United Airlines 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

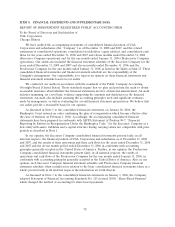

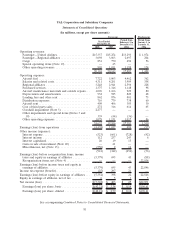

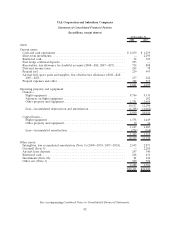

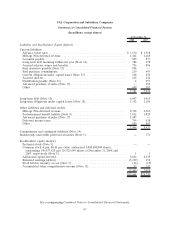

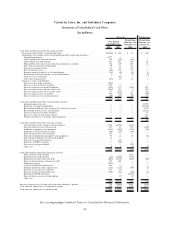

UAL Corporation and Subsidiary Companies

Statements of Consolidated Operations

(In millions, except per share amounts)

2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

Operating revenues:

Passenger—United Airlines . . . .................. $15,337 $15,254 $13,293 $ 1,074

Passenger—Regional affiliates . .................. 3,098 3,063 2,697 204

Cargo ...................................... 854 770 694 56

Special operating items (Note 19) ................ — 45 — —

Other operating revenues ...................... 905 1,011 1,198 124

20,194 20,143 17,882 1,458

Operating expenses:

Aircraft fuel ................................. 7,722 5,003 4,462 362

Salaries and related costs ....................... 4,311 4,261 3,909 358

Regional affiliates ............................ 3,248 2,941 2,596 228

Purchased services ............................ 1,375 1,346 1,148 98

Aircraft maintenance materials and outside repairs. . . 1,096 1,166 929 80

Depreciation and amortization .................. 932 925 820 68

Landing fees and other rent . . .................. 862 876 801 75

Distribution expenses .......................... 710 779 738 60

Aircraft rent ................................. 409 406 385 30

Cost of third party sales ........................ 272 316 614 65

Goodwill impairment (Note 3) .................. 2,277 — — —

Other impairments and special items (Notes 3 and

19) ...................................... 339 (44) (36) —

Other operating expenses ...................... 1,079 1,131 1,017 86

24,632 19,106 17,383 1,510

Earnings (loss) from operations . .................. (4,438) 1,037 499 (52)

Other income (expense):

Interest expense .............................. (523) (661) (728) (42)

Interest income .............................. 112 257 243 6

Interest capitalized............................ 20 19 15 —

Gain on sale of investment (Note 20) ............. — 41 — —

Miscellaneous, net (Note 13) . . .................. (550) 2 14 —

(941) (342) (456) (36)

Earnings (loss) before reorganization items, income

taxes and equity in earnings of affiliates ........... (5,379) 695 43 (88)

Reorganization items, net (Note 4) ............... — — — 22,934

Earnings (loss) before income taxes and equity in

earnings of affiliates ........................... (5,379) 695 43 22,846

Income tax expense (benefit)...................... (25) 297 21 —

Earnings (loss) before equity in earnings of affiliates . . . (5,354) 398 22 22,846

Equity in earnings of affiliates, net of tax ............ 6 5 3 5

Net income (loss) .............................. $(5,348) $ 403 $ 25 $22,851

Earnings (loss) per share, basic .................. $(42.21) $ 3.34 $ 0.14 $196.61

Earnings (loss) per share, diluted ................ $(42.21) $ 2.79 $ 0.14 $196.61

See accompanying Combined Notes to Consolidated Financial Statements.

81