Vodafone 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance |45

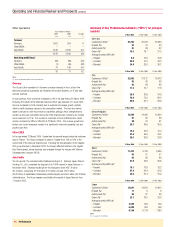

Balance Sheet

Assets

Intangible fixed assets decreased from £93,622 million at 31 March 2004 to £83,464

million at 31 March 2005, as a result of £12,929 million of goodwill amortisation

charges and £412 million of other amortisation charges and an impairment charge of

£315 million to the profit and loss account in the 2005 financial year, partially offset by

£1,651 million of exchange movements and £1,757 million of goodwill arising on

acquisitions made in the 2005 financial year. See “Business Overview – History and

Development of the Company – Acquisitions of businesses”and note 25 to the

Consolidated Financial Statements.

Tangible fixed assets increased from £18,083 million at 31 March 2004 to

£18,398 million at 31 March 2005 as a result of £5,066 million of additions during the

year, offset by £4,528 million of depreciation charges in the 2005 financial year.

Network infrastructure assets of £14,620 million (2004: £14,823 million) represented

approximately 79% (2004: 82%) of the total tangible fixed asset base at 31 March

2005. Additions to network infrastructure in the year totalled £3,250 million. The

capital expenditure on 3G network infrastructure is discussed in “Business Overview –

Local operations – Licences and network infrastructure”.

The Group’s investments in associated undertakings reduced from £21,226 million at

31 March 2004 to £19,398 million at 31 March 2005, mainly as result of

£1,771 million of goodwill amortisation charges and £214 million of exchange

movements in the 2005 financial year.

Other fixed asset investments at 31 March 2005 totalled £852 million (2004: £1,049

million) and include the Group’s equity interest in China Mobile.

Current assets decreased to £11,794 million from £13,149 million, principally as a

result of a reduction in cash and liquid investments, partially offset by an increase in

tax assets.

Liabilities

The debt position of the Group is discussed in “Liquidity and Capital Resources”. Other

liabilities, including provisions for liabilities and charges, increased by 10% to

£19,761 million, mainly as a result of an increase in tax creditors and provisions, and

an increase in the proposed dividend.

Equity shareholders’ funds

Total equity shareholders’ funds decreased from £111,924 million at 31 March 2004

to £99,317 million at 31 March 2005. The decrease comprises the loss for the year of

£7,540 million (which includes goodwill amortisation of £14,700 million), equity

dividends of £2,658 million, purchases of the Company’s own shares (held in treasury)

of £3,997 million and £15 million of other movements, partially offset by net currency

translation gains of £1,467 million and the issue of new share capital of £136 million.

Equity Dividends

The table below sets out the amounts of interim, final and total cash dividends paid or,

in the case of the final dividend for the 2005 financial year, proposed in respect of

each financial year indicated both in pence per ordinary share and translated, solely for

convenience, into cents per ordinary share at the Noon Buying Rate on each of the

respective payment dates for such interim and final dividends.

Pence per ordinary share Cents per ordinary share

Year ended 31 March Interim Final Total Interim Final Total

2001 0.6880 0.7140 1.4020 0.9969 1.0191 2.0160

2002 0.7224 0.7497 1.4721 1.0241 1.1422 2.1663

2003 0.7946 0.8983 1.6929 1.2939 1.4445 2.7384

2004 0.9535 1.0780 2.0315 1.7601 1.9899 3.7500

2005 1.91 2.16(1) 4.07 3.60 4.08(1) 7.68

Notes:

(1) The final dividend for the year was proposed on 24 May 2005 and is payable on 5 August 2005 to holders of record as of

3 June 2005. This dividend has been translated at the Noon Buying Rate at 31 March 2005 for ADS holders, but will be

payable in US dollars under the terms of the terms of the deposit agreement.

The Company has historically paid dividends semi-annually, with a regular interim

dividend in respect of the first six months of the financial year payable in February and

a final dividend payable in August. The Board of directors expect that the Company will

continue to pay dividends semi-annually.

In considering the level of dividends, the Board of directors takes account of the outlook

for earnings growth, operating cash flow generation, capital expenditure requirements,

acquisitions and divestments, together with the amount of debt and share purchases.

In November 2004, the directors declared an interim dividend of 1.91 pence per share,

representing an approximate 100% increase over last year’s interim dividend, with the

expectation that the final dividend would also be increased by 100%. Consistent with

this, the directors have recommended a final dividend of 2.16 pence per share,

representing an approximate 100% increase over last year’s final dividend, and

bringing the total dividend per share to 4.07 pence, a doubling of last year’s total.

Following this rebasing of the dividend, the Board of directors expects future increases

in dividends per share to reflect underlying growth in earnings.

Cash dividends, if any, will be paid by the Company in respect of ordinary shares in

pounds sterling or, to holders of ordinary shares with a registered address in a country

which has adopted the euro as its national currency, in euro, unless shareholders wish

to elect to continue to receive dividends in sterling, are participating in the Company’s

Dividend Reinvestment Plan, or have mandated their dividend payment to be paid

directly into a bank or building society account in the United Kingdom. In accordance

with the Company’s Articles of Association, the sterling: euro exchange rate will be

determined by the Company shortly before the payment date.

The Company will pay the ADS Depositary, The Bank of New York, its dividend in US

dollars. The sterling: US dollar exchange rate for this purpose will be determined by the

Company shortly before the payment date. Cash dividends to ADS holders will be paid

by the ADS Depositary in US dollars.

US GAAP Reconciliation

The principal differences between US GAAP and UK GAAP, as they relate to the

Consolidated Financial Statements, are the use of equity accounting under US GAAP for

a subsidiary undertaking, Vodafone Italy, which is fully consolidated under UK GAAP,

methods of accounting for acquisitions completed before 31 March 1998, the

determination of the fair value of the share consideration as a component of the

purchase price of acquisitions, the accounting for goodwill and intangible assets, the

accounting for income taxes, the capitalisation of interest, the timing of recognition of

connection revenue and expenses, share options expense and the treatment of

dividends declared or proposed after the period end by the Board of directors.