Vodafone 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |93

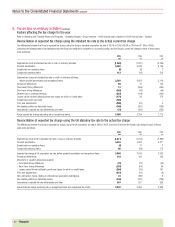

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include the absence of one-off restructuring benefits, the resolution of open issues, future planning opportunities,

corporate acquisitions and disposals, changes in tax legislation and rates, and the use of brought forward tax losses.

In particular, the Group’s subsidiary, Vodafone 2, is responding to an enquiry by the UK Inland Revenue with regard to the UK tax treatment of one of its Luxembourg holding

companies under the controlled foreign companies rules. Further details in relation to this enquiry are included in “Risk Factors and Legal Proceedings”. At 31 March 2005,

Vodafone has provided for £1,600 million tax and £157 million interest in respect of the potential UK tax liability that may arise in respect of this enquiry. At 31 March 2004,

the respective provisions were £1,335 million and £62 million. Vodafone considers these amounts are sufficient to settle any assessments that may arise from the enquiry.

However, the amount ultimately paid may differ materially from the amount accrued and, therefore, could affect the overall profitability of the Group in future periods. In the

absence of any material unexpected developments, the provisions are likely to be reassessed when the views of the European Court of Justice become known, which is

expected to be during 2006.

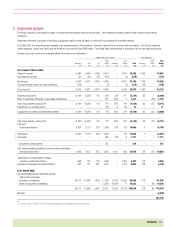

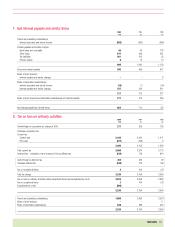

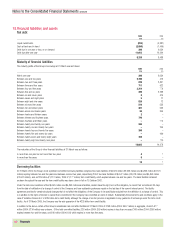

At 31 March 2005, the Group had the following trading and non-trading losses available for carry forward. These losses are available for offset against future trading and

non-trading profits of certain Group and associated undertakings:

Expiring within Expiring within

5 years 10 years Unlimited Total

£m £m £m £m

UK subsidiaries’ trading and non-trading losses ––2,035 2,035

International subsidiaries’ trading and non-trading losses 92 1,035 34,527 35,654

The losses in respect of UK subsidiaries include an amount of £1,870 million that is only available for offset against future capital gains and since it is uncertain whether

these losses will be utilised, no deferred tax asset has been recognised.

The losses in respect of international subsidiaries include amounts of £30,857 million (2004: £30,728 million) that have arisen in overseas holding companies as a result of

revaluations of those companies’ investments for local GAAP purposes. Since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised.

See note 21.

In addition to the losses described above, the Group has potential tax losses of £34,674 million (2004: £33,763 million) in respect of a write down in the value of investments

in Germany. These losses have to date been denied by the German Tax Authorities. Vodafone is now in discussions with them regarding the availability of the losses,

however the outcome of these discussions and the timing of the resolution are not yet known. The Group has not recognised the availability of the losses, nor the benefit

arising from them, due to this uncertainty. If upon resolution a benefit is recognised, it may impact both the amount of current income taxes provided since the date of initial

deduction and the amount of benefit from tax losses the Group will recognise. The recognition of these benefits could affect the overall profitability of the Group in future

periods.

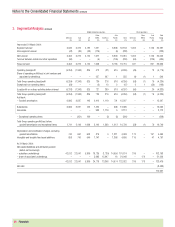

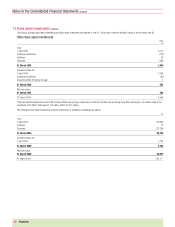

9. Equity dividends

2005 2004 2003

Pence per Pence per Pence per

2005 ordinary 2004 ordinary 2003 ordinary

£m share £m share £m share

Interim dividend paid 1,263 1.91 650 0.9535 542 0.7946

Proposed final dividend 1,395 2.16 728 1.0780 612 0.8983

2,658 4.07 1,378 2.0315 1,154 1.6929

Shares held in treasury do not qualify for dividends. Dividends that would have been paid on these shares would have been £124 million for the year ended 31 March 2005

(2004: £9 million; 2003: £nil) had they qualified.