United Airlines 2008 Annual Report Download - page 37

Download and view the complete annual report

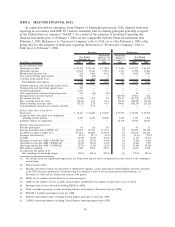

Please find page 37 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS.

Overview

As discussed above under Item 1, Business, the Company derives virtually all of its revenues from

airline related activities. The most significant source of airline revenues is passenger revenues; however,

Mileage Plus, United Cargo and United Services are also major sources of operating revenues. The

airline industry is highly competitive and is characterized by intense price competition. Fare discounting

by United’s competitors has historically had a negative effect on the Company’s financial results because

United has generally been required to match competitors’ fares to maintain passenger traffic. Future

competitive fare adjustments may negatively impact the Company’s future financial results. The

Company’s most significant operating expense is jet fuel. Jet fuel prices are extremely volatile and are

largely uncontrollable by the Company. The Company’s historical and future earnings have been and will

continue to be significantly impacted by jet fuel prices.

This Annual Report on Form 10-K is a combined report of UAL and United. As UAL consolidates

United for financial statement purposes, disclosures that relate to activities of United also apply to UAL,

unless otherwise noted. United’s operating revenues and operating expenses comprise nearly 100% of

UAL’s revenues and operating expenses. In addition, United comprises approximately the entire balance

of UAL’s assets, liabilities and operating cash flows. Therefore, the following qualitative discussion is

applicable to both UAL and United, unless otherwise noted. Any significant differences between UAL

and United results are separately disclosed and explained. United meets the conditions set forth in

General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the

reduced disclosure format allowed under that general instruction.

Bankruptcy Matters. On December 9, 2002, UAL, United and 26 direct and indirect wholly-owned

subsidiaries filed voluntary petitions to reorganize its business under Chapter 11 of the Bankruptcy

Code. The Company emerged from bankruptcy on February 1, 2006, under a Plan of Reorganization

that was approved by the Bankruptcy Court. In connection with its emergence from Chapter 11

bankruptcy protection, the Company adopted fresh-start reporting, which resulted in significant changes

in post-emergence financial statements, as compared to the Company’s historical financial statements.

See the “Financial Results” section below for further discussion. See Note 4, “Voluntary Reorganization

Under Chapter 11,” in Combined Notes to Consolidated Financial Statements for further information

regarding bankruptcy matters.

Recent Developments. The unprecedented increase in fuel prices and a worsening global recession

have created an extremely challenging environment for the airline industry. While the Company

significantly improved its financial performance in 2006 and 2007, the Company was not able to

financially compensate for the substantial increase in fuel prices during 2008. The Company’s average

consolidated fuel price per gallon, including net hedge losses that are classified in fuel expense, increased

59% from 2007 to 2008. The increased cost of fuel purchases and hedging losses drove the $3.1 billion

increase in the Company’s consolidated fuel costs. The Company’s fuel hedge losses that are classified in

nonoperating expense also had a significant negative impact on its 2008 liquidity and results of

operations.

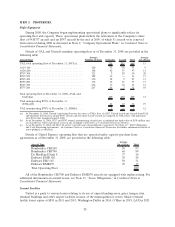

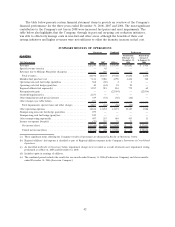

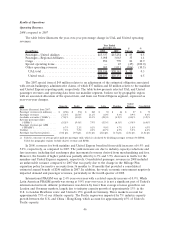

Although the Company was adversely impacted by fuel costs and special items in this recessionary

environment, the Company’s commitment to cost reduction was a contributory factor to the

year-over-year reduction in other areas of operating expenses as presented in the table below. The

37