United Airlines 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

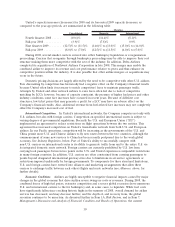

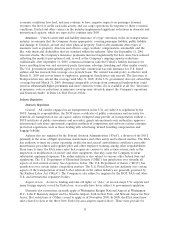

United’s capacity increases (decreases) for 2008 and its forecasted 2009 capacity decreases, as

compared to the year-ago periods, are summarized in the following table:

Consolidated Domestic International

Mainline

Fourth Quarter 2008 ...... (10.6)% (14.4)% (8.1)%

Full-year 2008 . . . ........ (3.9)% (7.8)% 0.9%

First Quarter 2009 ........ (12.5)% to (11.5)% (14.0)% to (13.0)% (15.0)% to (14.0)%

Full-year 2009 . . . ........ (8.0)%to(7.0)% (12.5)% to (11.5)% (6.0)% to (5.0)%

During 2008, several smaller carriers entered into either bankruptcy liquidation or reorganization

proceedings. Carriers that reorganize through bankruptcy proceedings may be able to improve their cost

structure making them more competitive with the rest of the industry. In addition, Delta Airlines

completed its acquisition of Northwest Airlines Corporation in late 2008. This merger may enable the

combined airline to improve its revenue and cost performance relative to peers and thus enhance its

competitive position within the industry. It is also possible that other airline mergers or acquisitions may

occur in the future.

Domestic pricing decisions are largely affected by the need to be competitive with other U.S. airlines.

Fare discounting by competitors has historically had a negative effect on the Company’s financial results

because United often finds it necessary to match competitors’ fares to maintain passenger traffic.

Attempts by United and other network airlines to raise fares often fail due to lack of competitive

matching by LCCs; however, because of capacity constraint, the pressure of higher fuel prices and other

industry conditions, some fare increases have occurred in recent years. Because of different cost

structures, low ticket prices that may generate a profit for a LCC may have an adverse effect on the

Company’s financial results. Also, additional revenue from fuel-related fare increases may not completely

offset the Company’s increased cost of fuel.

International Competition. In United’s international networks, the Company competes not only with

U.S. airlines, but also with foreign carriers. Competition on specified international routes is subject to

varying degrees of governmental regulations. Recently the U.S. and European Union (“EU”)

implemented an agreement to reduce restrictions on flight operations between the two entities. This

agreement has increased competition on United’s transatlantic network from both U.S. and European

airlines. In our Pacific operations, competition will be increasing as the governments of the U.S. and

China permit more U.S. and Chinese airlines to fly new routes between the two countries, although the

commencement of some new services to China has been recently postponed due to the weak global

economy. See Industry Regulation, below. Part of United’s ability to successfully compete with

non-U.S. carriers on international routes is its ability to generate traffic from and to the entire U.S. via

its integrated domestic route network. Foreign carriers are currently prohibited by U.S. law from

carrying local passengers between two points in the U.S. and United experiences comparable restrictions

in many foreign countries. In addition, U.S. carriers are often constrained from carrying passengers to

points beyond designated international gateway cities due to limitations in air service agreements or

restrictions imposed unilaterally by foreign governments. To compensate for these structural limitations,

U.S. and foreign carriers have entered into alliances and marketing arrangements that allow these

carriers to exchange traffic between each other’s flights and route networks (see Alliances, above, for

further details).

Economic Conditions. Airlines are highly susceptible to negative financial impacts caused by major

changes in the global economy that drive sudden severe swings in costs or revenues. During 2008, the

combined forces of high fuel prices, extensive competition and a severe global recession drove numerous

U.S. and international carriers to file for bankruptcy and, in some cases, to liquidate. While fuel costs

have significantly fallen since reaching historic highs in the summer of 2008, overall demand for airline

services has decreased, and may decrease further, and the depth of, and recovery from, the global

recession continues to be uncertain. As discussed further in Item 1A, Risk Factors, and in Item 7,

Management’s Discussion and Analysis of Financial Condition and Results of Operations, the current

10