Vodafone 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategy |9

Increasing shareholder returns

Overall, the business is performing well. We are generating strong cash flows and,

through our focus on customers and leveraging our scale and scope, we continue to

see strong growth prospects for the business.

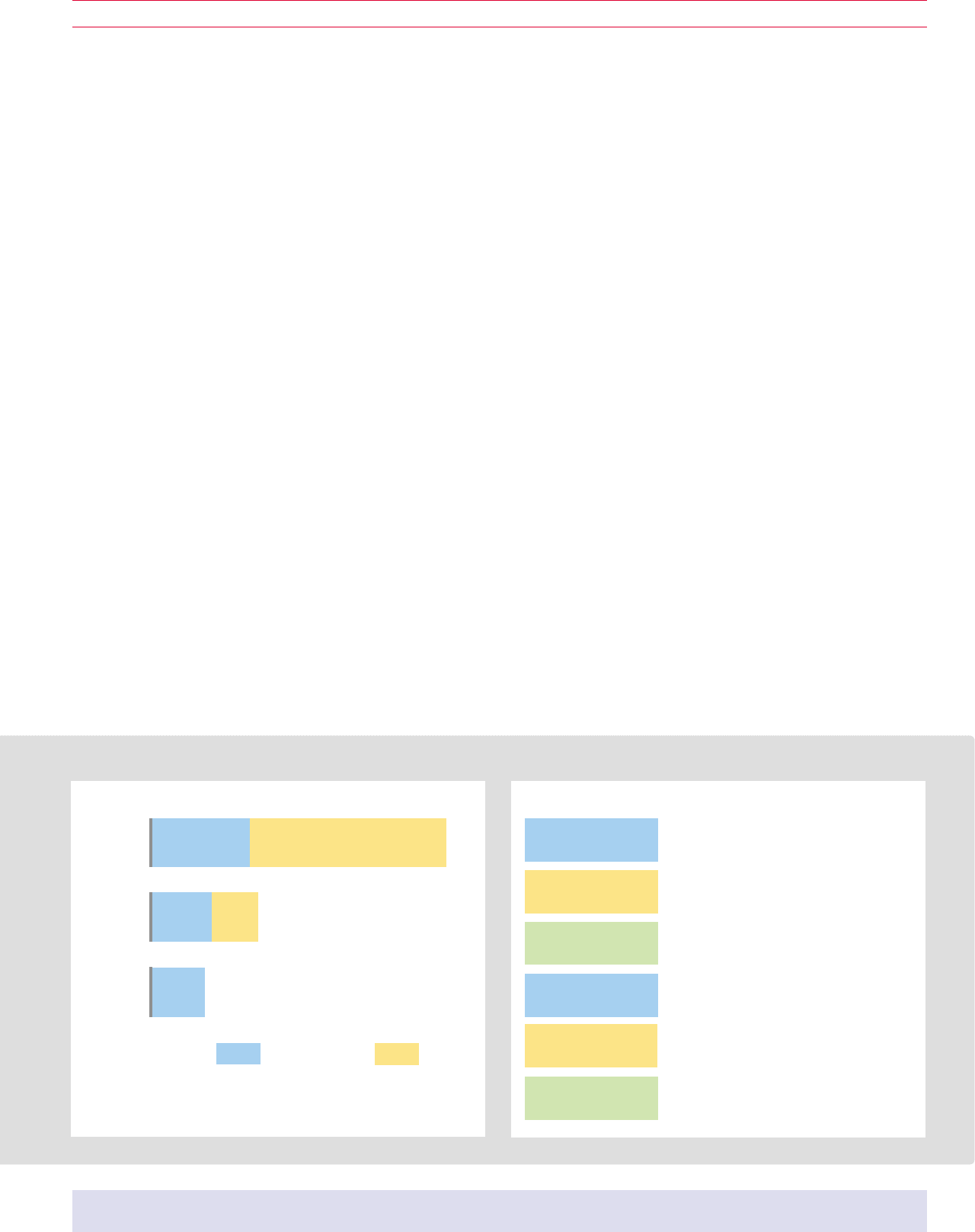

These factors have enabled us to deliver a substantial increase in shareholder returns

in the year. At our interim results we doubled the dividend and indicated we would do

the same for the final dividend, which we have now proposed for approval at the AGM.

In addition to increasing the dividend, we re-purchased £4 billion of our shares in the

year to March 2005. The result was an increase in cash returns to shareholders

compared to the previous year from £2.3 billion to £6 billion.

Through our shareholder returns policy, we wish to continue to provide shareholders

with a mix of dividends and share purchases, whilst retaining flexibility within our debt

capacity to pursue selective acquisition opportunities should they arise. Given our

strong financial position, we see no need for the business to reduce absolute levels of

debt in the future.

Having increased the dividend by 100% in the year, we currently expect future

increases in dividends to be in line with underlying growth in earnings. We also intend

to continue to purchase shares on an ongoing basis, although this is subject to gaining

shareholder approval each year. For the year to March 2006, we are targeting another

£4.5 billion of share purchases. Given our expectations for cash generation in the year

ahead, we would expect shareholder returns to represent a pay out ratio of

approximately 100%.

Expanding market boundaries

The proposed acquisition of TIW’s mobile interests in Romania and the Czech Republic

is very much in line with our acquisition strategy, focusing on selected opportunities,

primarily in Central and Eastern Europe. These businesses are fast growing and we

believe they will benefit fully from the global services and scale benefits that our Group

can deliver. Retaining financial flexibility to pursue these incremental opportunities

enables us to act quickly and decisively when the ability to enhance shareholder

value arises.

Executing our strategy

We have made excellent progress in executing against our strategic goals in the year

but there is still much to do. We have restructured the business to more closely align

ourselves to these goals and have outstanding and passionate leaders and people in

the organisation to deliver them. Our commitment to deliver on our goals is underlined

by our values, which state that everything we do is driven by our passion for

customers, our people, results and the world around us.

Outlook

For the year ahead, we see continued good growth in mobile revenue. We expect to

add approximately a further £5 billion of fixed assets as we continue to expand our 3G

networks. Free cash flow is anticipated to be in the £6.5 billion to £7 billion range,

with a lower level of dividends expected from Verizon Wireless combined with higher

cash expenditure on taxation and fixed assets offsetting growth in operating cash flow.

This year Vodafone has taken important steps to deliver ongoing growth and increased

shareholder returns. The future for mobile telecommunications is both challenging and

exciting. We face increasing competition and differing regulatory environments but the

opportunities for us remain significant. We are in a unique position and, through our

launch of 3G and the establishment of One Vodafone, we are creating platforms to

deliver differentiated services to the benefit of both our customers and shareholders.

Arun Sarin

Chief Executive

March 2005

March 2004

March 2003

£1.3bn £1.0bn

£1.1bn £nil

£4bn

Cash Dividends Cash Share Purchases

£2bn

Total

£6bn

Total

£2.3bn

Total

£1.1bn

Delight our

Customers

Leverage Scale

and Scope

Build the Best

Global Vodafone Team

Provide Superior

Shareholder Returns

Be a Responsible

Business

Expand Market

Boundaries

•Consumer launch of 3G; launch of

Vodafone Simply; expanding business

services; simplifying tariffs

•Implementing One Vodafone; launch of

new roaming proposition

•Acquiring control in Romania and Czech

Republic; extending Partner Networks

•Simplifying management structure to

focus on customers and deliver on

strategic goals

•Integrating Corporate Responsibility

into the business

•Doubled the dividend and increased

share purchases to £4bn in the year

Cash returns to shareholders Executing our strategic goals