United Airlines 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

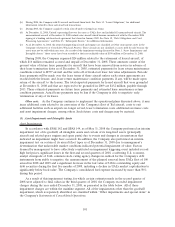

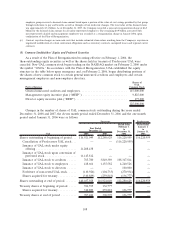

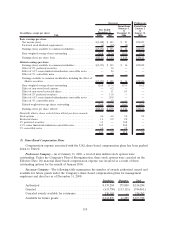

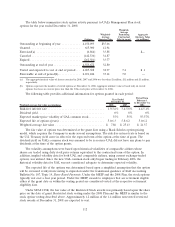

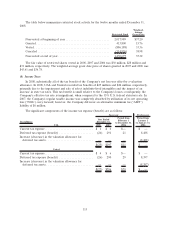

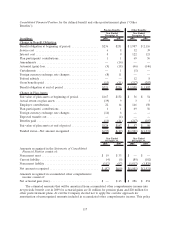

The following table provides information related to our share-based compensation plans.

(In millions) 2008 2007

Period from

February 1 to

December 31,

2006

Year Ended

December 31,

Compensation cost:

Management plan restricted stock ......................... $18 $25 $ 84

Management plan stock options ........................... 13 24 72

DEIP unrestricted stock . ................................ — — 3

Total compensation cost . ................................ $31 $49 $159

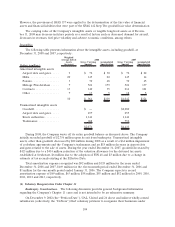

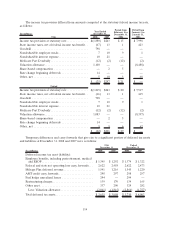

The unrecognized compensation cost related to unvested awards at December 31, 2008 and 2007

was $18 million and $41 million, respectively, which is expected to be recognized over a weighted-average

period of 1.6 and 2.2 years, respectively. During the second quarter of 2006, the Company revised its

initial estimated award forfeiture rate of 7.5% to 15% based upon actual attrition. As a result, the

share-based compensation expense was reduced by approximately $7 million for the eleven month period

ended December 31, 2006.

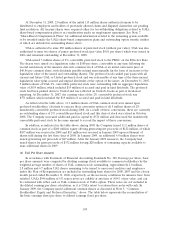

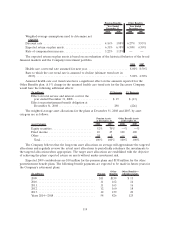

2008 Incentive Compensation Plan. In 2008, UAL’s Board of Directors and stockholders approved

the UAL Corporation 2008 Incentive Compensation Plan (the “2008 Plan”). The 2008 Plan is an

incentive compensation plan that allows the Company to use different forms of compensation awards to

attract, retain and reward eligible participants. This approval by stockholders also allows for the issuance

of up to 8,000,000 additional shares pursuant to awards granted under the 2008 Plan. The 2008 Plan

replaced the UAL Corporation 2006 Management Equity Incentive Plan, which was automatically

terminated with respect to future grants and otherwise replaced and superseded by the 2008 Plan. Any

awards granted under the MEIP remain in effect pursuant to their terms.

Any officer or employee of UAL or its affiliates is eligible to participate in the 2008 Plan. The 2008

Plan allows for the grant of options intended to qualify as incentive stock options (“ISOs”) under

Section 422 of the Code, non-qualified stock options (“NSOs”), stock appreciation rights (“SARs”),

restricted share awards, restricted stock units (“RSUs”), performance compensation awards,

performance units, cash incentive awards and other equity-based and equity-related awards. Any shares

of our common stock issued under the 2008 Plan will consist, in whole or in part, of authorized and

unissued shares or of treasury shares.

The 2008 Plan provides that, unless otherwise provided in an award agreement, in the event of a

change of control of the Company (as defined in the 2008 Plan):

• any options and SARs outstanding as of the date the change of control is determined to have

occurred become fully exercisable and vested, as of immediately prior to the change of control.

• all performance units, cash incentive awards and other awards designated as performance

compensation awards will be paid out at the “target” performance level on a prorated basis based

on the number of days elapsed from the beginning of the performance period up to and including

the change of control.

• all other outstanding awards are automatically deemed exercisable or vested and all restrictions

and forfeiture provisions related thereto lapse as of immediately prior to such change of control.

111