Vodafone 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

Notes to the Consolidated Financial Statements continued

114 |Financials

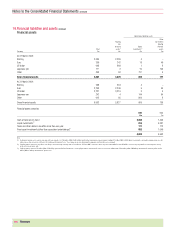

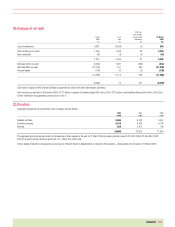

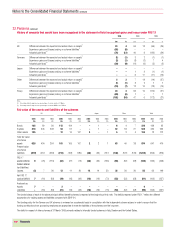

28.Analysis of cash flows

2005 2004 2003

£m £m £m

Net cash inflow from operating activities

Operating loss (5,304) (4,776) (5,295)

Exceptional items 315 (228) 496

Depreciation 4,528 4,362 3,979

Goodwill amortisation (subsidiary undertakings) 12,929 13,095 11,875

Amortisation of other intangible fixed assets 412 98 53

Loss on disposal of tangible fixed assets 161 89 109

13,041 12,640 11,217

Decrease/(increase) in stocks 22 (102) (17)

(Increase)/decrease in debtors (453) (293) 198

Increase/(decrease) in creditors 150 157 (233)

Payments in respect of exceptional items (47) (85) (23)

12,713 12,317 11,142

Net cash outflow for returns on investments and servicing of finance

Interest received 746 942 543

Dividends from investments 19 25 15

Interest paid (1,074) (901) (1,004)

Interest element of finance leases (8) (10) (14)

Dividends paid to minority shareholders in subsidiary undertakings (74) (100) (91)

(391) (44) (551)

Net cash outflow from financing

Issue of ordinary share capital 115 69 28

Issue of shares to minorities –– 1

Purchase of treasury shares (4,053) (1,032) –

Purchase of own shares in relation to employee share schemes –(17) (14)

Capital element of finance lease payments (12) (115) (97)

Debt due within one year:

Decrease in short term debt (1,997) (1,791) (1,366)

Debt due after one year:

Decrease in long-term debt (161) (507) (1,700)

Issue of new bonds –2,693 2,998

(6,108) (700) (150)