Vodafone 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

42 |Performance

Total UK turnover increased by 18% to £4,782 million for the 2004 financial year,

driven by organic growth of 12% and the acquisition of a number of service providers,

including Singlepoint which contributed growth of 6%. The organic growth resulted

from the larger customer base and increased usage of services, partially offset by a

regulatory reduction in termination rates and the inclusion of calls to other mobile

operators within new bundled price plans. Non-voice service revenue, as a percentage

of service revenue, improved over the year to 16.1% for the year ended 31 March

2004 as usage levels of SMS and other data offerings increased. The increased

number of Vodafone live! active devices contributed towards the improved non-voice

service usage. Equipment and other revenue increased by 91%, principally as a result

of revenue from non-Vodafone customers acquired with the service providers and

increased customer acquisition and upgrade activity.

Blended ARPU increased in the year, mainly due to growth in prepaid ARPU and the

Singlepoint acquisition. Prepaid ARPU improved to £130 for the year ended 31 March

2004 from £125 for the year ended 31 March 2003. Contract ARPU, excluding the

impact of the Singlepoint acquisition, increased by £14 to £531 for the year ended

31 March 2004.

Vodafone UK’s share of mobile service revenue in the last quarterly review in the 2004

financial year by OFCOM, the national UK regulator, for the quarter ended

30 September 2003, was 31.8%, representing a lead of 6.5 percentage points over

the second placed competitor.

Registered customers increased by 6% to 14,095,000 and the proportion of contract

customers and activity levels remained stable throughout the year ended 31 March

2004. The acquisition of the service providers, including Singlepoint, during the year

increased the proportion of in-house managed contract customers from 57% to 93%,

enabling closer management of the contract customer base.

On 24 July 2003, Vodafone UK reduced its termination charges by RPI minus 15% (on

the weighted average charge for the previous year) to comply with its licence

requirements. This reduction implemented the decision of the UK Competition

Commission in January 2003.

UK operating profit before goodwill amortisation and exceptional items fell by

£22 million in the year ended 31 March 2004 to £1,098 million. Contributing factors

included: increased investment in the acquisition and retention of the customer base;

increased interconnect costs due to changes in the call mix; lower incoming revenue

due to the reduction in termination rates; increased depreciation as a result of a

general increase in capital expenditure; and amortisation of the 3G licence, which was

charged for the first time in this year. As the Singlepoint business had a lower margin,

this diluted the margin in the second half of the year. These factors were partially

offset by operating efficiencies, including reductions in network operating costs as a

percentage of turnover.

Vodafone UK announced a restructuring programme in the second half of the 2004

financial year which resulted in an exceptional charge of £130 million relating to staff

costs, property provisions and the write down of other assets. The objective of the

restructuring was to consolidate recent business acquisitions and to reorganise the

customer management organisation to meet the changing needs of Vodafone UK’s

customers. In addition, the business reorganised its network and technology

organisations and implemented a programme to consolidate switching centres in its

network.

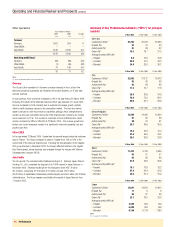

Other Europe, Middle East and Africa

Years ended 31 March

2004 2003 Change

£m £m %

Turnover 7,627 6,219 23

Operating profit(1) 3,142 2,387 32

Notes:

(1) before goodwill amortisation and exceptional items

Proportionate customers for the other markets in the Europe, Middle East and Africa

region increased by 17% to 41,336,000 in the 2004 financial year, including the effect

of stake increases.

Vodafone Spain’s turnover for the year ended 31 March 2004 increased by 13%, when

measured in local currency, as a result of a 7% rise in the customer base and

improved voice and data usage, partially offset by reduced prices. Turnover for the

region also benefited from growth in the other mobile operating subsidiaries in the

region, particularly in Greece and the Netherlands. In Greece, turnover increased by

17%, when measured in local currency, reflecting an increase in the customer base of

9% and increased voice and data usage, partially offset by price reductions. In the

Netherlands, the increase in revenue was principally driven by an increased contract

customer base and higher data service usage and revenue.

Vodafone Spain’s operating profit before goodwill amortisation improved due to the

increased proportion of data revenue and reduced acquisition and retention costs as a

percentage of turnover, partially offset by a higher proportion of depreciation and

licence amortisation charges, as a result of the commencement of depreciation on the

3G network and related licence amortisation. The regional operating profit, before

goodwill amortisation and exceptional items, also grew as a result of an increase in the

profits of the Group’s associated undertaking, SFR. This business reported a strong

financial performance, with revenue increasing as a result of an 8% increase in the

customer base to 14,370,000, and higher data revenue. Blended ARPU was broadly

unchanged from the previous year. The reported results also benefited from the full

year impact of an effective stake increase in the mobile business of SFR from 31.9% to

43.9% in the second half of the previous financial year.

Americas

Years ended 31 March Local currency

2004 2003 Change change

£m £m % %

Turnover

Verizon Wireless ––––

Other Americas –5 (100)

–5 (100)

Operating profit/(loss)(1)

Verizon Wireless 1,406 1,270 11 20

Other Americas (13) (51) (75)

1,393 1,219 14

Notes:

(1) before goodwill amortisation and exceptional items

United States

The Americas Region predominantly comprises the Group’s interests in Verizon

Wireless, which is accounted for using equity accounting. Accordingly, the turnover

from this operation is not included in the Group’s statutory profit and loss account.

In a highly competitive US market, Verizon Wireless continued to outperform its

competitors and ranked first in customer net additions for the year ended 31 March

2004. The total customer base increased by 17% over the year to 38,909,000. At