Vodafone 2005 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

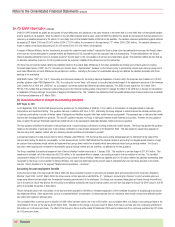

Information on International Financial Reporting Standards

138 |Shareholder information

Introduction

On 19 July 2002, the European Parliament adopted Regulation No. 1606/2002 requiring listed companies in the Member States of the European Union to prepare their

consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) from 2005. IFRS will apply for the first time in the Group’s Annual Report

for the year ending 31 March 2006. Consequently, the Group’s interim results for the six month period ending 30 September 2005 will be presented under IFRS together with

restated information for the six months ended 30 September 2004 and the year ended 31 March 2005.

The Group provided an update of its adoption of IFRS on 20 January 2005 which included restated financial information for the six months ended 30 September 2004, and

additional IFRS segmental information was released on 18 March 2005. The Group currently intends to publish restated IFRS financial information for the year ended 31 March

2005 in July 2005. These updates are available on the Company’s website, www.vodafone.com.

Basis of preparation of IFRS financial information

The Group’s IFRS financial information for the year ending 31 March 2006 will be prepared in accordance with the IFRS, International Accounting Standards (“IAS”) and

interpretations issued by the IASB and its committees, and as interpreted by any regulatory bodies applicable to the Group, for those standards that are mandatory for EU listed

companies adopting IFRS for the first time. In addition, the Group has elected to adopt early the amendment to IAS 19, “Employee Benefits”, issued on 16 December 2004 which

allows actuarial gains and losses to be charged or credited to equity.

On 19 November 2004, the European Commission endorsed an amended version of IAS 39, “Financial Instruments: Recognition and Measurement”rather than the full version as

previously published by the IASB. In accordance with guidance issued by the UK Accounting Standards Board, the full version of IAS 39, as issued by the IASB, will be adopted.

Following the SEC’s issuance on 12 April 2005 of its final rule, “First-Time Application of International Financial Reporting Standards”, the Group’s Annual Report for the year ending

31 March 2006 will provide one year of comparative financial information under IFRS and the opening balance sheet date for adoption of IFRS will be 1 April 2004.

IFRS 1 exemptions

IFRS 1, “First-time Adoption of International Financial Reporting Standards”sets out the procedures that the Group must follow when it adopts IFRS for the first time as the basis for

preparing its consolidated financial statements. The Group is required to establish its IFRS accounting policies as at 31 March 2006 and, in general, apply these retrospectively to

determine the IFRS opening balance sheet at its date of transition, 1 April 2004. This standard provides a number of optional exceptions to this general principle. The most

significant of these are set out below, together with a description in each case of the exception to be adopted by the Group.

Business combinations that occurred before the opening IFRS balance sheet date (IFRS 3, “Business Combinations”).

The Group has elected not to apply IFRS 3 retrospectively to business combinations that took place before the date of transition. As a result, in the opening balance sheet, goodwill

arising from past business combinations remains as stated under UK GAAP at 31 March 2004.

Employee Benefits – actuarial gains and losses (IAS 19, “Employee Benefits”)

The Group has elected to recognise all cumulative actuarial gains and losses in relation to employee benefit schemes at the date of transition.

Share-based Payments (IFRS 2, “Share-based Payment”)

The Group has elected to apply IFRS 2 to all relevant share-based payment transactions granted but not fully vested at 1 April 2004.

Financial Instruments (IAS 39, “Financial Instruments: Recognition and Measurement”and IAS 32, “Financial Instruments:

Disclosure and Presentation”)

The Group has applied IAS 32 and IAS 39 for all periods presented and has therefore not taken advantage of the exemption in IFRS 1 that would enable the Group to only apply

these standards from 1 April 2005.

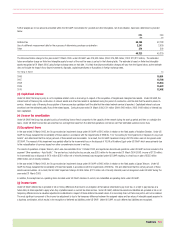

Reconciliation of IFRS equity shareholders’ funds at opening balance sheet date

The following is a summary of the effects of the differences between IFRS and UK GAAP on the Group’s total equity shareholders’ funds at the opening balance sheet date. Further

significant differences may arise from accounting standards and pronouncements that the IASB could issue in the future and which the Group may elect to early adopt in its first

IFRS accounts.

At 1 April 2004

£m

Total equity shareholders’ funds (UK GAAP) 111,924

Proposed dividends 728

Financial instruments 385

Defined benefit pension schemes (257)

Licence fee amortisation (164)

Deferred and current taxes (1,011)

Share based payments 12

Other (66)

Total equity shareholders’ funds (IFRS) 111,551