United Airlines 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

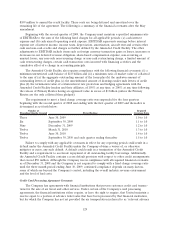

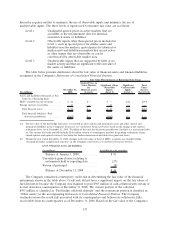

(16) Statement of Consolidated Cash Flows—Supplemental Disclosures

Supplemental disclosures of cash flow information and non-cash investing and financing activities

for both UAL and United, except as noted, are as follows:

(In millions) 2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

Cash paid during the period for:

Interest (net of amounts capitalized) .................. $412 $614 $703 $35

Income taxes ..................................... 3 10 — —

Non-cash transactions:

Long-term debt incurred to acquire assets .............. $ — $ — $242 $—

Capital lease obligations incurred to acquire assets ....... 281 — 155 —

Pension and other postretirement changes recorded in

other comprehensive income (loss) .................. (11) — 87 (4)

Accrued special distribution on UAL common stock (UAL

only) ......................................... — 257 — —

Interest paid in kind on 6% senior notes ............... 31 15 — —

Net unrealized gain (loss) on financial instruments

recorded in other comprehensive income (loss) ........ (37) 5 (5) 24

Receivable from unsettled stock sales as of December 31,

2008 .......................................... 15 — — —

In addition to the above non-cash transactions, see Note 4, “Voluntary Reorganization Under

Chapter 11,” Note 5, “Common Stockholders’ Equity and Preferred Securities,” Note 12, “Debt

Obligations and Card Processing Agreements,” and Note 15, “Lease Obligations.”

(17) Advanced Purchase of Miles

In September 2008, the Company amended certain terms of its agreement with its co-branded credit

card partner (the “Amendment”). In connection with the Amendment, the Company sold an additional

$500 million of pre-purchased miles to its co-branded credit card partner and extended the term of the

agreement to December 31, 2017. Prior to the Amendment, our Advanced purchase of miles obligation

to our co-branded credit card partner was approximately $600 million, which represented pre-purchased

miles purchased by our co-branded credit card partner. As a result of the additional $500 million

purchase of miles, our co-branded credit card partner has a remaining pre-purchase miles balance of

approximately $1.1 billion as of December 31, 2008. As part of the Amendment, our co-branded credit

card partner cannot use the pre-purchased miles for issuance to its cardholders prior to 2011;

accordingly, the $1.1 billion of deferred revenue at December 31, 2008 for the pre-purchased miles is

classified as “Advanced purchase of miles” in the non-current liabilities section of the Company’s

Statements of Consolidated Financial Position. The Amendment specifies the maximum amount of the

pre-purchased miles that our co-branded credit card partner can award to its cardholders each year from

2011 to 2017.

Prior to the Amendment, the pre-purchased miles were reflected as a current liability because the

miles pre-purchased by our co-branded credit card partner were generally awarded to cardholders within

one year of purchase. As of December 31, 2007, the total Advanced purchase of miles was $694 million.

United has the right, but is not required, to repurchase the pre-purchased miles from its co-branded

credit card partner during the term of the agreement. The Amendment contains termination penalties

that may require United to make certain payments and repurchase outstanding pre-purchased miles in

cases such as the Company’s insolvency, bankruptcy false representations or other material breaches.

139