United Airlines 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

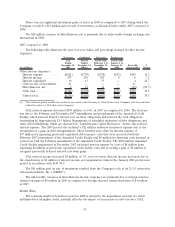

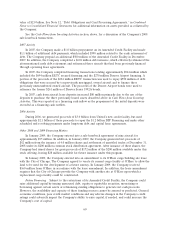

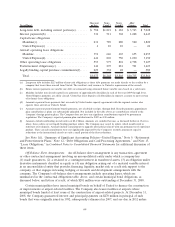

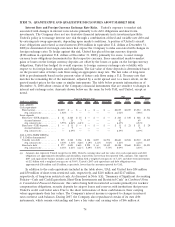

(In millions)

One year

or less

Ye a r s

2 and 3

Years

4 and 5

After

5 years Total

Long-term debt, including current portion(a) ....... $ 782 $1,821 $ 682 $ 3,743 $ 7,028

Interest payments(b) .......................... 336 511 368 1,228 2,443

Capital lease obligations

Mainline(c)................................ 231 789 280 520 1,820

United Express(c) .......................... 6 10 10 — 26

Aircraft operating lease obligations

Mainline.................................. 351 646 603 655 2,255

United Express(d) .......................... 441 869 750 1,090 3,150

Other operating lease obligations ................ 553 975 801 2,798 5,127

Postretirement obligations(e) .................... 146 295 281 701 1,423

Legally binding capital purchase commitments(f) .... 229 332 28 — 589

Total..................................... $3,075 $6,248 $3,803 $10,735 $23,861

(a) Long-term debt includes $113 million of non-cash obligations as these debt payments are made directly to the creditor by a

company that leases three aircraft from United. The creditor’s only recourse to United is repossession of the aircraft.

(b) Future interest payments on variable rate debt are estimated using estimated future variable rates based on a yield curve.

(c) Mainline includes non-aircraft capital lease payments of approximately $6 million in each of the years 2009 through 2011.

United Express payments are all for aircraft. United has lease deposits of $326 million in separate accounts to meet certain

of its future lease obligations.

(d) Amounts represent lease payments that are made by United under capacity agreements with the regional carriers who

operate these aircraft on United’s behalf.

(e) Amounts represent postretirement benefit payments, net of subsidy receipts, through 2018. Benefit payments approximate

plan contributions as plans are substantially unfunded. Not included in the table above are contributions related to the

Company’s foreign pension plans. The Company does not have any significant contributions required by government

regulations. The Company’s expected pension plan contributions for 2009 are $10 million.

(f) Amounts exclude nonbinding aircraft orders of $2.4 billion. Amounts are excluded because, as discussed further in Overview

above, these orders are not legally binding purchase orders. The Company may cancel its orders, which would result in

forfeiture of its deposits. Amounts include commitments to upgrade international aircraft with our premium travel experience

product. These aircraft commitments were not significantly impacted by the Company’s recently announced capacity

reductions as the international aircraft are only a small portion of the fleet reductions.

See Note 1(i), “Summary of Significant Accounting Policies—United Express,” Note 9, “Retirement

and Postretirement Plans,” Note 12, “Debt Obligations and Card Processing Agreements,” and Note 15,

“Lease Obligations,” in Combined Notes to Consolidated Financial Statements for additional discussion of

these items.

Off-Balance Sheet Arrangements. An off-balance sheet arrangement is any transaction, agreement

or other contractual arrangement involving an unconsolidated entity under which a company has

(1) made guarantees, (2) a retained or a contingent interest in transferred assets, (3) an obligation under

derivative instruments classified as equity or (4) any obligation arising out of a material variable interest

in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the

company, or that engages in leasing, hedging or research and development arrangements with the

company. The Company’s off-balance sheet arrangements include operating leases, which are

summarized in the contractual obligations table, above, and certain municipal bond obligations, as

discussed below, and letters of credit, of which $281 million were outstanding at December 31, 2008.

Certain municipalities have issued municipal bonds on behalf of United to finance the construction

of improvements at airport-related facilities. The Company also leases facilities at airports where

municipal bonds funded at least some of the construction of airport-related projects. At December 31,

2008, the Company guaranteed interest and principal payments on $270 million in principal of such

bonds that were originally issued in 1992, subsequently refinanced in 2007, and are due in 2032 unless

64