United Airlines 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ticket sales”). As of December 31, 2008, the Company had advance ticket sales of approximately

$1.5 billion of which approximately $1.3 billion relates to credit card sales.

In November 2008, United entered into an amendment for its card processing agreement with

Paymentech and JPMorgan Chase Bank (the “Amendment”) that suspends until January 20, 2010 the

requirement for United to maintain additional cash reserves with this processor of bank cards (above the

current cash reserve of $25 million at December 31, 2008) if United’s month-end balance of unrestricted

cash, cash equivalents and short-term investments falls below $2.5 billion. In exchange for this benefit,

United has granted the processor a security interest in certain of United’s owned aircraft with a current

appraised value of at least $800 million. United also has agreed that such security interest collateralizes

not only United’s obligations under the processing agreement, but also United’s obligations under

United’s Amended and Restated Co-Branded Card Marketing Services Agreement. United has an

option to terminate the Amendment prior to January 20, 2010, in which event the parties’ prior credit

card processing reserve arrangements under the processing agreement will go back into effect.

After January 20, 2010, or in the event United terminates the Amendment, and in addition to

certain other risk protections provided to the processor, the amount of any such reserve will be

determined based on the amount of unrestricted cash held by the Company as defined under the

Amended Credit Facility. If the Company’s unrestricted cash balance is more than $2.5 billion as of any

calendar month-end measurement date, its required reserve will remain at $25 million. However, if the

Company’s unrestricted cash is less than $2.5 billion, its required reserve will increase to a percentage of

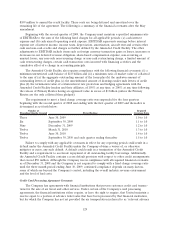

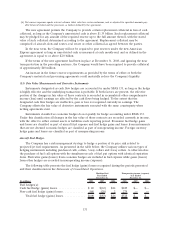

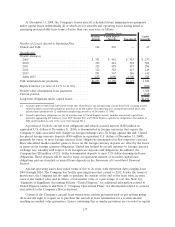

relevant advance ticket sales as summarized in the following table:

Total Unrestricted Cash Balance(a)

Required % of

Relevant Advance Ticket Sales

Less than $2.5 billion ................ 15%

Less than $2.0 billion ................ 25%

Less than $1.0 billion ................ 50%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already

held in reserve, as defined by the agreement.

If the November 2008 Amendment had not been in effect as of December 31, 2008, the Company

would have been required to post an additional $132 million of reserves based on an actual unrestricted

cash, cash equivalents and short-term investments balance of between $2.0 billion and $2.5 billion at

December 31, 2008.

United’s card processing agreement with American Express expired on February 28, 2009 and was

replaced by a new agreement on March 1, 2009 which has an initial five year term. As of December 31,

2008, there were no required reserves under this card agreement, and no reserves were required up

through the date of expiration.

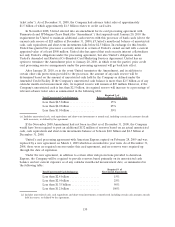

Under the new agreement, in addition to certain other risk protections provided to American

Express, the Company will be required to provide reserves based primarily on its unrestricted cash

balance and net current exposure as of any calendar month-end measurement date, as summarized in

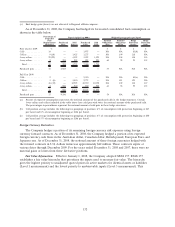

the following table:

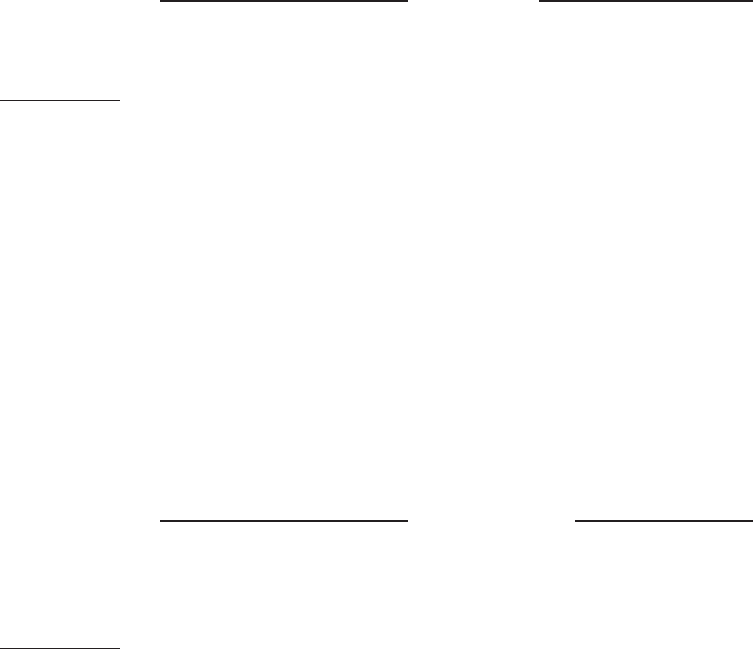

Total Unrestricted Cash Balance(a)

Required % of

Net Current Exposure(b)

Less than $2.4 billion ................... 15%

Less than $2.0 billion ................... 25%

Less than $1.35 billion .................. 50%

Less than $1.2 billion ................... 100%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already

held in reserve, as defined by the agreement.

130