United Airlines 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

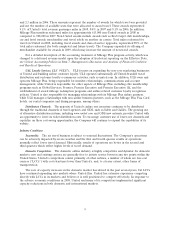

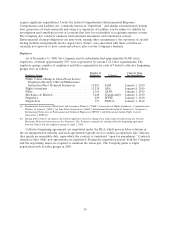

balance and net current exposure as of any calendar month-end measurement date, as summarized in

the following table:

Total Unrestricted Cash Balance(a)

Required % of

Net Current Exposure(b)

Less than $2.4 billion .................................. 15%

Less than $2.0 billion .................................. 25%

Less than $1.35 billion ................................. 50%

Less than $1.2 billion .................................. 100%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already

held in reserve, as defined by the agreement.

(b) Net current exposure equals relevant advance ticket sales less certain exclusions, and as adjusted for specified amounts pay-

able between United and the processor, as further defined by the agreement.

The new agreement permits the Company to provide certain replacement collateral in lieu of cash

collateral, as long as the Company’s unrestricted cash is above $1.35 billion. Such replacement collateral

may be pledged for any amount of the required reserve up to the full amount thereof, with the stated

value of such collateral determined according to the agreement. Replacement collateral may be

comprised of aircraft, slots and routes, real estate or other collateral as agreed between the parties.

In the near term, the Company will not be required to post reserves under the new American

Express agreement as long as unrestricted cash as measured at each month-end, and as defined in the

agreement, is equal to or above $2.0 billion.

If the terms of the new agreement had been in place at December 31, 2008, and ignoring the near

term protection in the preceding sentence, the Company would have been required to provide collateral

of approximately $40 million.

An increase in the future reserve requirements as provided by the terms of either or both the

Company’s material card processing agreements could materially reduce the Company’s liquidity.

The Company may not be able to maintain adequate liquidity.

While the Company’s cash flows from operations and its available capital have been sufficient to

meet its current operating expenses, lease obligations and debt service requirements to date, the

Company’s future liquidity could be negatively impacted by many factors including, but not limited to,

substantial volatility in the price of fuel, declines in passenger and cargo demand associated with the

weak global economy and deterioration of global financial systems. During 2008, particularly in the

fourth quarter, the Company experienced weaker demand for its services due to the current economic

conditions. Decreases in passenger and cargo demand resulting from a weak global economy have

resulted in both lower passenger volumes and lower ticket fares, which have adversely impacted our

liquidity and are expected to adversely impact our results of operations and liquidity in 2009. In addition,

the Company’s 2008 and planned 2009 capacity cuts may not be sufficient to address lower demand from

a weak global economy. See “Economic and industry conditions constantly change and continued or

worsening negative economic conditions in the United States and elsewhere may have a material adverse

effect on our business and results of operations,” below, for further discussion of the adverse impacts of

a weak economy on our operations.

In 2008, fuel price changes had a more significant impact on liquidity than changes in demand for

the Company’s products and services. For example, the crude oil spot price rose to a record high of

approximately $145 per barrel in July 2008. The Company’s consolidated fuel cost, including the impact

of fuel hedges, increased by more than $3.1 billion for the full year of 2008 as compared to 2007

primarily due to increased fuel prices, resulting in a significant negative impact on liquidity.

Furthermore, fuel prices continue to be extremely volatile which may negatively impact the Company’s

liquidity. Additionally, the Company’s fuel hedges require that it post cash collateral with applicable

counterparties if crude oil prices change by specified amounts. The Company provided cash collateral of

17