United Airlines 2008 Annual Report Download - page 70

Download and view the complete annual report

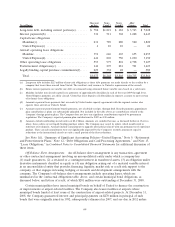

Please find page 70 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.circumstances indicate that an impairment loss may have been incurred, on an interim basis. An

impairment charge could have a material adverse effect on the Company’s financial position and results

of operations in the period of recognition. The Company tested its goodwill and other indefinite-lived

intangible assets for impairment during its annual impairment test as of October 1, 2007 and as part of

its interim test as of May 31, 2008. The interim testing resulted in the total impairment of the Company’s

goodwill and partial impairment of other indefinite-lived intangible assets. The Company also performed

its annual interim test of indefinite-lived intangible assets as of October 1, 2008.

Goodwill—2008 Interim Impairment Test

For purposes of testing goodwill, the Company performed Step One of the SFAS 142 test by

estimating the fair value of the mainline reporting unit (to which all goodwill is allocated) utilizing

several fair value measurement techniques, including two market estimates and one income estimate,

and using relevant data available through and as of May 31, 2008. The market approach is a valuation

technique in which fair value is estimated based on observed prices in actual transactions and on asking

prices for similar assets. The valuation process is essentially that of comparison and correlation between

the subject asset and other similar assets. The income approach is a technique in which fair value is

estimated based on the cash flows that an asset could be expected to generate over its useful life,

including residual value cash flows. These cash flows are discounted to their present value equivalents

using a rate of return that accounts for the relative risk of not realizing the estimated annual cash flows

and for the time value of money. Certain variations of the income approach were used to determine

certain of the intangible asset fair values.

Under the market approaches, the fair value of the mainline reporting unit was estimated based

upon the fair value of invested capital for UAL, as well as a separate comparison to revenue and

EBITDAR multiples for similar publicly traded companies in the airline industry. The fair value

estimates using both market approaches included a control premium similar to those observed for

historical airline and transportation company market transactions.

Under the income approach, the fair value of the mainline reporting unit was estimated based upon

the present value of estimated future cash flows for UAL. The income approach is dependent on a

number of critical management assumptions including estimates of future capacity, passenger yield,

traffic, operating costs (including fuel prices), appropriate discount rates and other relevant assumptions.

The Company estimated its future fuel-related cash flows for the income approach based on the five-year

forward curve for crude oil as of May 31, 2008. The impacts of the Company’s aircraft and other tangible

and intangible asset impairments, discussed below, were considered in the fair value estimation of the

mainline reporting unit.

Taking into consideration an equal weighting of the two market estimates and the income estimate,

which has been the Company’s practice when performing annual goodwill impairment tests, the indicated

fair value of the mainline reporting unit was less than its carrying value, and therefore, the Company was

required to perform Step Two of the SFAS 142 goodwill impairment test.

In Step Two of the impairment test, the Company determined the implied fair value of goodwill of

the mainline reporting unit by allocating the fair value of the reporting unit determined in Step One to

all the assets and liabilities of the mainline reporting unit, including any recognized and unrecognized

intangible assets, as if the mainline reporting unit had been acquired in a business combination and the

fair value of the mainline reporting unit was the acquisition price. As a result of the Step Two testing,

the Company determined that goodwill was completely impaired and therefore recorded an impairment

charge to write-off the full value of goodwill.

Indefinite-lived Intangible Assets

The Company utilized appropriate valuation techniques to separately estimate the fair values of all

of its indefinite-lived intangible assets as of May 31, 2008 and compared those estimates to related

carrying values. Tested assets included tradenames, international route authorities, London Heathrow

70