United Airlines 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

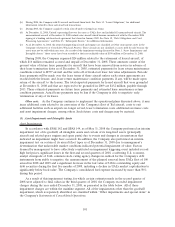

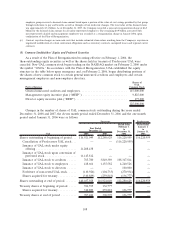

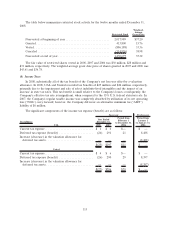

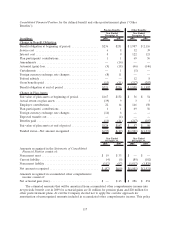

UAL 2008 2007

Period from

February 1

to

December 31,

2006

Period from

January 1

to

January 31,

2006

(In millions, except per share)

Year Ended

December 31,

Successor Predecessor

Basic earnings per share:

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(5,348) $ 403 $ 25 $22,851

Preferred stock dividend requirements . . . . . . . . . . . . . . . . . . . . . (3) (10) (9) (1)

Earnings (loss) available to common stockholders . . . . . . . . . . . . . $(5,351) $ 393 $ 16 $22,850

Basic weighted-average shares outstanding . . . . . . . . . . . . . . . . . . 126.8 117.4 115.5 116.2

Earnings (loss) per share, basic . . . . . . . . . . . . . . . . . . . . . . . . . . $(42.21) $ 3.34 $ 0.14 $196.61

Diluted earnings per share:

Earnings (loss) available to common stockholders . . . . . . . . . . . . . $(5,351) $ 393 $ 16 $22,850

Effect of 2% preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . — 10 — —

Effect of 4.5% senior limited-subordination convertible notes . . . . — 20 — —

Effect of 5% convertible notes. . . . . . . . . . . . . . . . . . . . . . . . . . . — 5 — —

Earnings available to common stockholders including the effect of

dilutive securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(5,351) $ 428 $ 16 $22,850

Basic weighted-average shares outstanding . . . . . . . . . . . . . . . . . . 126.8 117.4 115.5 116.2

Effect of non-vested stock options . . . . . . . . . . . . . . . . . . . . . . . . — 0.2 — —

Effect of non-vested restricted shares . . . . . . . . . . . . . . . . . . . . . . — 1.1 0.7 —

Effect of 2% preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . — 11.0 — —

Effect of 4.5% senior limited-subordination convertible notes . . . . — 20.8 — —

Effect of 5% convertible notes. . . . . . . . . . . . . . . . . . . . . . . . . . . — 3.2 — —

Diluted weighted-average shares outstanding . . . . . . . . . . . . . . . . 126.8 153.7 116.2 116.2

Earnings (loss) per share, diluted . . . . . . . . . . . . . . . . . . . . . . . . $(42.21) $ 2.79 $ 0.14 $196.61

Potentially dilutive shares excluded from diluted per share amounts:

Stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.4 4.0 5.0 9.0

Restricted shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.4 0.9 2.0 —

2% preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.1 — 10.8 —

4.5% senior limited-subordination convertible notes . . . . . . . . . . . . . 22.2 — 20.8 —

5% convertible notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.4 — 3.2 —

34.5 4.9 41.8 9.0

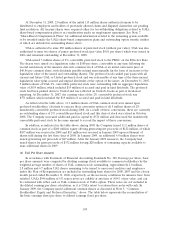

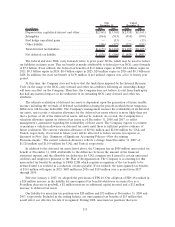

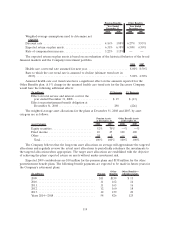

(7) Share-Based Compensation Plans

Compensation expense associated with the UAL share-based compensation plans has been pushed

down to United.

Predecessor Company—As of January 31, 2006, a total of nine million stock options were

outstanding. Under the Company’s Plan of Reorganization, these stock options were canceled on the

Effective Date. No material share-based compensation expense was incurred as a result of these

outstanding options for the month of January 2006.

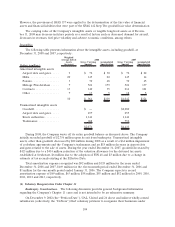

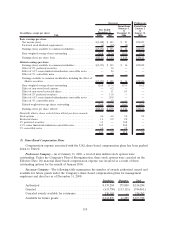

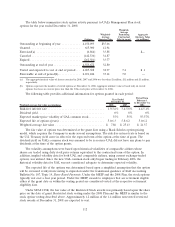

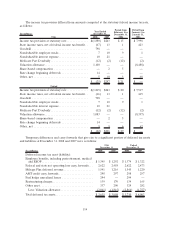

Successor Company—The following table summarizes the number of awards authorized, issued and

available for future grants under the Company’s share-based compensation plans for management

employees and directors as of December 31, 2008:

Employees Directors Total

Authorized ...................................... 8,339,284 175,000 8,514,284

Granted......................................... (633,750) (113,111) (746,861)

Canceled awards available for reissuance ............... 336,365 — 336,365

Available for future grants .......................... 8,041,899 61,889 8,103,788

110