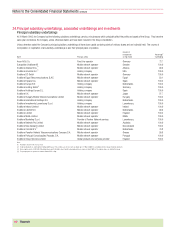

Vodafone 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

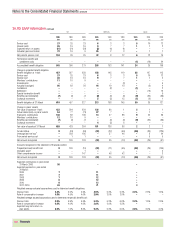

Financials |127

Condensed financial information for Vodafone Italy

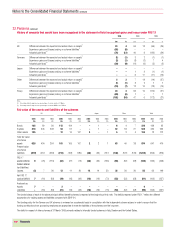

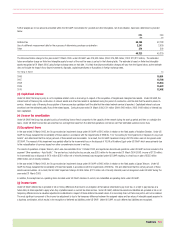

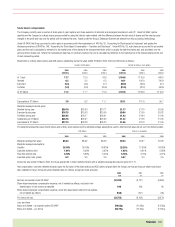

The basis of consolidation under UK GAAP differs from that under US GAAP. Under UK GAAP, the results and net assets of Vodafone Italy are consolidated in the Group’s

financial statements. Under US GAAP, as a result of significant participating rights held by minority shareholders, the Group’s interest in Vodafone Italy has been accounted for

under the equity method of accounting.

The following tables present, on a condensed basis, the financial information of Vodafone Italy as it is included in the Consolidated Profit and Loss Account and Consolidated

Balance Sheet prepared under UK GAAP.

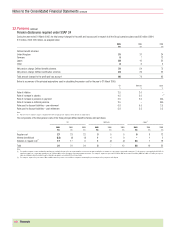

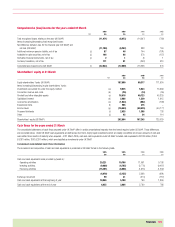

2005 2004 2003

£m £m £m

Turnover 5,521 5,276 4,371

Cost of sales (2,578) (2,132) (2,201)

Gross margin 2,943 3,144 2,170

Selling and distribution costs (213) (211) (182)

Administrative expenses (4,252) (4,276) (3,943)

Goodwill amortisation (3,779) (3,837) (3,543)

Other administrative expenses (473) (439) (400)

Operating loss (1,522) (1,343) (1,955)

Other income/ (expense) 14 (12)

Loss on ordinary activities before taxation (1,521) (1,339) (1,967)

Tax on loss on ordinary activities (660) (583) (478)

Equity minority interest (384) (459) (264)

Loss for the financial year (2,565) (2,381) (2,709)

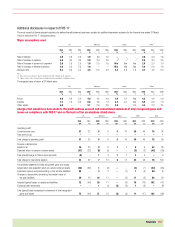

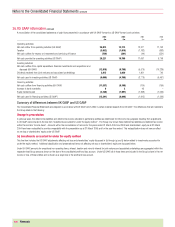

2005 2004

£m £m

Goodwill 16,162 19,443

Other intangible assets 1,690 1,666

Tangible assets 2,006 1,934

Fixed assets 19,858 23,043

Debtors 1,349 1,220

Other current assets 73 82

Current assets 1,422 1,302

Total assets 21,280 24,345

Creditors: amounts falling due within one year (1,630) (1,587)

Non-current creditors and provisions (560) (518)

19,090 22,240

Total equity shareholders’ funds 17,280 20,855

Equity minority interests 1,810 1,385

19,090 22,240