United Airlines 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• While fuel prices decreased significantly from their record high prices, fuel prices remain

volatile and could increase significantly.

• Our level of indebtedness, our non-investment grade credit rating, and general credit market

conditions may make it difficult, or impossible, for us to raise capital to meet liquidity needs

and/or may increase our cost of borrowing.

• Due to the factors above, and other factors, we may be unable to comply with our Amended

Credit Facility covenant that currently requires the Company to maintain an unrestricted cash

balance of $1.0 billion and will also require the Company, beginning in the second quarter of

2009, to maintain a minimum ratio of EBITDAR to fixed charges. If the Company does not

comply with these covenants, the lenders may accelerate repayment of these debt obligations,

which would have a material adverse impact on the Company’s financial position and liquidity.

• If a default occurs under our Amended Credit Facility or other debt obligations, the cost to cure

any such default may materially and adversely impact our financial position and liquidity, and no

assurance can be provided that such a default will be mitigated or cured.

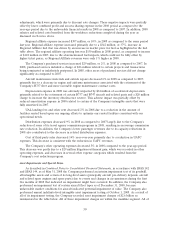

Although the factors described above may adversely impact the Company’s liquidity, the Company

believes it has an adequate available cash position to fund current operations. UAL’s unrestricted and

restricted cash balances were $2.0 billion and $0.3 billion, respectively, at December 31, 2008. In

addition, the Company has recently taken actions to improve its liquidity and believes it may access

additional capital or improve its liquidity further, as described below.

• During 2008, the Company completed several initiatives that generated unrestricted cash of more

than $1.9 billion. These initiatives are described below.

• The Company has significant additional unencumbered aircraft and other assets that may be used

as collateral to obtain additional financing, as discussed below. At December 31, 2008, the

Company had 62 unencumbered aircraft. As discussed in Note 23, “Subsequent Events,” in

Combined Notes to Consolidated Financial Statements, in January 2009, the Company completed

several financing-related transactions which generated approximately $315 million of proceeds.

• The Company is taking aggressive actions to right-size its business including significant capacity

reductions, disposition of underperforming assets and a workforce reduction, among others.

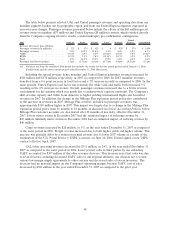

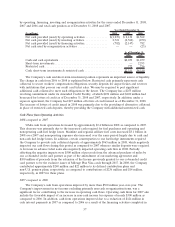

Cash Position and Liquidity. As of December 31, 2008, approximately 50% of the Company’s cash

and cash equivalents consisted of money market funds directly or indirectly invested in U.S. treasury

securities with the remainder largely in money market funds that are covered by the new government

money market funds guarantee program. There are no withdrawal restrictions at the present time on any

of the money market funds in which the Company has invested. In addition, the Company has no

auction rate securities as of December 31, 2008. Therefore, we believe our credit risk is limited with

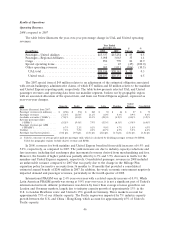

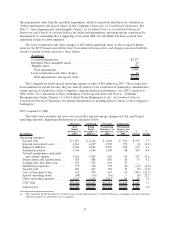

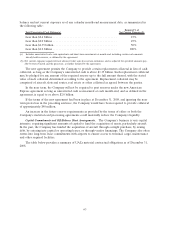

respect to our cash balances. The following table provides a summary of UAL’s net cash provided (used)

56