United Airlines 2008 Annual Report Download - page 52

Download and view the complete annual report

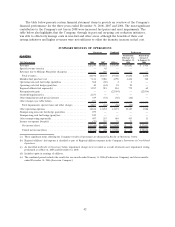

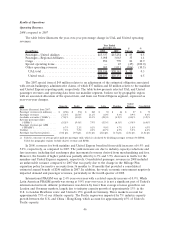

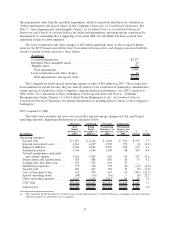

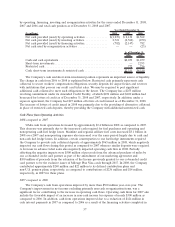

Please find page 52 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mainline aircraft fuel increased $179 million, or 4%, in the year ended December 31, 2007 as

compared to 2006. This net fuel variance was due to a 4% increase in the average price per gallon of jet

fuel from $2.11 in 2006 to $2.18 in 2007, resulting from unfavorable market conditions. Included in the

2007 average price per gallon was an $83 million net hedge gain; a net fuel hedge loss of $26 million is

included in the 2006 average price per gallon.

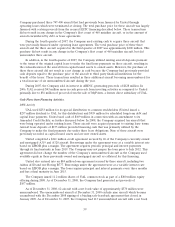

UAL salaries and related costs remained relatively flat in 2007 as compared to 2006. The Company

recognized $49 million of share-based compensation expense in 2007 as compared to $159 million in

2006. There were no significant grants in 2007 as compared to 2006, which included a large number of

grants associated with the Company’s emergence from bankruptcy. Additionally, immediate recognition

of 100% of the cost of awards granted to retirement-eligible employees on the grant date, together with

accelerated vesting of grants within the first twelve months after the grant date, accounted for most of

the decrease in share-based compensation expense. Also benefiting the 2007 period was the absence of

the $22 million severance charge incurred in 2006. Offsetting the decreased share-based compensation

and severance expense was a slight increase in salaries and related costs as a result of certain wage

increases as well as a $110 million increase in profit sharing, including related employee taxes, which is

based on annual pre-tax earnings. As noted above, this increase is due to increased pre-tax earnings and

an increase in the payout percentage from 7.5% in 2006 to 15% in 2007.

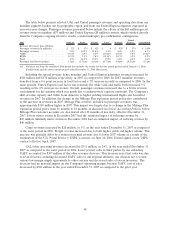

Regional affiliate expense, which includes aircraft fuel, increased $117 million, or 4%, during 2007

as compared to 2006. Regional affiliate capacity increased 4% in 2007, which was a major contributor to

the increase in expense. Including the special revenue item of $8 million, our regional affiliate operating

income was $53 million higher in the 2007 period as compared to the 2006 period. The margin

improvement was due to improved revenue performance, which was due to increased yield and traffic,

and cost control. Factors impacting regional affiliate margin include the restructuring of regional carrier

capacity agreements, the replacement of some 50-seat regional jets with 70-seat regional jets and

regional carrier network optimization. All of these improvements were put in place throughout 2006;

therefore, we realized some year-over-year benefits in 2007. Regional affiliate fuel expense increased

$81 million, or 10%, from $834 million in 2006 to $915 million in 2007 due to a 9% increase in the

average price of fuel and a 1% increase in consumption.

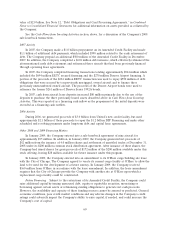

Purchased services increased 8% in 2007 as compared to 2006, primarily due to increased

information technology and other costs incurred in support of the Company’s customer and employee

initiatives. Information technology expenses increased due to an increase in non-capitalizable

information technology related expenditures, generally occurring during the planning and scoping

phases, for new applications in 2007. In addition, airport operations handling and security costs increased

due to the new USPS contract and new international routes, among other factors.

Aircraft maintenance materials and outside repairs expense increased $157 million, or 16%,

year-over-year primarily due to inflationary increases related to our V2500 engine maintenance contract

and the cost of component parts, as well as the impact of increases in airframe and engine repair

volumes.

A charge of $18 million in 2007 for surplus and obsolete aircraft parts inventory accounted for

approximately half of the 4% increase in depreciation and amortization.

Ongoing efforts to efficiently utilize our rented facilities have offset contractual rent increases,

keeping 2007 rent expense in line with 2006 rent expense.

In 2007, United’s mainline revenues increased by 6%. During the same period of time, distribution

expenses, which include commissions, GDS fees and credit card fees decreased 2% from $798 million in

2006 to $779 million in 2007. This decrease was due to cost savings realized as the Company continues

to drive reductions across the full spectrum of costs of sale. Impact areas included renegotiation of

contracts with various channel providers, rationalization of commission plans and programs, and

continued emphasis on movement of customer purchases toward lower cost channels including online

channels. Such efforts resulted in a 9% year-over-year reduction in GDS fees and commissions.

52