Vodafone 2005 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |131

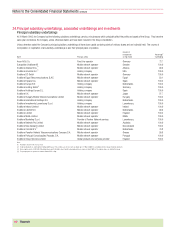

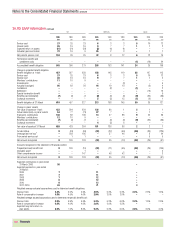

Further analysis as to how amounts presented within the US GAAP reconciliation for goodwill and other intangibles, net of amortisation, have been determined is provided

below.

2005 2004

£m £m

Deferred tax 38,108 42,188

Use of a different measurement date for the purposes of determining purchase consideration 2,241 2,630

Other 374 502

40,723 45,320

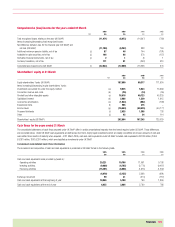

The total amortisation charge for the year ended 31 March 2005, under US GAAP, was £16,530 million (2004: £15,893 million; 2003: £13,873 million). The estimated

future amortisation charge on finite-lived intangible assets for each of the next five years is set out in the following table. The estimate is based on finite-lived intangible

assets recognised at 31 March 2005 using foreign exchange rates on that date. It is likely that future amortisation charges will vary from the figures below, as the estimate

does not include the impact of any future investments, disposals, capital expenditures or fluctuations in foreign exchange rates.

Year ending 31 March2 £m

2006 15,991

2007 15,703

2008 15,543

2009 15,422

2010 12,402

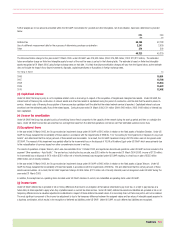

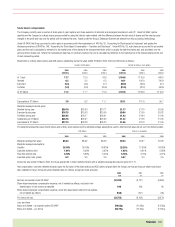

(d) Capitalised interest

Under UK GAAP, the Group’s policy is not to capitalise interest costs on borrowings in respect of the acquisition of tangible and intangible fixed assets. Under US GAAP, the

interest costs of financing the construction of network assets and other fixed assets is capitalised during the period of construction until the date that the asset is placed in

service. Interest costs of financing the acquisition of licences are also capitalised until the date that the related network service is launched. Capitalised interest costs are

amortised over the estimated useful lives of the related assets. During the year ended 31 March 2005, £31 million (2004: £429 million; 2003: £408 million) of interest has

been capitalised.

(e) Licence fee amortisation

Under UK GAAP, the Group has adopted a policy of amortising licence fees in proportion to the capacity of the network during the start up period and then on a straight line

basis. Under US GAAP, licence fees are amortised on a straight line basis from the date that operations commence over their estimated useful economic lives.

(f) Exceptional items

In the year ended 31 March 2005, the Group recorded an impairment charge under UK GAAP of £315 million in relation to the fixed assets of Vodafone Sweden. Under US

GAAP, the Group evaluated the recoverability of these assets in accordance with the requirements of SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived

Assets”, and determined that the carrying amount of these assets was recoverable. As a result, the UK GAAP impairment charge of £315 million was not recognised under

US GAAP. The reversal of this impairment was partially offset by the incremental loss on the disposal of 16.9% of Vodafone Egypt under US GAAP which arose primarily due

to the reclassification of currency losses from other comprehensive income to net loss.

The results of operations of Japan Telecom, which was deconsolidated from 1 October 2003, are reported as discontinued operations under US GAAP and are included in the

segment “Other operations – Asia Pacific”. The pre-tax loss, including the loss on sale, was £515 million for the year ended 31 March 2004 (2003: income of £133 million).

An incremental loss on disposal of £476 million (£351 million net of minority interests) was recognised under US GAAP resulting in a total loss on sale of £555 million

(£399 million net of minority interests).

In the year ended 31 March 2003, the Group recorded an impairment charge under UK GAAP of £405 million in relation to the fixed assets of Japan Telecom. Under US

GAAP, the Group evaluated the recoverability of these fixed assets in accordance with the requirements of SFAS No. 144 and determined that the carrying amount of these

assets was recoverable. As a result, the UK GAAP impairment charge of £405 million (£270 million net of minority interests) was not recognised under US GAAP during the

year ended 31 March 2003.

In addition, the exceptional non-operating items recorded under UK GAAP, disclosed in note 6, are reclassified as operating items under US GAAP.

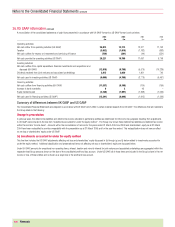

(g) Income taxes

Under UK GAAP, deferred tax is provided in full on timing differences that result in an obligation at the balance sheet date to pay more tax, or a right to pay less tax, at a

future date, at rates expected to apply when they crystallise based on current tax rates and law. Under US GAAP, deferred tax assets and liabilities are provided in full on all

temporary differences and a valuation adjustment is established in respect of those deferred tax assets where it is more likely than not that some portion will not be realised.

The most significant component of the income tax adjustment is due to the temporary difference between the assigned values and tax values of intangible assets acquired in

a business combination, which results in the recognition of deferred tax liabilities under US GAAP. Under UK GAAP, no such deferred tax liabilities are recognised.