareholders (see “Option agreements”) and obligations to pay dividends to minority shareholders (see “Dividends

from associated undertakings and dividends to minority interests”). Disclosures required by Financial Accounting Standards

Board (“FASB”) Interpretation No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others”, are provided in note 27 to the Consolidated Financial Statements. The table also

excludes obligations under post employment benefit schemes, details of which are provided in note 32 to the Consolidated

Financial Statements.

(2) See note 19 to the Consolidated Financial Statements.

(3) Future interest payments on the Group’s gross debt reflects fixed and floating rate interest payments. Floating rate payments

are calculated in accordance with market derived forward rates at 31 March 2005. Actual interest payments could vary from

the amounts in the table.

(4) See note 26 to the Consolidated Financial Statements.

(5) Capital commitments shown in the table above are estimated to represent approximately 15% of the Group’s total capital

expenditure in the 2005 financial year and are primarily related to network infrastructure.

(6) Predominantly commitments for handsets.

(7) The balance represents the irrevocable purchase instructions as described in “Share purchase programme”above.

(8) As described in “Business Overview – History and Development of the Company”. In addition, the Group will assume

approximately $0.9 billion (£0.5 billion) of net debt on completion of the acquisition.

Option agreements

Potential cash inflows

As part of the agreements entered into upon the formation of Verizon Wireless, the

Company entered into an Investment Agreement with Verizon Communications, Inc.

(“Verizon Communications”), formerly Bell Atlantic Corporation, and Verizon Wireless.

Under this agreement, dated 3 April 2000, the Company has the right to require Verizon

Communications or Verizon Wireless to acquire interests in the Verizon Wireless

partnership from the Company with an aggregate market value of up to $20 billion during

certain periods up to August 2007, dependent on the value of the Company’s 45% stake

in Verizon Wireless. This represents a potential source of liquidity to the Group.