United Airlines 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Factors deemed by management to have collectively constituted a potential impairment triggering

event as of May 31, 2008 included record high fuel prices, significant losses in the first and second

quarters of 2008, a softening U.S. economy, analyst downgrade of UAUA common stock, rating agency

changes in outlook for the Company’s debt instruments from stable to negative, the announcement of

the planned removal from UAL’s fleet of 100 aircraft in 2008 and 2009 and a significant decrease in the

fair value of the Company’s outstanding equity and debt securities during the first five months of 2008,

including a decline in UAL’s market capitalization to significantly below book value. The Company’s

consolidated fuel expense increased by more than 50% during this period.

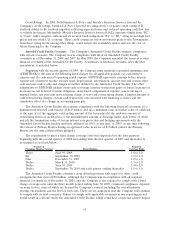

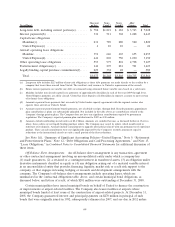

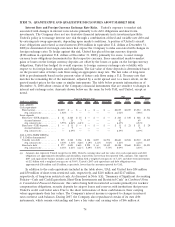

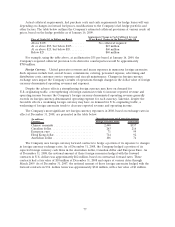

As a result of the interim impairment testing performed as of May 31, 2008 and December 31,

2008, the Company recorded impairment charges during the year as presented in the table below. All of

these impairment charges are within the mainline segment. All of the impairments other than the

goodwill impairment, which is separately identified, are classified as “Other impairments and special

items” in the Company’s Statements of Consolidated Operations.

(In millions)

Year Ended

December 31,

2008

Goodwill impairment ......................................... $2,277

Indefinite-lived intangible assets:

Codeshare agreements ........................................ 44

Tradenames................................................. 20

Intangible asset impairments.................................. 64

Tangible assets:

Pre-delivery advance deposits including related capitalized interest...... 105

B737 aircraft, B737 spare parts and other ......................... 145

Aircraft and related deposit impairments ........................ 250

Total impairments ............................................ $2,591

Discussed below is the methodology used for each type of asset impairment shown in the table

above.

Accounting for Long-Lived Assets. The net book value of operating property and equipment for

UAL was $10.3 billion and $11.4 billion at December 31, 2008 and 2007, respectively. In addition to the

original cost of these assets, as adjusted by fresh-start reporting as of February 1, 2006, their recorded

value is impacted by a number of accounting policy elections, including the estimation of useful lives and

residual values and, when necessary, the recognition of asset impairment charges.

For purposes of testing impairment of long-lived assets at May 31, 2008, the Company determined

whether the carrying amount of its long-lived assets was recoverable by comparing the carrying amount

to the sum of the undiscounted cash flows expected to result from the use and eventual disposition of

the assets. If the carrying value of the assets exceeded the expected cash flows, the Company estimated

the fair value of these assets to determine whether an impairment existed. The Company grouped its

aircraft by fleet type to perform this evaluation and used data and assumptions through May 31, 2008.

The estimated undiscounted cash flows were dependent on a number of critical management

assumptions including estimates of future capacity, passenger yield, traffic, operating costs (including fuel

prices) and other relevant assumptions. If estimates of fair value were required, fair value was estimated

using the market approach. Asset appraisals, published aircraft pricing guides and recent transactions for

similar aircraft were considered by the Company in its market value determination. As of May 31, 2008,

based on the results of these tests, the Company determined that an impairment of $36 million existed

which was attributable to the Company’s fleet of owned B737 aircraft and related spare parts. As

described in Overview above, the Company is retiring its entire B737 fleet earlier than originally planned.

The Company recorded an additional $2 million of impairment for other assets in the second quarter of

2008. Subsequently in the fourth quarter of 2008, the Company determined it was necessary to perform

an impairment test of certain of its operating fleet due to changes in market conditions for aircraft which

68