Vodafone 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance |47

On 25 May 2004, the Board of directors allocated £3 billion to the share purchase

programme for the year to May 2005. The Board subsequently increased the share

purchase programme to £4 billion, completing by March 2005, subject to the

maintenance of credit ratings. For the period from 27 May 2004 to 31 March 2005,

2,985 million shares were purchased on market on the London Stock Exchange for a

total consideration of £4 billion, including stamp duty and broker commissions. The

average share price paid, excluding transaction costs, was 133.30 pence, compared

with the average volume weighted price over the same period of 133.62 pence.

Shares purchased are held in treasury in accordance with section 162 of the

Companies Act 1985. At 31 March 2005, 3,785 million shares were held in treasury.

By placing irrevocable purchase instructions prior to the start of the period from

17 January 2005 up to and including 25 January 2005, the date the Group issued its

Key Performance data for the quarter ended 31 December 2004, the Group purchased

193 million shares at a total consideration of £268 million, including stamp duty and

broker commissions during the period. These purchases during this period are

included within the £4 billion of share purchases referred to above.

In addition to ordinary market purchases and irrevocable purchase instructions, in the

year ended 31 March 2005, put options over 130 million shares were sold for a

premium of £3 million with exercise dates falling within the close period of 1 October

2004 up to and including 15 November 2004. As the Company’s share price was

higher than the option exercise price on each exercise date, none of the put options

was exercised and no additional shares were acquired by the Company.

At the AGM in July 2004, approval was obtained from the shareholders to purchase up

to 6.6 billion ordinary shares of the Company. This approval will expire at the

conclusion of the Company’s AGM on 26 July 2005. Up to 23 May 2005,

2,661 million shares had been purchased under this approval. The Board of directors

has approved a share purchase target for the year to 31 March 2006 of £4.5 billion,

including £565 million already spent. Achieving the target purchases will be subject to

renewed shareholder approval on 26 July 2005 at the AGM. Shares will be purchased

on market on the London Stock Exchange and the maximum share price payable for

any share purchase will be no greater than 105% of the average of the middle market

closing price of the Company’s share price on the London Stock Exchange for the five

business days immediately preceding the day on which any shares are contracted to

be purchased and otherwise in accordance with the rules of the Financial Services

Authority. Purchases will be made only if accretive to earnings per share, excluding

items not reflecting underlying business performance.

Prior to the start of the close period from 1 April 2005 to 23 May 2005, Vodafone

placed irrevocable purchase instructions, which has resulted in the purchase of

406 million shares at a total consideration of £565 million, including stamp duty and

broker commissions, in the close period.

Further details of shares purchased under the programme are shown in note 23 to the

Consolidated Financial Statements.

Treasury shares

The Companies Act 1985 permits companies to purchase their own shares out of

distributable reserves and to hold shares with a nominal value not to exceed 10% of

the nominal value of their issued share capital in treasury. If shares in excess of this

limit are purchased they must be cancelled. Whilst held in treasury, no voting rights or

pre-emption rights accrue and no dividends are paid in respect of treasury shares.

Treasury shares may be sold for cash, transferred (in certain circumstances) for the

purposes of an employee share scheme, or cancelled. If treasury shares are sold, such

sales are deemed to be a new issue of shares and will accordingly count towards the

5% of share capital which the Company is permitted to issue on a non pre-emptive

basis in any one year as approved by its shareholders at the AGM. The proceeds of

any sale of treasury shares up to the amount of the original purchase price, calculated

Dividends from associated undertakings and dividends to minority

shareholders

Dividends from the Group’s associated undertakings are generally paid at the discretion

of the Board of directors or shareholders of the individual operating companies and

Vodafone has no rights to receive dividends, except where specified within certain of

the companies’ shareholders’ agreements. Similarly, the Group does not have existing

obligations under shareholders’ agreements to pay dividends to minority interest

partners of Group subsidiaries, except as specified below.

Included in the dividends received from joint ventures and associated undertakings was

an amount of £923 million received from Verizon Wireless. Until April 2005, Verizon

Wireless’ distributions were determined by the terms of the partnership agreement

distribution policy and comprised income distributions and tax distributions. From April

2005, tax distributions will continue and a new distribution policy is expected to be set

in the future by the Board of Representatives of Verizon Wireless. Current projections

forecast that tax distributions will not be sufficient to cover the US tax liabilities arising

from the Group’s partnership interest in Verizon Wireless until 2015 and, in the

absence of additional distributions above the level of tax distributions during this period,

this will result in a net cash outflow for the Group. Under the terms of the partnership

agreement, the Board has no obligation to provide for additional distributions above the

level of the tax distributions. It is the expectation that Verizon Wireless will re-invest

free cash flow in the business and reduce indebtedness for the foreseeable future.

During the year ended 31 March 2005, cash dividends totalling £616 million were

received from SFR in accordance with the shareholder agreement.

Verizon Communications Inc. has an indirect 23.1% shareholding in Vodafone Italy

and, under the shareholders’ agreement, can request dividends to be paid, provided

that such dividends would not impair the financial condition or prospects of Vodafone

Italy including, without limitation, its credit rating. No dividends were proposed or paid

by Vodafone Italy during or since the year ended 31 March 2005.

Acquisitions and disposals

Net cash outflow from acquisitions and disposals of £2,017 million in the 2005

financial year arose primarily in respect of the business acquisitions of additional stakes

in Vodafone Japan, partially offset by the part disposal of Vodafone Egypt to Telecom

Egypt. The acquisitions are described in more detail under “Business Overview –

History and Development of the Company”and “Business Overview – Mobile

Telecommunications”above. In addition, a net cash inflow of £3 million arose from the

purchase and sale of investments.

An analysis of the main transactions in the 2005 financial year, including the changes

in the Group’s effective shareholding, is shown below:

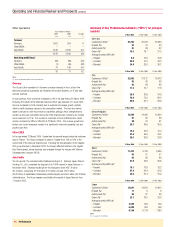

£m

Acquisitions:

Japan (69.7% to 97.7%) 2,380

Hungary (92.8% to 100%) 55

Other acquisitions including investments 45

Disposals:

Japan Telecom withholding tax recovered (226)

Japan Telecom preference shares (152)

Egypt (67.0% to 50.1%) (65)

Other disposals, including investments (23)

2,014

Share purchase programme

When considering how increased returns to shareholders can be provided in the form

of dividends and share purchases, the Board reviews the free cash flow, anticipated

cash requirements, dividends, credit profile and gearing of the Group.