Vodafone 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

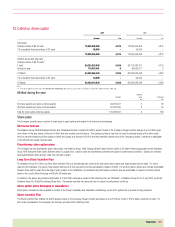

Notes to the Consolidated Financial Statements continued

100 |Financials

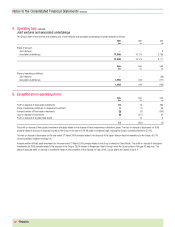

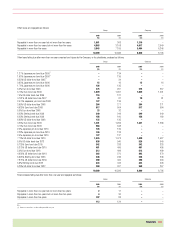

16.Investments

Group Company

2005 2004 2005 2004

£m £m £m £m

Liquid investments 816 4,381 28 –

Group liquid investments principally comprise collateralised deposits and investments in commercial paper. The Company’s liquid investments comprise short term foreign

exchange deals.

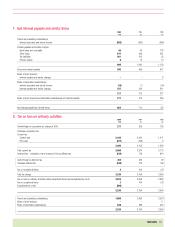

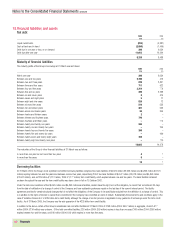

17.Creditors: amounts falling due within one year

Group Company

2005 2004 2005 2004

£m £m £m £m

Bank overdrafts 47 42 ––

Bank loans and other loans 332 2,000 15 956

Finance leases 13 12 ––

Trade creditors 2,887 2,842 ––

Amounts owed to subsidiary undertakings ––88,710 93,553

Amounts owed to associated undertakings 98––

Taxation 4,759 4,275 ––

Other taxes and social security costs 332 367 ––

Other creditors 444 741 471

Accruals and deferred income 4,619 4,011 301 371

Proposed dividend 1,395 728 1,395 728

14,837 15,026 90,425 95,679

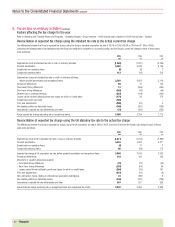

18.Creditors: amounts falling due after more than one year

Group Company

2005 2004 2005 2004

£m £m £m £m

Bank loans 1,231 1,504 16 23

Other loans 10,269 10,596 8,800 8,795

Finance leases 113 124 ––

Other creditors 12 7––

Accruals and deferred income 757 744 358 453

12,382 12,975 9,174 9,271

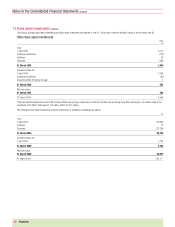

Bank loans are repayable as follows:

Group Company

2005 2004 2005 2004

£m £m £m £m

Repayable in more than one year but not more than two years 1,182 105 66

Repayable in more than two years but not more than five years 28 1,398 10 16

Repayable in more than five years 21 1–1

1,231 1,504 16 23