Vodafone 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Information on International Financial Reporting Standards continued

140 |Shareholder information

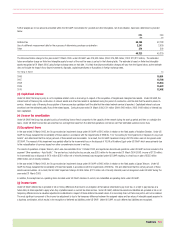

Deferred and Current Taxes

The scope of IAS 12, “Income Taxes”is wider than the corresponding UK GAAP standards, and requires deferred tax to be provided on all temporary differences rather than just

timing differences under UK GAAP.

As a result, the Group’s IFRS opening balance sheet at 1 April 2004 includes an additional deferred tax liability of £1,801 million in respect of the differences between the carrying

value and tax written down value of the Group’s investments in associated undertakings and joint ventures. This comprises £1.3 billion in respect of differences that arose when

US investments were acquired and £0.5 billion in respect of undistributed earnings of certain associated undertakings and joint ventures, principally Vodafone Italy. UK GAAP does

not permit deferred tax to be provided on the undistributed earnings of the Group’s associated undertakings and joint ventures until there is a binding obligation to distribute those

earnings.

IAS 12 also requires deferred tax to be provided in respect of the Group’s liabilities under its post employment benefit arrangements and on other employee benefits such as share

and share option schemes.

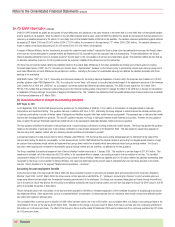

Share-based Payments

IFRS 2, “Share-based Payment”requires that an expense for equity instruments granted be recognised in the financial statements based on their fair value at the date of grant.

This expense, which is primarily in relation to employee option and performance share schemes, is recognised over the vesting period of the scheme.

While IFRS 2 allows the measurement of this expense to be calculated only on options granted after 7 November 2002, the Group has applied IFRS 2 to all instruments granted

but not fully vested as at 1 April 2004. The Group has adopted the binomial model for the purposes of computing fair value under IFRS.

Principal presentational differences

Scope of consolidation

IAS 31, “Interests in Joint Ventures”defines a jointly controlled entity as an entity where unanimous consent over the strategic financial and operating decisions is required between

the parties sharing control. Control is defined as the power to govern the financial and operating decisions of an entity so as to obtain economic benefit from it.

The Group has reviewed the classification of its investments and concluded that the Group’s 76.8% interest in Vodafone Italy, currently classified as a subsidiary undertaking under

UK GAAP, should be accounted for as a joint venture under IFRS. In addition, the Group’s interests in South Africa, Poland, Romania, Kenya and Fiji, which are currently classified

as associated undertakings under UK GAAP, have been classified as joint ventures under IFRS as a result of the contractual rights held by the Group. The Group has adopted

proportionate consolidation as the method of accounting for these six entities.

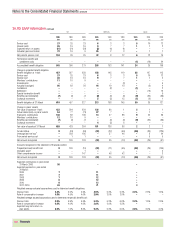

Under UK GAAP, the revenue, operating profit, net financing costs and taxation of Vodafone Italy are consolidated in full in the income statement with a corresponding allocation to

minority interest. Under proportionate consolidation, the Group recognises its share of all income statement lines with no allocation to minority interest. There is no effect on the

result for a financial period from this adjustment.

Under UK GAAP, the Group’s interests in South Africa, Poland, Romania, Kenya and Fiji are accounted for under the equity method, with the Group’s share of operating profit,

interest and tax being recognised separately in the consolidated income statement. Under proportionate consolidation, the Group recognises its share of all income statement lines.

There is no effect on the result for a financial period from this adjustment.

Under UK GAAP, the Group fully consolidates the cash flows of Vodafone Italy, but does not consolidate the cash flows of its associated undertakings. The IFRS consolidated cash

flow statements reflect the Group’s share of cash flows relating to its joint ventures on a line by line basis, with a corresponding recognition of the Group’s share of net debt for

each of the proportionately consolidated entities.

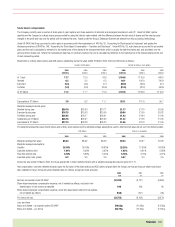

Associated undertakings taxation

Under IFRS, in accordance with IAS 1, “Presentation of Financial Statements”, “Tax on (loss)/profit on ordinary activities”on the face of the consolidated income statement

comprises the tax charge of the Company, its subsidiaries and its share of the tax charge of joint ventures. The Group’s share of its associated undertakings’ tax charges is shown

as part of “Share of result in associated undertakings”rather than being disclosed as part of the tax charge under UK GAAP.

In respect of the Verizon Wireless partnership, the line “Share of result in associated undertakings”includes the Group’s share of pre-tax partnership income and the Group’s share

of the post-tax income attributable to corporate entities (as determined for US corporate income tax purposes) held by the partnership. The tax attributable to the Group’s share of

allocable partnership income is included as part of “Tax on (loss)/profit on ordinary activities”on the consolidated income statement. This treatment reflects the fact that tax on

allocable partnership income is, for US corporate income tax purposes, a liability of the partners and not the partnership.