United Airlines 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

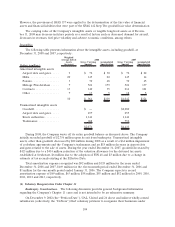

However, the provisions of SFAS 157 were applied to the determination of the fair value of financial

assets and financial liabilities that were part of the SFAS 142 Step Two goodwill fair value determination.

The carrying value of the Company’s intangible assets or tangible long-lived assets as of Decem-

ber 31, 2008 may decrease in future periods as a result of factors such as decreased demand for aircraft,

decreases in revenues, fuel price volatility and adverse economic conditions, among others.

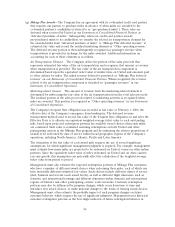

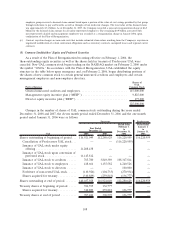

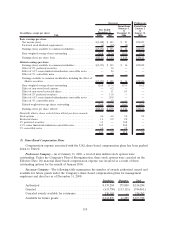

Intangibles

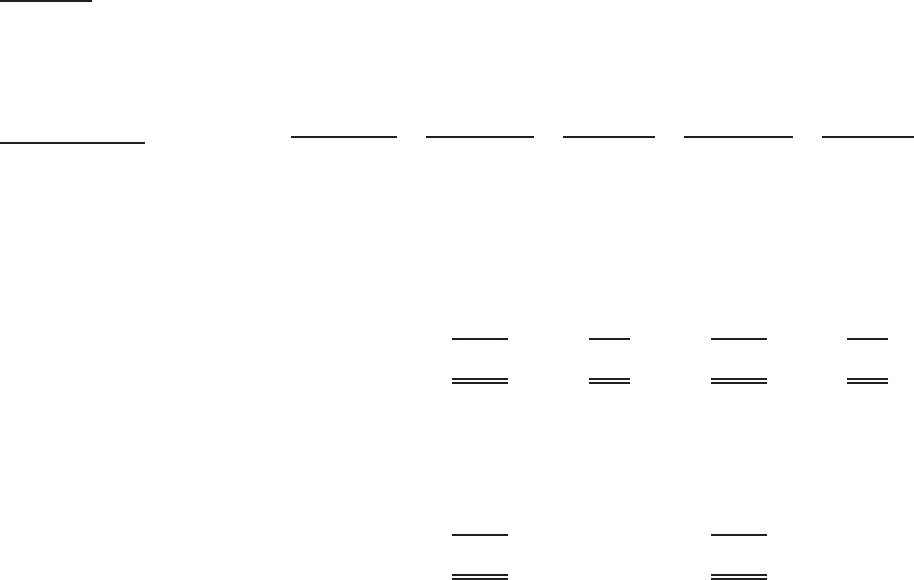

The following table presents information about the intangible assets, including goodwill, at

December 31, 2008 and 2007, respectively:

(Dollars in millions)

Weighted

Average Life of

Assets

(in years)

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

2008 2007

Amortized intangible assets

Airport slots and gates ..... 9 $ 72 $ 30 $ 72 $ 22

Hubs................... 20 145 22 145 14

Patents................. 3 70 68 70 45

Mileage Plus database ..... 7 521 179 521 137

Contracts ............... 13 140 35 216 101

Other.................. 7 13 5 18 5

10 $ 961 $339 $1,042 $324

Unamortized intangible assets

Goodwill................ $ — $2,280

Airport slots and gates ..... 237 255

Route authorities ......... 1,146 1,146

Tradenames ............. 688 752

$2,071 $4,433

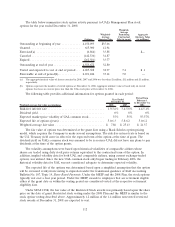

During 2008, the Company wrote off its entire goodwill balance as discussed above. The Company

initially recorded goodwill of $2,756 million upon its exit from bankruptcy. Unamortized intangible

assets, other than goodwill, decreased by $82 million during 2008 as a result of a $64 million impairment

of codeshare agreements and the Company’s tradenames and an $18 million decrease in airport slots

and gates related to the sale of assets. During the year ended December 31, 2007, goodwill decreased by

$423 million due to a $414 million reduction of the valuation allowance for the deferred tax assets

established at fresh-start, $6 million due to the adoption of FIN 48 and $3 million due to a change in

estimate of tax accruals existing at the Effective Date.

Total amortization expense recognized was $92 million and $155 million for the years ended

December 31, 2008 and 2007, $169 million for the eleven month period ended December 31, 2006 and

$1 million for the one month period ended January 31, 2006. The Company expects to record

amortization expense of $69 million, $63 million, $58 million, $55 million and $52 million for 2009, 2010,

2011, 2012 and 2013, respectively.

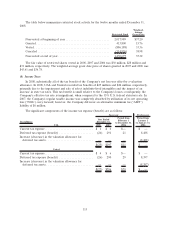

(4) Voluntary Reorganization Under Chapter 11

Bankruptcy Considerations. The following discussion provides general background information

regarding the Company’s Chapter 11 cases and is not intended to be an exhaustive summary.

On December 9, 2002 (the “Petition Date”), UAL, United and 26 direct and indirect wholly-owned

subsidiaries (collectively, the “Debtors”) filed voluntary petitions to reorganize their businesses under

104