Vodafone 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |99

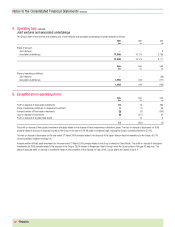

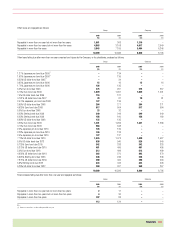

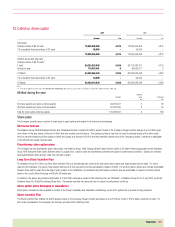

14.Stocks

2005 2004

£m £m

Goods held for resale 430 458

Stocks are reported net of allowances for obsolescence, an analysis of which is as follows:

2005 2004 2003

£m £m £m

Opening balance at 1 April 193 89 126

Exchange adjustments (4) (1) 2

Amounts (credited)/charged to the profit and loss account (51) 107 (27)

Assets written off (15) (2) (12)

Closing balance at 31 March 123 193 89

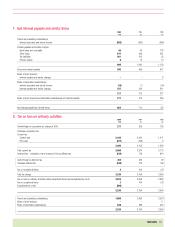

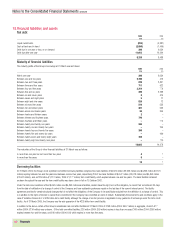

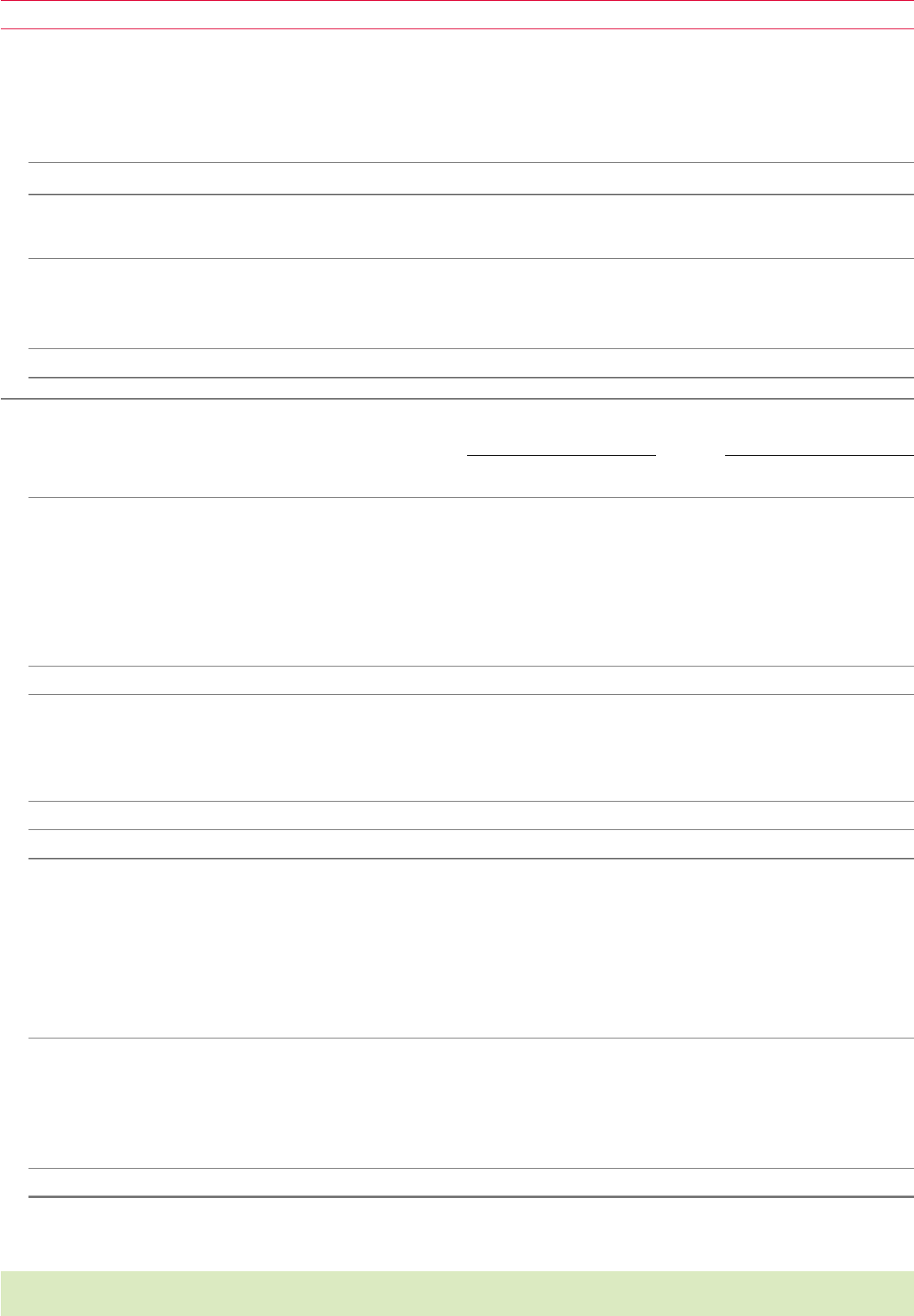

15.Debtors

Group Company

2005 2004 2005 2004

£m £m £m £m

Due within one year:

Trade debtors 2,768 2,593 ––

Amounts owed by subsidiary undertakings ––76,303 65,098

Amounts owed by associated undertakings 23 17 ––

Taxation recoverable 268 372 37 –

Group relief receivable ––43 132

Other debtors 413 491 272 310

Prepayments and accrued income 2,130 2,048 ––

5,602 5,521 76,655 65,540

Due after more than one year:

Trade debtors 49 37 ––

Other debtors 122 76 ––

Prepayments 384 302 ––

Deferred taxation (note 21) 1,541 965 83 87

2,096 1,380 83 87

7,698 6,901 76,738 65,627

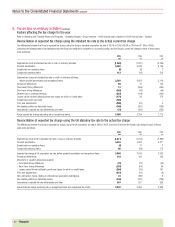

The Group’s deferred tax asset of £1,541 million at 31 March 2005 (2004: £965 million) relates to fixed asset timing differences of £206 million (2004: £nil) and short term

timing differences and losses of £1,335 million (2004: £965 million). The directors are of the opinion, based on recent and forecast trading, that the level of future taxable

profits and deferred tax liabilities will be sufficient to utilise the deferred tax asset being recognised.

The Company’s deferred tax asset of £83 million (2004: £87 million) is in respect of the closure of derivative financial instruments. The movement in the asset recognised

has been charged to the Company’s profit and loss account for the year. There are no unrecognised deferred tax assets at 31 March 2005 (2004: £18 million).

Debtors are stated after allowances for bad and doubtful debts, an analysis of which is as follows:

2005 2004 2003

£m £m £m

Opening balance at 1 April 461 520 526

Exchange adjustments 6(20) 17

Amounts charged to the profit and loss account 224 209 193

Acquisitions –11 2

Disposals –(21) –

Debtors written off (195) (238) (218)

Closing balance at 31 March 496 461 520