Vodafone 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

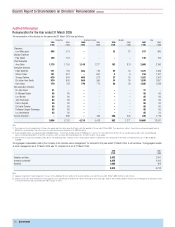

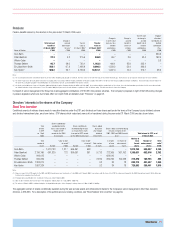

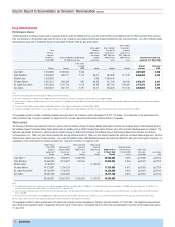

Board’s Report to Shareholders on Directors’ Remuneration continued

68 |Governance

For example, if the Company’s share price increases by over 50% from 140 pence to

approximately 210 pence, the Company’s value increases by £46 billion, and there is

50% vesting of long term incentives, the Chief Executive would have a pre-tax gain of

just under £4 million, representing less than a tenth of 1% of the total increase in

shareholder value.

New Share Plan Rules

The Company proposes to introduce new share plan rules, which will be tabled for

shareholder approval at the AGM on 26 July 2005. No changes are proposed to the

award policy for Executive directors or other participants. The Company wishes to

introduce one consistent set of rules under which all long term incentives may be

awarded. The new rules will comply with the latest UK corporate governance

guidelines and industry best practice. Full details of the proposed rules can be found in

the notice of the 2005 AGM. Any future changes to the award policy for the Board will

be discussed with major shareholders and relevant institutions prior to implementation.

Measurement of performance under IFRS

From 1 April 2005, the Company will no longer report its financial statements under UK

GAAP, and instead will report under IFRS. The Remuneration Committee has reviewed

the impact of the introduction of IFRS for incentive scheme purposes, to ensure that

performance achievement can be measured on a consistent basis and that the

introduction of the new standard does not advantage or disadvantage participants.

Only three past incentive awards are potentially affected by the transition to IFRS: GMR

options granted in 2001, 2002 Executive Options and 2003 Executive Options. The

2001 GMR options include the measurement of EBITDA, which will not materially be

affected by IFRS, and therefore no adjustment is required to measure performance

achievement. The 2002 and 2003 Executive Option grants are subject to achievement

of growth in EPS. For these schemes, EPS under IFRS will be adjusted to reflect UK

GAAP measurement so that performance may be measured on a consistent basis. In

each case, an independent auditor will be requested to review and verify the

achievement level.

Share ownership guidelines

Executive directors participating in long term incentive plans must comply with the

Company’s share ownership guidelines. These guidelines, which were first introduced

in 2000, require the Chief Executive to have a shareholding in the Company of four

times base salary and other executive directors to have a shareholding of three times

base salary.

It is intended that these ownership levels will be attained within five years from the

director first becoming subject to the guidelines and be achieved through the retention

of shares awarded under incentive plans.

Pensions

The Chief Executive, Arun Sarin, is provided with a defined contribution pension

arrangement to which the Company contributes 30% of his base salary. The

contribution is held in a notional fund outside the Company pension scheme.

Sir Julian Horn-Smith, Ken Hydon (until his normal retirement age) and Peter Bamford,

being UK based directors, are contributing members of the Vodafone Group Pension

Scheme, which is a UK scheme approved by the Inland Revenue.

This Scheme provides a benefit of two-thirds of pensionable salary after a minimum of

20 years’ service, with a contingent spouse’s pension of 50% of the member’s

pension. The normal retirement age is 60, but directors may retire from age 55 with a

pension proportionately reduced to account for their shorter service but with no

actuarial reduction. Pensions increase in payment by the lower of 5% per annum or

the maximum amount permitted by the Inland Revenue. Peter Bamford, whose

benefits are restricted by Inland Revenue earnings limits, also participates in a defined

contribution Vodafone Group Funded Unapproved Retirement Benefit Scheme

(“FURBS”) to enable pension benefits to be provided on his base salary above the

earnings cap. The Company makes a contribution of 30% of base salary above the

earnings cap.

Ken Hydon reached 60 years of age in November 2004 and in accordance with normal

pension plan rules received an immediate pension based on his accrued service

and final pensionable salary. In recognition of Mr Hydon agreeing to stay with the

Company until the end of the 2005 AGM, the Committee agreed to provide a pension

allowance of 30% of base salary for each complete month from his 60th birthday until

he steps down from the Board.

Thomas Geitner is entitled to a defined benefit pension of 40% of salary from a normal

retirement age of 60. On early retirement, the pension may be reduced if he has

accrued less than 10 years of Board service, but will not be subject to actuarial

reduction. The pension increases in line with German price inflation and a spouse’s

pension of 60% of his pension is payable from his death.

All the plans referred to above provide for benefits on death in service.

Further details of the pension benefits earned by the directors in the year ended

31 March 2005 can be found on page 71. Liabilities in respect of the pension

schemes in which the executive directors participate are funded to the extent described

in note 32 to the Consolidated Financial Statements, “Pensions”.

A-Day proposals

As a result of the new UK legislation affecting the taxation of pensions, the Company

has reviewed the pension arrangements it provides to UK based executives. The

Company will permit executives to continue participation in the defined benefit scheme

and, from April 2006, intends to permit executives to cease pension accrual in this

scheme and elect to receive a non-pensionable cash allowance. Participation in a

defined contribution plan will be provided in place of the current FURBS.

All-employee share incentive schemes

Global All Employee Share Plan

As in the year ended 31 March 2004, the Remuneration Committee has approved that

an award of shares based on the achievement of performance conditions be made to

all employees in the Vodafone Group on 1 July 2005. These awards have a dilutive

effect of approximately 0.03%.

Sharesave

The Vodafone Group 1998 Sharesave Scheme is an Inland Revenue approved scheme

open to all UK permanent employees.

The maximum that can be saved each month is £250 and savings plus interest may be

used to acquire shares by exercising the related option. The options have been

granted at up to a 20% discount to market value. UK based executive directors are

eligible to participate in the scheme and details of their participation are given in the

table on page 73.

Share Incentive Plan

The Vodafone Share Incentive Plan (“SIP”) is an Inland Revenue approved plan open to

all UK permanent employees. Eligible employees may contribute up to £125 each

month and the trustee of the plan uses the money to buy shares on their behalf. An

equivalent number of shares is purchased with contributions from the employing

company. UK based executive directors are eligible to participate in the SIP and details

of their share interests under these plans are given in the table on page 74.

Non-executive directors’ remuneration

The remuneration of non-executive directors is periodically reviewed by the Board,

excluding the non-executive directors. Basic fee levels were increased in April 2005 to

reflect directors’ considerably increased workload and the increased complexity of

managing an international group. The fees payable are as follows:

Fees payable from

1 April 2005

£’000

Chairman 510

Deputy Chairman and Senior Independent Director 120

Basic Non-Executive Director fee 95

Chairmanship of Audit Committee 20

Chairmanship of Remuneration Committee 15

Chairmanship of Nominations and Governance Committee 10