United Airlines 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

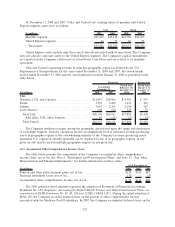

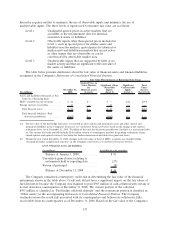

(a) Fuel hedge gains (losses) are not allocated to Regional affiliates expense.

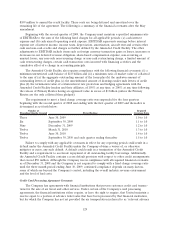

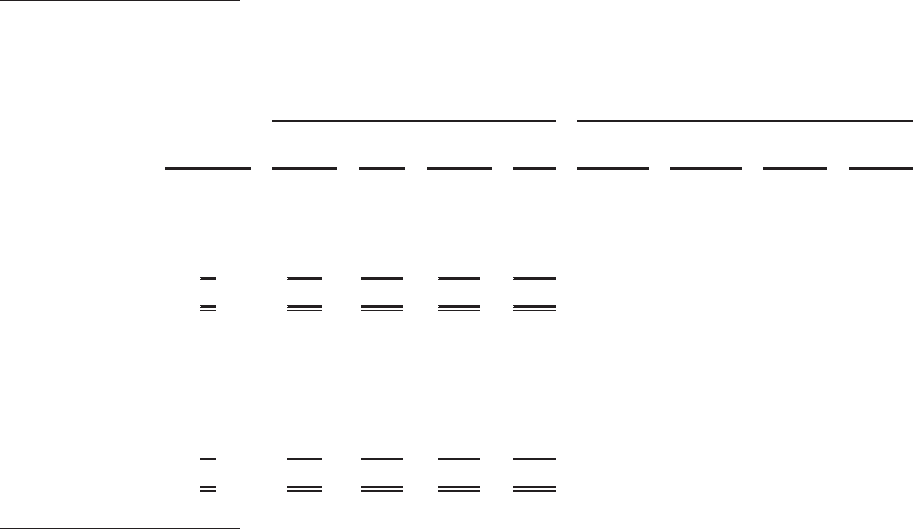

As of December 31, 2008, the Company had hedged its forecasted consolidated fuel consumption as

shown in the table below.

Percentage of

Projected

Fuel

Requirements

Hedged(a)

Purchased

Puts

Sold

Puts(a)

Purchased

Calls

Sold

Calls

Payment

Obligations

Stop

Payment

Obligations

Begin

Hedge

Protection

Begins

Hedge

Protection

Ends

Barrels hedged (in 000s) Weighted-average price per barrel

First Quarter 2009: % $ $ $ $

Calls ............ 14 — — 1,975 — NA NA 83(b) NA

Collars ........... 9(10) — 1,425 1,275 — NA 109 118 NA

3-way collars ....... 25(29) — 4,125 3,525 3,525 NA 104 118 143

4-way collars ....... 2 225 225 225 225 63 78 95 135

Total........... 50 225 5,775 7,000 3,750

Purchasedputs ..... 35 4,925 — — — 57 NA NA NA

Full Year 2009:

Calls ............ 9 — — 5,350 — NA NA 81(c) NA

Collars ........... 5 (6) — 3,450 2,775 — NA 111 123 NA

3-way collars ....... 18(22) — 12,525 10,350 10,350 NA 102 118 147

4-way collars ....... 2 900 900 900 900 63 78 95 135

Total........... 34 900 16,875 19,375 11,250

Purchasedputs ..... 17 9,500 — — — 54 NA NA NA

(a) Percent of expected consumption represents the notional amount of the purchased calls in the hedge structures. Certain

3-way collars and collars included in the table above have sold puts with twice the notional amount of the purchased calls.

The percentages in parentheses represent the notional amount of sold puts in these hedge structures.

(b) Call position average includes the following two groupings of positions: 6% of consumption with protection beginning at $47

per barrel and 8% of consumption beginning at $106 per barrel.

(c) Call position average includes the following two groupings of positions: 4% of consumption with protection beginning at $50

per barrel and 5% of consumption beginning at $106 per barrel.

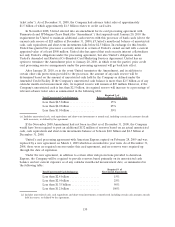

Foreign Currency Derivatives.

The Company hedges a portion of its remaining foreign currency risk exposure using foreign

currency forward contracts. As of December 31, 2008, the Company hedged a portion of its expected

foreign currency cash flows in the Australian dollar, Canadian dollar, British pound, European Euro and

Japanese yen. As of December 31, 2008, the notional amount of these foreign currencies hedged with

the forward contracts in U.S. dollars terms was approximately $62 million. These contracts expire at

various dates through December 2009. For the years ended December 31, 2008 and 2007, there were no

material gains or losses from these derivative positions.

Fair Value Information. Effective January 1, 2008, the Company adopted SFAS 157. SFAS 157

establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy

gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). This

132