United Airlines 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

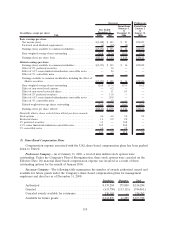

employee group received a deemed claim amount based upon a portion of the value of cost savings provided by that group

through reductions to pay and benefits as well as through certain work rule changes. The total value of this deemed claim

was approximately $7.4 billion. As of December 31, 2005, the Company recorded a non-cash reorganization charge of $6.5

billion for the deemed claim amount for all union-represented employees. The remaining $0.9 billion associated with

non-represented salaried and management employees was recorded as a reorganization charge in January 2006, upon

confirmation of the Plan of Reorganization.

(e) Contract rejection charges are non-cash costs that include estimated claim values resulting from the Company’s rejection or

negotiated modification of certain contractual obligations such as executory contracts, unexpired leases and regional carrier

contracts.

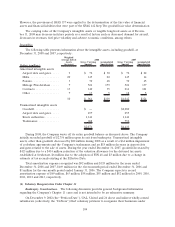

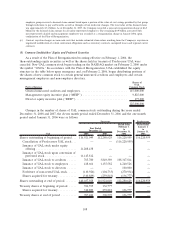

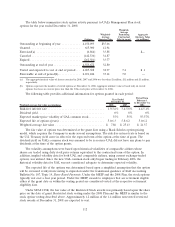

(5) Common Stockholders’ Equity and Preferred Securities

As a result of the Plan of Reorganization becoming effective on February 1, 2006, the

then-outstanding equity securities as well as the shares held in treasury of Predecessor UAL were

canceled. New UAL common stock began trading on the NASDAQ market on February 2, 2006 under

the symbol “UAUA.” In accordance with the Plan of Reorganization, UAL established the equity

structure in the table below upon emergence and, on February 2, 2006, began distributing portions of

the shares of new common stock to certain general unsecured creditors and employees and certain

management employees and non-employee directors.

Party of Interest

Shares of

UAL

Common Stock

General unsecured creditors and employees.............................. 115,000,000

Management equity incentive plan (“MEIP”) ............................ 9,825,000

Director equity incentive plan (“DEIP”) ................................ 175,000

125,000,000

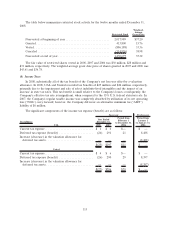

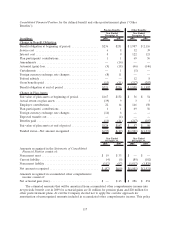

Changes in the number of shares of UAL common stock outstanding during the years ended

December 31, 2008 and 2007, the eleven month period ended December 31, 2006 and the one month

period ended January 31, 2006 were as follows:

UAL 2008 2007

Period from

February 1

to

December 31,

2006

Period from

January 1

to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

Shares outstanding at beginning of period . . . 116,921,049 112,280,629 116,220,959 116,220,959

Cancellation of Predecessor UAL stock . . . — — (116,220,959) —

Issuance of UAL stock under equity

offering.......................... 11,208,438 — — —

Issuance of UAL stock upon conversion of

preferred stock .................... 11,145,812 — — —

Issuance of UAL stock to creditors ...... 765,780 3,849,389 108,347,814 —

Issuance of UAL stock to employees ..... 418,664 1,155,582 4,240,526 —

Issuance of UAL stock to directors ...... — — 100,000 —

Forfeiture of non-vested UAL stock ...... (110,926) (104,733) (270,934) —

Shares acquired for treasury ............ (310,889) (259,818) (136,777) —

Shares outstanding at end of period........ 140,037,928 116,921,049 112,280,629 116,220,959

Treasury shares at beginning of period...... 396,595 136,777 — —

Shares acquired for treasury ............ 310,889 259,818 136,777 —

Treasury shares at end of period .......... 707,484 396,595 136,777 —

108