United Airlines 2008 Annual Report Download - page 99

Download and view the complete annual report

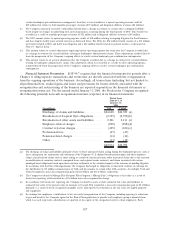

Please find page 99 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or the rendering of relevant court decisions. See Note 8, “Income Taxes,” for further

information related to uncertain income tax positions and the adoption of FIN 48.

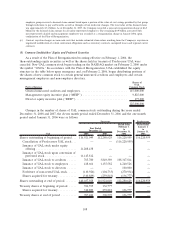

(2) Company Operational Plans

The volatility of and increases in crude oil prices, a weakening economic environment and a highly

competitive industry with excess capacity have created an extremely challenging environment for the

Company. The Company’s cash flows and results of operations have been adversely impacted by these

factors as indicated by its net loss of $5.3 billion during the year ended December 31, 2008. The

Company’s results in 2008 include asset impairment charges of approximately $2.6 billion that resulted

primarily from unfavorable market and economic conditions as discussed in Note 3, “Asset Impairments

and Intangible Assets.” These factors have had a significant negative impact on the Company’s liquidity

as unrestricted cash and short-term investments decreased by $1.5 billion in 2008 to $2.0 billion at

December 31, 2008. In addition, the Company may not be able to improve its liquidity position with cash

from operations in 2009 because of lower demand for air travel during 2009 and a weak global economy.

The Company is implementing certain operational plans to address its increased operating costs and its

liquidity needs in 2009. In addition, the Company continues to evaluate the most cost-effective

alternatives to raise additional capital, including asset sales and financings. Highlights of the Company’s

operational plans and financings include the following:

• The Company is significantly reducing mainline domestic and consolidated capacity. Fourth

quarter 2008 mainline domestic and consolidated capacity were down approximately 14% and

11% year-over-year, respectively. The Company is planning to further decrease mainline domestic

and consolidated capacity in 2009.

• The capacity reductions are being made through reductions in frequencies of routes and the

elimination of unprofitable routes. These actions have resulted in the closure of a small number

of airport operations where United cannot operate profitably in the current economic

environment. Additional airport operations may be closed in future periods.

• The Company has announced plans to permanently remove 100 aircraft from its mainline fleet,

including its entire B737 fleet and six B747 aircraft, by the end of 2009. The B737 aircraft being

retired are some of the oldest and least fuel efficient in the Company’s fleet. This planned

reduction reflects the Company’s efforts to eliminate unprofitable capacity and divest the

Company of assets that currently do not provide an acceptable return.

• United is eliminating its Ted product for leisure markets and will reconfigure that fleet’s 56

A320s to include United First seating. The reconfiguration of the Ted aircraft will occur in stages,

with expected completion by year-end 2009. We will continue to review the deployment of all of

our aircraft in various markets and the overall composition of our fleet to ensure that we are

using our assets appropriately to provide the best available return.

• In connection with the capacity reductions, the Company is further streamlining its operations

and corporate functions in order to reduce the size of its workforce to match the size of its

operations.

• The Company also recently entered into an alliance partnership with Continental Airlines that is

expected to create revenue enhancements, costs savings and operational efficiencies.

• The Company is managing its liquidity by investing only in those projects that are considered

high-value, such as the international premium product. The Company has $0.2 billion of binding

commitments for the purchase of property in 2009 and $0.8 billion of long-term debt obligations

in 2009.

• As of December 31, 2008, the Company has 62 unencumbered aircraft and other assets that may

be used as collateral to obtain additional financing. The Company could also sell certain of these

assets to generate liquidity.

99