Vodafone 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business |13

jurisdictions in which it operates. No assurances can be given that the Group will be

successful in obtaining any 3G licences for which it intends to apply or bid.

Rollout of the 3G network infrastructure has continued throughout the 2005 financial

year, with total tangible capital expenditure amounting to approximately £5.1 billion

during the financial year, including approximately £1.6 billion incremental expenditure

on 3G network infrastructure. The 3G network rollout is focused to deliver high quality

indoor coverage to enable the delivery of the new 3G services.

Wireless local area networks (“W-LAN”)

The Group’s subsidiary companies in Greece, Hungary, Malta, the Netherlands and the

UK introduced public access W-LAN services during 2004, bringing the total to nine

subsidiaries in addition to several affiliates and Partner Networks which provide this

offering. The Group is integrating public access W-LAN services into its Vodafone

Mobile Connect family of data devices, software and services in a comprehensive

mobile data offering. Roaming services are being introduced among several of the

Group companies giving customers access to thousands of W-LAN hotspots at home

and abroad.

Other initiatives

On 14 February 2005, Vodafone commenced field tests of the High Speed Downlink

Packet Access (“HSDPA”) technology in Japan. HSDPA enables data transmission

speeds of up to two megabits (“Mbps”) per second, although 14.4 Mbps can

theoretically be achieved, which will provide customers with faster access speeds than

experienced on existing 3G networks.

Global Services

One Vodafone

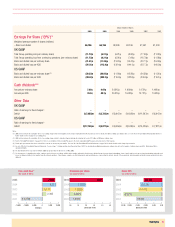

The One Vodafone initiatives are targeted at achieving £2.5 billion of annual pre-tax

operating free cash flow improvements in the Group’s controlled mobile businesses by

the year ending 31 March 2008. The Group also expects mobile capital expenditure in

the 2008 financial year to be 10% of mobile revenue as a result of the initiaitives.

These targets, and the analysis below, have been prepared on the basis of UK GAAP.

Cost initiatives are anticipated to generate improvements of £1.4 billion, with a further

£1.1 billion from revenue initiatives. Of the £1.4 billion of cost savings, £1.1 billion

relates to savings in operating expenses, being payroll and other operating expenses,

and tangible fixed asset additions. The remaining cost saving, of £0.3 billion, relates to

handset procurement activities. The Group expects that, in the 2008 financial year, the

combined mobile operating expenses and tangible fixed asset additions will be broadly

similar to those for the year ended 31 March 2004, assuming no significant changes in

exchange rates and after adjusting for acquisitions and disposals.

Revenue enhancement initiatives are expected to deliver benefits equivalent to at least

1% additional revenue market share for the Group’s controlled mobile businesses in

the 2008 financial year compared to the 2005 financial year. The Group will measure

the revenue benefits in its five principal controlled markets compared to its established

competitors. Incremental pre-tax operating free cash flow of £1.1 billion per annum is

anticipated from these benefits, with the majority expected to be derived from

enhanced handset offerings in addition to improved customer management and

roaming.

The objective for the 2005 financial year has been to establish the internal structure,

organisation and detailed plans for each area to deliver the One Vodafone targets. In

doing this, the programme focused on the following six key initiatives:

•The Group’s aim for the network and supply chain management initiative is to

exploit the benefits of the Group’s scale beyond the current centralised supply

chain. Harmonisation of network design and planning along with standardisation of

network equipment specifications across suppliers is expected to reduce

maintenance costs and increase purchasing options. Sharing of best practice

across operating companies has already led to cost savings from the replacement of

leased lines with owned fixed optical fibre capacity and microwave links.

•The service delivery platform initiative is aimed at consolidating European

development and operations. Hosting centres in Germany and Italy are already

operational and the Group’s European mobile operating subsidiaries are expected to

begin migrating their service delivery platforms over the next 18 months.

Development activities are to be consolidated into Germany, Italy, the UK and the

US.

•The Group has focused its plans for information technology delivery on the

development of a roadmap towards the consolidation of billing and customer

relationship management systems. This is expected to be a longer term project and

is expected to deliver benefits over a number of years. A key theme is the

identification of best practice and implementing this across existing systems.

•The development of an end-to-end terminals delivery process from initial design to

delivery to customer, incorporating benefits from greater volumes of customised

handsets, is intended to reduce time to market, through consolidation of platforms

and streamlined testing programmes and to generate cost savings. These savings

are expected to arise primarily from standardised handsets and accessories,

through better management of volumes across Europe and efficiencies in logistics.

The availability of a common portfolio of 3G handsets following the launch of

Vodafone live! with 3G in November 2004 is an early example of success.

•The customer management initiative aims to implement consistent segment and

value based customer management across the Group to improve customer retention

and satisfaction and, therefore, reduce churn.

•Finally, providing Vodafone’s customers with better value when they travel aboard,

as well as generating the best value inter-operator tariffs for the Group, are the key

goals of the roaming initiative. The Group also expects to centralise certain support

activities for roaming. The announcement of the launch of the Vodafone Travel

Promise, outlined in “Global Services – Products and services – Roaming Services”,

in May 2005 is a key step in delivering better value for our customers when

travelling abroad.

The objective for the 2006 financial year is to begin implementation of these plans and

deliver benefits in each area, although some initiatives will be more advanced than

others. Significant benefits are expected in the 2007 financial year, with the full targets

expected to be met in the 2008 financial year.

Products and Services

Voice Services

Revenue from voice services makes up the largest portion of the Group’s turnover and the

Group is undertaking a wide range of activities to encourage growth in the usage of these

services. In increasingly competitive local markets where value for money is an important

consideration, improving use of existing products and developing a range of new offerings

for customers has helped the Group to continue to grow its total voice revenue.

Pricing is an important factor for customers choosing a mobile phone network and is

also important in encouraging usage of services whilst maximising revenue and

margins. Two main pricing models exist in the mobile market – contract and prepaid.

Contract customers are usually governed by a written contract and credit facilities are

granted to them to enable access to mobile network services. In most cases contracts

have a term of 12 to 24 months with monthly payments for services and, in many of

the Group’s mobile operating subsidiaries, the option of purchasing a subsidised

handset. A prepaid customer pays in advance in order to gain access to voice and

other services. The take-up of these models in the markets in which the Group

operates varies significantly, from Japan and the US, where the vast majority of

customers are on contract plans, to Italy, where the market is predominantly prepaid.