Vodafone 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s Review

6|Strategy

Delivering operational performance

Our results are built on the base of a strong overall Group operational performance that

has delivered on all our key targets.

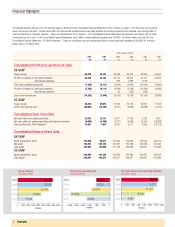

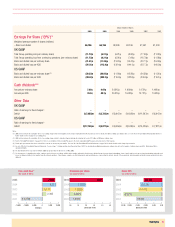

Organic growth of 12% in proportionate customers was driven by particularly strong

performances in the year in Germany, Spain and the US. Customer growth has again

been the driver for the increase in revenue but, as average customer spend has

reduced, this led to growth in Group mobile revenue of 4%, or 5% on an organic basis.

Group revenue increased by 2% to £34.1 billion. Removing the effect of acquisitions

and disposals and adverse foreign exchange movements, organic revenue growth

was 6%.

Cash flow generation continues to be robust, reflecting the underlying strength of our

operations and financial structure. Operating cash flow increased by £0.4 billion to

£12.7 billion, driven by higher revenue. Free cash flow for the year was £7.8 billion,

compared to £8.5 billion last year that included one-off items amounting to £0.8 billion.

This strong cash flow supports our significant increases in shareholder returns this year.

This past financial year we added a further £5.1 billion of fixed assets, primarily in

respect of our mobile network infrastructure. This amount is only slightly higher than the

prior year, even though we continue to invest significantly in our 3G networks.

Our operating performance in Europe remains robust. In the US, Verizon Wireless has

performed exceptionally well, delivering impressive financial performance across all

metrics. We have a productive working relationship with our partner, Verizon

Communications, and believe that we will continue to benefit from our investment in

Verizon Wireless as we go forward.

We face challenges in Japan, where we are half way through a two year plan to

turnaround our business. This plan has three main objectives: to improve the

attractiveness of 3G handsets and content in that market, to increase the effectiveness

of our distribution channels and to improve the coverage of our 3G network.

Japan remains a strategically important mobile market for us and is a significant profit

generator for the Group, contributing £0.8 billion of operating profit before goodwill

amortisation in the last year. However, the pace of change and advanced state of 3G

there requires additional focus to improve our competitive position. Together with our

three main objectives, we have strengthened the management team and remain

focused on a successful execution of our recovery plan.

As we look forward, we see both greater opportunities and greater challenges. The

potential for growth in voice and data is significant. However, penetration levels in many

of our markets are now reaching saturation and competition is intensifying through

existing network operators and the introduction of many more low cost operators and

resellers. Greater choice in the market place is leading to rising customer demands.

We are also seeing continued regulatory led termination rate reductions.

In this environment, we see winners and losers. We believe Vodafone is uniquely

positioned to succeed through our scale and scope and the customer focus of all our

employees. To achieve this success, we are focused on the execution of the six

strategic goals that we outlined last year; delighting our customers, leveraging our

scale and scope, expanding market boundaries, building the best global team, being a

responsible business and providing superior shareholder returns.

Delighting our customers

Focus on customer needs

A core strategic goal is delighting our customers. Vodafone has nearly 155 million

proportionate customers around the world, all with the common need to communicate

with friends, family and colleagues wherever they are. Within this common need, our

customers have different communication requirements. Some may need constant and

real time access to their email. Others may want to download music and games.

Others just want to talk. However, all of our customers desire simplicity and

transparency. Vodafone aims to deliver increasing value to its customers by creating

innovative services that meet these different needs, supported by world class customer

service.

Arun Sarin Chief Executive

Delivering operating performance

Delighting our customers

Implementing One Vodafone

Increasing shareholder returns

Executing our strategy

This has been another successful year for Vodafone. We closed the year with

nearly 155 million proportionate customers, having generated £7.8 billion of free

cash flow from £12.7 billion of operating cash flow. Cash shareholder returns

increased to £6 billion as we doubled the dividend and purchased £4 billion of our

shares. We also launched 3G for consumers and firmly established our One

Vodafone plan – key drivers for our future growth.