United Airlines 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

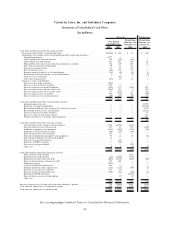

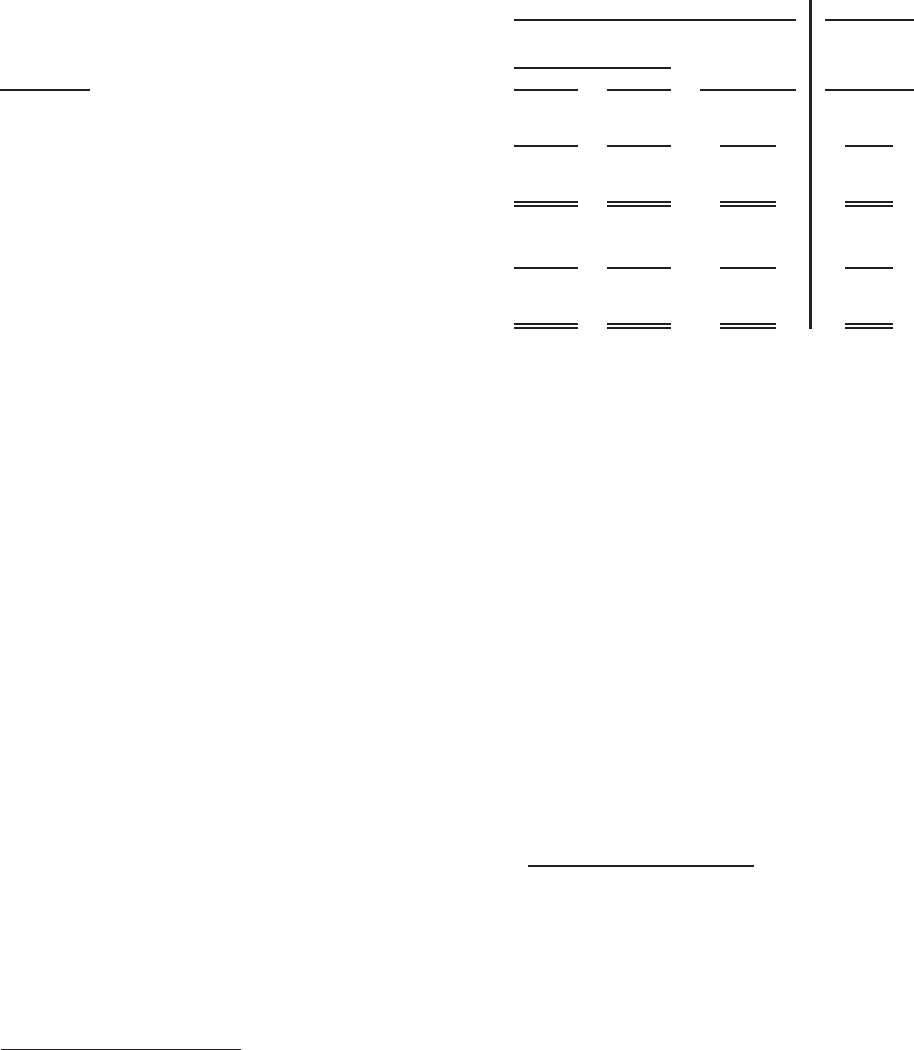

December 31, 2006 and the one month period ended January 31, 2006 is shown in the table

below:

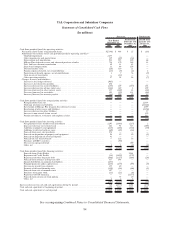

(In millions) 2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

Cash flows provided (used) from operating activities.... $(1,239) $ 2,134 $1,401 $ 161

Adjustment for (increase) decrease in restricted cash . . . 484 91 313 (203)

Pro-forma cash flows provided (used) from operating

activities .................................... $ (755) $ 2,225 $1,714 $ (42)

Cash flows provided (used) from investing activities .... $2,721 $(2,560) $ (12) $(238)

Adjustment for increase (decrease) in restricted cash . . . (484) (91) (313) 203

Pro-forma cash flows provided (used) from investing

activities .................................... $2,237 $(2,651) $ (325) $ (35)

See Note 20, “Investments,” for information related to the Company’s investments in

noncurrent debt securities.

(e) Aircraft Fuel, Spare Parts and Supplies—The Company records fuel, maintenance, operating

supplies and aircraft spare parts at cost when acquired and provides an obsolescence allowance

for aircraft spare parts.

(f) Operating Property and Equipment—The Company records additions to owned operating

property and equipment at cost when acquired. Property under capital leases and the related

obligation for future lease payments are recorded at an amount equal to the initial present

value of those lease payments. Owned operating property and equipment, and equipment under

capital leases, were stated at fair value as of February 1, 2006 upon the adoption of fresh-start

reporting.

Depreciation and amortization of owned depreciable assets is based on the straight-line method

over the assets’ estimated service lives. Leasehold improvements are amortized over the

remaining term of the lease, including estimated facility renewal options when renewal is

reasonably assured at key airports, or the estimated service life of the related asset, whichever is

less. Properties under capital leases are amortized on the straight-line method over the life of

the lease or, in the case of certain aircraft, over their estimated service lives. Amortization of

capital leases is included in depreciation and amortization expense. The estimated useful lives of

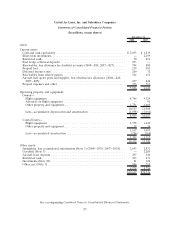

our property and equipment are as follows:

Estimated Useful Life (in years)

Aircraft ......................... 27to30

Buildings ........................ 25to45

Other property and equipment ....... 4to15

Software (a) ...................... 5

Aircraft lease terms ................ 3to17

Building lease terms ............... 40

(a) The carrying amount of computer software, which is classified as noncurrent other assets in our Statements of Consolidated

Financial Position, was $182 million and $157 million at December 31, 2008 and 2007, respectively.

Maintenance and repairs, including the cost of minor replacements, are charged to maintenance

expense as incurred, except for costs incurred under our power-by-the-hour engine maintenance

agreements, which are expensed based upon the number of hours flown. Costs of additions to

and renewals of units of property are capitalized as property and equipment additions.

93